November 4, 2019 by Dan Mitchell

Last November, voters in some states had the opportunity to accept or reject some very important initiatives, including votes on Colorado’s flat tax, Arizona’s school choice system, and a carbon tax in the state of Washington.

Last November, voters in some states had the opportunity to accept or reject some very important initiatives, including votes on Colorado’s flat tax, Arizona’s school choice system, and a carbon tax in the state of Washington.

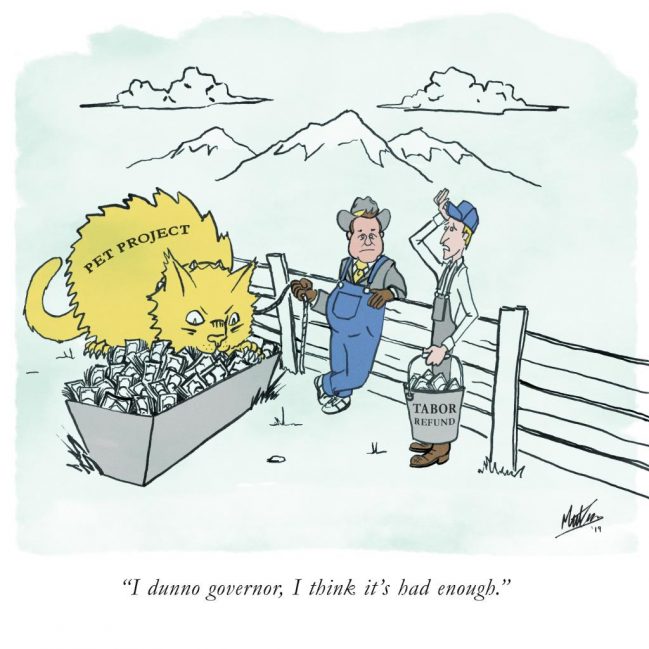

Since 2019 is an off-year election, there aren’t as many initiatives and referendums. But one of them is vitally important. Politicians in Colorado are hoping voters will approve Proposition CC, which would gut the Taxpayer Bill of Rights (TABOR) and thus allow more government spending.

Why is TABOR worth defending? Because it’s far and away the most effective and well-designed fiscal rule in the United States.

It’s basically a spending cap, which is the ideal fiscal policy, and here’s a description of how it works that I shared last year.

Colorado voters adopted The Taxpayer’s Bill of Rights in 1992. TABOR allows government spending to grow each year at the rate of inflation-plus-population. Government can increase faster whenever voters consent. Likewise, tax rates can be increased whenever voters consent. …The Taxpayer’s Bill of Rights requires that excess government revenues be refunded to taxpayers, unless taxpayers vote to let the government keep the revenue.

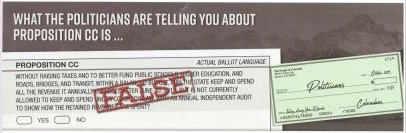

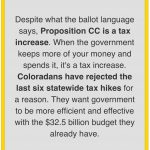

Proposition CC doesn’t fully repeal TABOR, but it allows politicians to keep – and spend – excess tax revenues.

“Without raising taxes and to better fund public schools, higher education, and roads, bridges, and transit, within a balanced budget, may the state keep and spend all the revenue it annually collects after June 30, 2019, but is not currently allowed to keep and spend under Colorado law, with an annual audit to show how the retained revenues are spent?”

“Without raising taxes and to better fund public schools, higher education, and roads, bridges, and transit, within a balanced budget, may the state keep and spend all the revenue it annually collects after June 30, 2019, but is not currently allowed to keep and spend under Colorado law, with an annual audit to show how the retained revenues are spent?” Colorado is a unique state for many reasons. Beautiful land, bountiful waters, the Rocky Mountains. However the most unique thing about our state is not physical. It’s a law passed in 1992.

Colorado is a unique state for many reasons. Beautiful land, bountiful waters, the Rocky Mountains. However the most unique thing about our state is not physical. It’s a law passed in 1992.