Reflections on 25 years of TABOR in Colorado

Friday marked 25 years since the Taxpayer’s Bill of Rights was added to the Constitution in 1992

TABOR timeline

• 1992 — Taxpayer’s Bill of Rights amends Section 20 Article X of the Colorado Constitution

• 2000 — Amendment 23 for education spending increases

• 2005 — Ballot measure Referendum C loosens some TABOR restrictions for five years

• 2006 — TABOR measures rejected by voters in Maine, Nebraska, Oregon

• 2011 — State Sen. Andy Kerr and House Speaker Dickey Lee Hullinghorst lead suit against TABOR

• 2014 — Kerr v. Hickenlooper confirms general assembly has standing to challenge the constitutionality of TABOR

• 2015 — U.S. Supreme Court returns Kerr & Hullinghorst case to 10th U.S. Circuit Court of Appeals

• 2017 — House Bill 17-1187 to change excess state revenues cap growth factor introduced

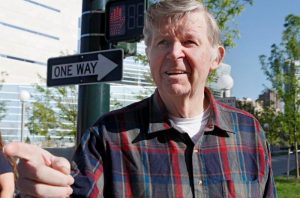

Both Sam Mamet and Larry Sarner acutely remember the moment that the Taxpayer’s Bill of Rights Act was amended to the Colorado Constitution. The difference: One man hated the amendment’s restrictions, while the other saw them as democratically vital.

Friday marked exactly 25 years since the election in which the amendment was added to the state constitution — Nov. 3, 1992. The measure took effect Dec. 31, 1992, and serves as a way to limit the growth of government by requiring increases in overall revenue from taxes not exceed the rates of inflation and population growth.