Can A People Tax Themselves Into Prosperity?

Denver, CO – New taxes may be on their way to the ballot. Colorado Initiative Title Setting Review Board approved language for 12 new taxes. The next step will be collecting the two hundred thousand or more signature to have these ballot initiatives appear on your November 2020 ballot.

After the sound defeat of Proposition CC in 2019, the tax and spend crowd would go away for a while. The simple answer is no. As long as liberal billionaires fund “think tanks” like the Colorado Fiscal Policy Institute and the Bell Center For Policy, they will always be pushing for tax increases and the repeal of the Taxpayer’s Bill of Rights (TABOR).

From Colorado Politics:

The board also approved 12 initiatives from Carol Hedges and Steve Briggs of Denver that would create a graduated income tax system, raising approximately $2 billion to $2.4 billion. The money would go toward education and addressing “the impacts of a growing population and a changing economy.”

Voters have turned down tax increases and eliminating spending caps every election they have been on the state-wide ballot. The last successful attempt was Referendum C in 2005 after too many Republicans campaigned hard for it. In a related note, those Republicans political careers ended that day.

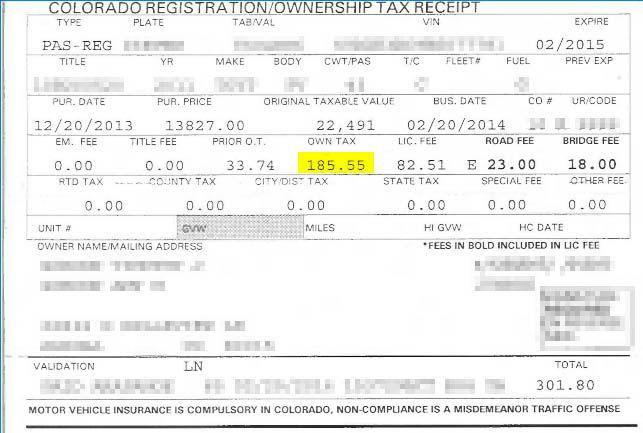

Just received my annual registration for my 2004 Subaru Outback and just reading the receipt my blood again begins to boil. The only “tax” listed is $3 for specific ownership tax, the next 12 items are all “fees”. Age of vehicle fee $7, bridge safety surcharge fee $23, clerk hire fee $4, county road and bridge fee $1.50, emergency medical services fee $2, emissions-statewide air account fee, $0.5 and many more, for a grand total of $70.17.

These are in addition to all of the gas taxes we all pay each time we fill up. I don’t mind being charged for normal needs-based surcharges such as those required to maintain our infrastructure but lets call it what they are.. Taxes! Since I/we are already paying all of these “fees” to the state, it’s another reason why I am appalled at the thought of eventually having to also pay more and more for the myriad of oncoming toll lanes throughout the state.

#TABOR

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteNo

#CoLeg

Guest blog from Dennis Simpson, retired CPA and TABOR activist. Simpson lives in Mesa County.

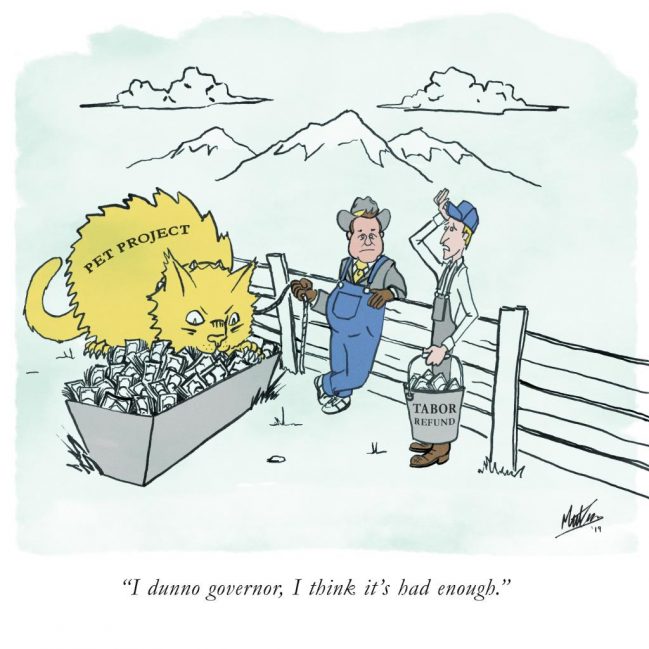

There are not many local Colorado governments left that have not relaxed TABOR restrictions. One of the remaining few is Mesa County. Recent action by County Commissioners increased the possibility that anti-TABOR folks (including our local newspaper) soon will mount an effort to remove protections that TABOR provides you.

