A Republican-sponsored bill in the Colorado legislature would likely let state government keep more of your tax money whether it needs it or not.

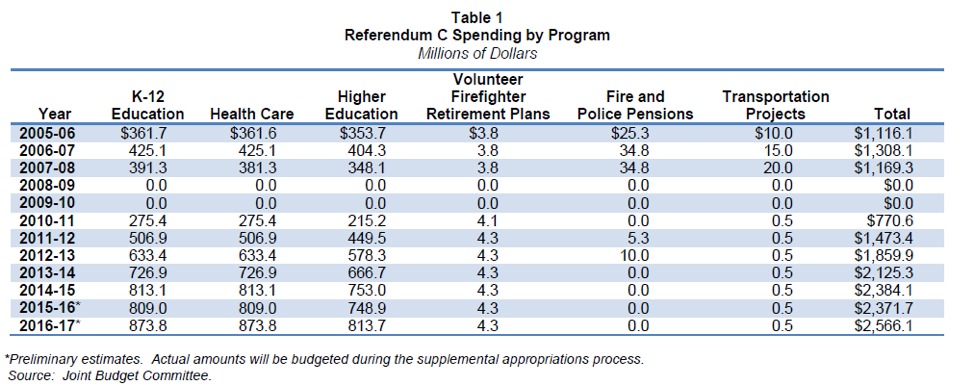

In 2005, Referendum C suspended Colorado’s constitutional limit on the amount of tax revenues that the state could keep. Called the “TABOR timeout,” the Referendum allowed the state to reset the limit on state revenue collection at the highest amount of annual revenue received between June FY 2005-6 and FY 2009-10. Referendum C was a permanent tax increase. As the table below shows, it has increased Colorado state spending by an estimated $2.6 billion over the last decade. At present, only 38 percent of state spending remains subject to TABOR.

Now the tax and spend coalition wants more.

Now the tax and spend coalition wants more.

Some state officials are understandably delighted by any measure that relieves them of the drudgery of running the state on a tight budget. It is much less taxing to be a state legislator when revenues are rising than when they are falling. When spending must be cut, difficult choices are required. No one is happy. Continue reading

An effort to reform the Taxpayer’s Bill of Rights, or TABOR, passed its first test on Monday with Republican support. File photo.An effort to reform the Taxpayer’s Bill of Rights, or TABOR, passed its first test on Monday with Republican support, though the legislation faces an uphill battle.

An effort to reform the Taxpayer’s Bill of Rights, or TABOR, passed its first test on Monday with Republican support. File photo.An effort to reform the Taxpayer’s Bill of Rights, or TABOR, passed its first test on Monday with Republican support, though the legislation faces an uphill battle.