Voters stood up for tax refunds—but not charter schools.

By The Editorial Board

Nov. 6, 2019 7:05 pm ET

Opinion: Colorado Voters Stood Up for Tax Refunds

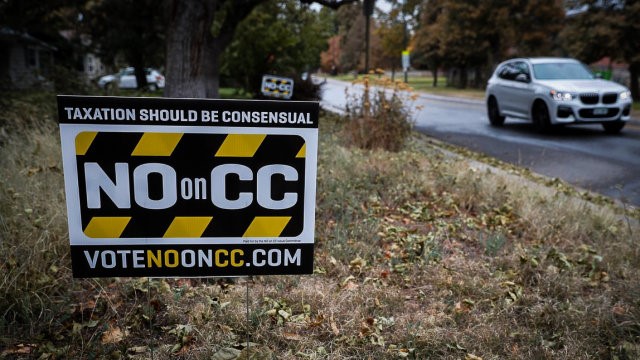

Proposition CC would have affected the Taxpayer Bill of Rights in Colorado. However, the measure failed at the polls on November 5, 2019. Image: David Zalubowski/Associated Press

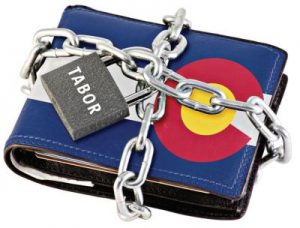

They didn’t make the biggest headlines, but Tuesday’s elections in Colorado included two results that deserve national attention. First, a wide margin of voters refused to weaken the state’s Taxpayer Bill of Rights, a constitutional provision that prevents state tax collections from outpacing inflation plus population growth.

Voters approved TABOR, as it’s commonly called, in 1992. Since then it has delivered Coloradans about $3.5 billion in tax refunds, which are required whenever state revenue exceeds the calculated limit. But politicians, being politicians, would much prefer to spend the extra funds. Proposition CC would have eviscerated TABOR by allowing the state to put any revenue windfall into schools and roads.

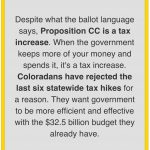

A point of worry among fiscal conservatives was the ballot question’s wording, which began: “Without raising taxes . . . ” Perhaps this was strictly accurate, since no tax rates would have changed. But it was misleading in spirit, given that the proposition’s point was to let the state government keep more taxpayer money. Voters weren’t fooled. The measure failed, 45% to 55%, as of the tally Wednesday.

Last November, voters in some states had the opportunity to accept or reject some

Last November, voters in some states had the opportunity to accept or reject some

“Without raising taxes and to better fund public schools, higher education, and roads, bridges, and transit, within a balanced budget, may the state keep and spend all the revenue it annually collects after June 30, 2019, but is not currently allowed to keep and spend under Colorado law, with an annual audit to show how the retained revenues are spent?”

“Without raising taxes and to better fund public schools, higher education, and roads, bridges, and transit, within a balanced budget, may the state keep and spend all the revenue it annually collects after June 30, 2019, but is not currently allowed to keep and spend under Colorado law, with an annual audit to show how the retained revenues are spent?” Colorado is a unique state for many reasons. Beautiful land, bountiful waters, the Rocky Mountains. However the most unique thing about our state is not physical. It’s a law passed in 1992.

Colorado is a unique state for many reasons. Beautiful land, bountiful waters, the Rocky Mountains. However the most unique thing about our state is not physical. It’s a law passed in 1992.