In this case, TABOR limits the ability of a government to retain excess revenue in two distinct ways. It limits the amount of property taxes collected and additionally limits the overall revenue collected in any year.

In 2018, Mesa County’s collection of property taxes was not an issue. However, the County had a banner year in the collection of sales taxes which resulted in excess revenue exceeding $5 million.

The concept of refunding anything other than excesses caused by property taxes has not happened for many years, presenting a new challenge to staff and Commissioners. The Commissioners ignored helpful suggestions for alternatives and dismissed the issue too rapidly. They decided to take the option that required the least amount of thought. They are giving the $5 million to property taxpayers proportionate to how much property tax each paid. Our largest property taxpayers are oil companies and box stores with main offices far away. Over $2 million of the sales tax refund will be removed from the local economy. Those who do not own property will get zero and those who own lower value homes will get a pittance.

A guest column on this issue, “Commissioners’ handling of refunds at odds with TABOR’s long-term survival,” provides additional discussion.

Colorado state Sens. Angela Williams and Faith Winter speak to the media the day after they turned their bill creating a paid-family-leave program into several studies of how to implement such a program in 2019.

ED SEALOVER | DENVER BUSINESS JOURNAL

By Ed Sealover

Reporter, Denver Business Journal

Feb 6, 2020, 10:18am EST

Before Democratic legislative leaders even have introduced the latest version of a bill to create a paid-family-and-medical-leave system for all private-sector workers in Colorado, they are being met with a host of concerns from the business groups to whom the compromise bill was supposed to appeal — as well as a lukewarm reaction from the advocates who have backed their efforts over the past six years.

Democratic Sens. Faith Winter of Westminster and Angela Williams of Denver confirmed in interviews Tuesday that they are about to introduce a new bill that would require employers to give workers with at least six months of service access to eight weeks of partially paid leave in the event of a new child, a severe health episode for themselves or a loved one, a need to escape domestic violence or a requirement to deal with the call-up to active military duty of a family member. Like past iterations, it involves job protection for workers who take leave, but it adds a new twist this year of having the leave offered through a private-market system in which the state lays out requirements for employers and companies then fund the program themselves or buy insurance policies to cover potential costs.

Last month, Denver Metro Chamber of Commerce President/CEO Kelly Broughcalled strongly at her organization’s annual Legislative Preview Breakfast for legislators to follow the suggestion of Democratic Gov. Jared Polis and offer a private-market solution that incorporates flexibility for companies that already offer paid-leave programs. Brough said Wednesday that she is pleased with that aspect of the bill and believes it will allow companies to meet the needs of workers better, but she said the proposal still has several provisions that worry her.

State lawmakers consider reforms in 2020 that would limit the growth of government.

GETTY

Americans are frequently told – by members of the media, candidates, and others – that political division is heightened in this consequential election year. Members of Congress, however, have reached bipartisan agreement that the federal government should spend more money than it brings in, even when the economy is growing and unemployment is low. Fiscal profligacy carries the day in Washington, yet lawmakers in state capitals are taking action to ensure that state spending and the size of government grows at a sustainable clip.

A member of the Wyoming Legislature, Representative Chuck Gray (R), introduced a joint resolution last week that seeks to limit the growth of the state budget and require voter consent for the approval of future tax increases. House Joint Resolution 2, introduced by Representative Gray on February 7, would amend the state constitution to include a “Taxpayer’s Bill of Rights” that would do two things: limit state spending to the rate of population growth plus inflation, and require all state tax hikes receive voter approval.

Representative Gray’s bill is inspired by Colorado’s Taxpayer’s Bill of Rights (TABOR). Like the TABOR measure now pending in the Wyoming statehouse, Colorado’s TABOR, which has been the law since it was approved by Colorado voters in 1992, requires that all state tax hikes receive approval from Colorado voters. Colorado’s TABOR also caps the increase in state spending at the rate of population growth plus inflation.

Colorado’s TABOR is the reason why Democrats who control the Colorado Legislature and would like to impose a host of tax increases are unable to do so. In November of 2019, Colorado voters affirmed their support for TABOR by rejecting Proposition CC, a measure referred to the ballot by legislative Democrats that would’ve gutted TABOR by ending the taxpayer refunds due in accordance with it.

#TABOR

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteNo

#CoLeg

![]() If

If