Polis Pitches Tax Cuts, But His Democrat-Run Statehouse Isn’t On Board

Patrick Gleason, Contributor

I cover the intersection of state & federal policy and politics.

Dec 15, 2023,05:40am EST

Colorado Governor Jared Polis (Photo by Michael Ciaglo/Getty Images)

GETTY IMAGES

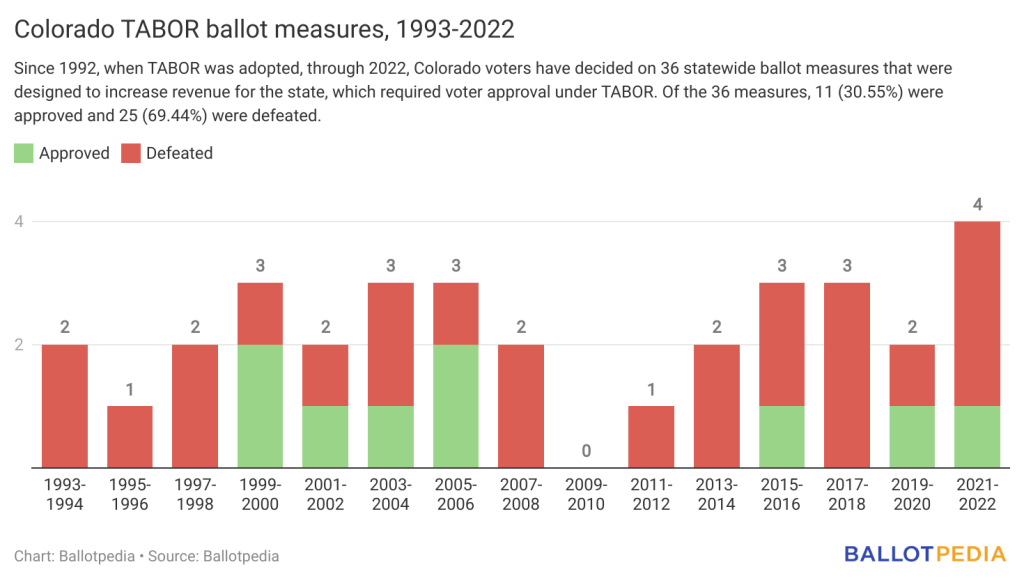

If Texas Governor Greg Abbott (R) were to coauthor a New Republic column with Paul Krugman or another famous progressive economist touting the benefits of greater government spending, that would surprise many. Yet the ideological analog to that occurred recently, with Colorado Governor Jared Polis (D) coauthoring an article with economist Arthur Laffer, in which they tout the benefits of reduced tax rates. Governor Polis and Dr. Laffer also contend that the Taxpayer’s Bill of Rights (TABOR), Colorado’s thirty one year old constitutional amendment that prevents state spending from growing faster than population growth plus inflation and requires tax hikes to receive voter approval, is flawed.

In their op-ed, published in National Review on December 7, Polis and Laffer lament that tax limitation measures “such as Colorado’s Taxpayer’s Bill of Rights, that focus on tax payments rather than tax rates totally miss the opportunity to address the damage done by high tax rates.” Polis and Laffer bemoan the fact that TABOR surpluses are not automatically refunded in the form of tax rate reductions and instead go out as rebate checks.

“If there is an excess in tax revenues above population growth and inflation, as defined by TABOR, that means tax rates should have been lower but were not,” write Polis and Laffer. “The law serves as a signal that tax rates have been too high. The proper response to this signal is not to have it keep signaling, but to get the message and cut tax rates permanently.”

Many if not most Republican lawmakers in Colorado, however, would probably agree with Polis and Laffer that it would be better for TABOR surpluses to be returned to taxpayers in the form of permanent tax rate reductions instead of rebates. There is no indication, however, that Governor Polis is urging his fellow Democrats who control the state legislature to do that even though it is fully within their power to do so. If Polis and Laffer want to change the manner of TABOR refunds, they need to convince Colorado Democrats, not National Review readers.

What’s more, Governor Polis’s stated desire for tax rate reductions is belied by his enactment of a bill that will make it more difficult to pass income tax cuts in the future by ballot measure. That new law, which was signed by Polis in 2021, mandates that citizen-initiated income tax cuts feature poison pill ballot language claiming the measure will reduce funding for education, healthcare, and other priorities, even when that’s not true.

Colorado House Minority Leader Mike Lynch (R) and Senator Byron Pelton (R) introduced a bill during last month’s special legislative session that would have reduced Colorado’s income tax rate from 4.4% to 4.0%. Governor Polis acknowledges the economic benefits of lowering income tax rates in his recent column, yet he did not support that bill, which was killed in committee along party lines.

Click (HERE) to go to Forbes to read the rest of this article