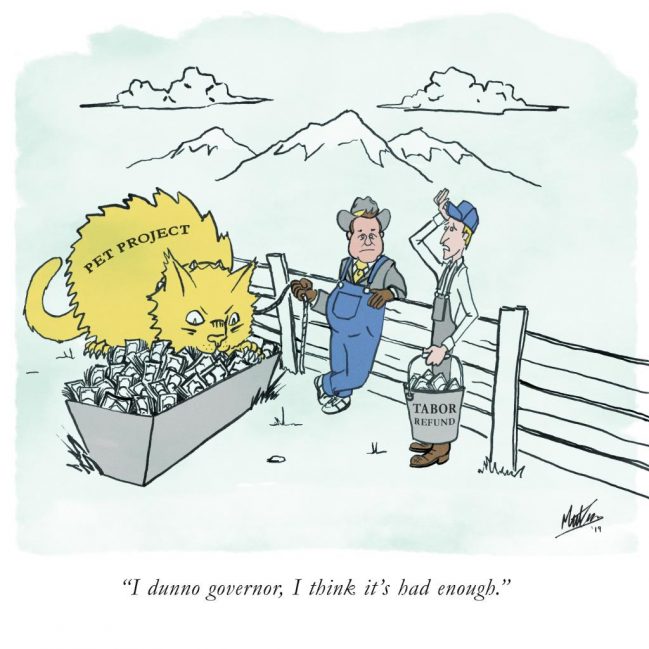

The defeat of Proposition CC on the 2019 ballot is not deterring a movement by liberal groups for a graduated income tax system

Colorado voters rejected a bid to remove the spending caps in the Taxpayer’s Bill of Rights — but the fiscal fight is only expected to get more intense in the next year.

One interest group is considering a repeal of the Taxpayer’s Bill of Rights and another is testing ideas for a graduated tax system that increases rates for the wealthy. Both are eyeing the 2020 ballot and appear undeterred by Proposition CC’s defeat this year.

“Whatever we do next must be bold enough to drown out the alarmists. That work begins today,” said Scott Wasserman at the Bell Policy Center, the organization seeking to overhaul the tax system, in a statement.

“If we truly want to build a state that works for everyone, then we need to amend the constitution,” added Carol Hedges at the Colorado Fiscal Institute, which is working to unwind TABOR.

Last November, voters in some states had the opportunity to accept or reject some

Last November, voters in some states had the opportunity to accept or reject some

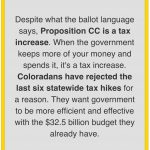

“Without raising taxes and to better fund public schools, higher education, and roads, bridges, and transit, within a balanced budget, may the state keep and spend all the revenue it annually collects after June 30, 2019, but is not currently allowed to keep and spend under Colorado law, with an annual audit to show how the retained revenues are spent?”

“Without raising taxes and to better fund public schools, higher education, and roads, bridges, and transit, within a balanced budget, may the state keep and spend all the revenue it annually collects after June 30, 2019, but is not currently allowed to keep and spend under Colorado law, with an annual audit to show how the retained revenues are spent?” Colorado is a unique state for many reasons. Beautiful land, bountiful waters, the Rocky Mountains. However the most unique thing about our state is not physical. It’s a law passed in 1992.

Colorado is a unique state for many reasons. Beautiful land, bountiful waters, the Rocky Mountains. However the most unique thing about our state is not physical. It’s a law passed in 1992.