RE-1 Valley Superintendent Jan DeLay giving a presentation discussing the finances of the school district. By building more understanding of the situation, she believes she can build momentum for a $2 million ballot measure for funding.

Jenny Brundin/CPR News

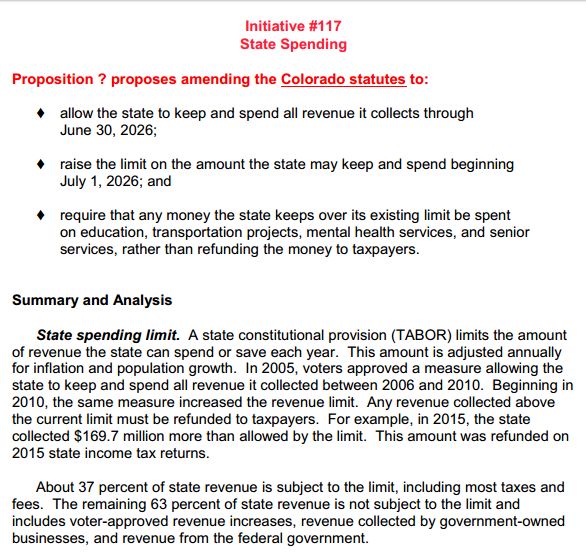

How schools are funded in Colorado is so complex, there’s a joke that only five people in the state truly understand it.

Superintendent Jan DeLay in northeastern Colorado’s RE-1 Valley School District is on a mission to change that. She’s convinced that once average citizens understand why so many districts like hers are in a fiscal crisis, they’ll approve a local tax measure on the ballot to fund RE-1.

The money would be would be used to attract and keep teachers and to expand academic opportunities for students through technology, textbooks and other programs.

The last time the district passed a mill levy was in 2005, for $500,000 to update buildings, technology, textbooks and transportation. DeLay says that money is gone within the first couple of months in the new school year. Continue reading