Category Archives: Editorial

Lesley Smith and Laurie Albright: Sign a petition to de-fang TABOR

More Evidence that Balanced Budget Rules Don’t Work as Well as Spending Caps

More Evidence that Balanced Budget Rules Don’t Work as Well as Spending Caps

July 16, 2016 by Dan Mitchell

If you asked a bunch of Republican politicians for their favorite fiscal policy goals, a balanced budget amendment almost certainly would be high on their list.

This is very unfortunate. Not because a balanced budget amendment is bad, per se, but mostly because it is irrelevant. There’s very little evidence that it produces good policy.

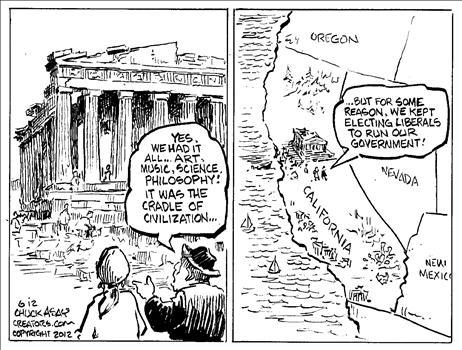

Before branding me as an apologist for big government or some sort of fiscal heretic, consider the fact that balanced budget requirements haven’t prevented states like California, Illinois, Connecticut, and New York from adopting bad policy.

Or look at France, Italy, Greece, and other EU nations that are fiscal basket cases even though there are “Maastricht rules” that basically are akin to balanced budget requirements (though the target is a deficit of 3 percent of economic output rather than zero percent of GDP).

Indeed, it’s possible that balanced budget rules contribute to bad policy since politicians can argue that they are obligated to raise taxes. Continue reading

EDITORIAL: Celebrate TABOR for Making Colorado strong

EDITORIAL: Celebrate TABOR for Making Colorado strong | Colorado Springs Gazette, News

By: The Gazette editorial board

Colorado is reliably hot, economically. During good times and bad nationally and internationally, the economy typically produces above-average indicators when compared to other states. When Forbes, Business Insider and others rank states by economic performance, Colorado sometimes ranks first and seldom fails to finish among the top five.

One economic factor makes Colorado different than all other states. It’s called the Taxpayer’s Bill of Rights, or TABOR. Only Colorado has such a law.

TABOR is like that persnickety old-school spouse who won’t let the household live beyond its means. The rest of the family may resent the rules, because compulsive spending is fun. But they ultimately benefit from the safety and security of a stable home.

The law restricts government spending with a formula that accounts for inflation and population growth. If revenues exceed what the formula allows, politicians must return the windfalls unless voters say otherwise. All changes to tax policy must be approved by a public vote.

TABOR is constantly under attack because it tells politicians “no.” It limits their ability to spend. But the benefits are not in question if one examines the facts.

Anti-TABOR lawsuit deserved latest setback in federal court

Anti-TABOR lawsuit deserved latest setback in federal court

Cyrus McCrimmon, Denver Post file

Colorado Attorney General Cynthia Coffman is defending the state against a lawsuit regarding TABOR.

By The Denver Post Editorial Board |

June 7, 2016 |

The Taxpayer’s Bill of Rights has multiple flaws that this editorial page has documented repeatedly over the years while urging lawmakers and voters to fix them.

We’re also on record as recently as last month urging the legislature to adopt a budgetary mechanism to free up revenue that otherwise would have to be refunded under TABOR.

But our critique of TABOR doesn’t extend to questioning the right of voters to enact or defend it. The 5-year-old lawsuit arguing that TABOR violates the U.S. Constitution’s mandate that states have a “Republican Form of Government” is too strained and exotic for our taste. It deserved the setback it suffered last week in federal court.

The 10th U.S. Circuit Court of Appeals ruled that several Colorado lawmakers who are plaintiffs lacked legal standing to sue because they do not represent the General Assembly as a whole.

Progressives Return To Their Roots

Progressives Return To Their Roots

The Virgin Islands’ Attorney General issued a subpoena against ExxonMobil and a free-market think tank in Washington, branding, blacklisting, and besmirching hundreds from coast to coast as participants in a long-running criminal conspiracy. The think tank’s lawyer reviled the subpoena as “offensive,” “unlawful,” a violation of “civil rights,” and “un-American.” It is all that but one: “un-American.” It has its roots in progressives’ earliest and proudest days.

High Taxes Lack a Guarantee of Quality Services: See Detroit

It’s about how resources are managed

It’s about how resources are managed

By JAMES M. HOHMAN | May 18, 2016

It is a common trope in Michigan and elsewhere that the path to state prosperity is to have high taxes and quality services, with Minnesota pointed to as the paragon. Yet high taxes do not guarantee quality services, as Detroit can attest.

Detroit has the highest effective property taxes in the country, according to the Minnesota Center for Fiscal Excellence’s 2014 property tax study. For commercial property at all different values, Detroit is No. 1 in the nation. For homesteaded property, only Bridgeport, Connecticut surpasses Detroit. Detroit also has the highest property taxes for most values of industrial property. Only New York City has higher property taxes on apartments than Detroit. All of these rates are higher than those in Minneapolis. The one saving grace for property taxpayers in Detroit is that the net tax burden has decreased with the collapse in real estate values in the city. Continue reading

Two Decades of Colorado’s Taxpayer’s Bill of Rights (TABOR)

Executive Summary:

Over two decades have passed since Colorado voters adopted The Taxpayer’s Bill of Rights in 1992. TABOR allows government spending to grow each year at the rate of inflation-plus-population. Government can increase faster whenever voters consent. Likewise, tax rates can be increased whenever voters consent. This Issue Paper analyzes TABOR’s effect on state government spending and taxes by examining three decades: The 1983-92 pre-TABOR decade; the first decade of TABOR, 1993-2002; and the second decade, 2003-12. The final decade included the largest tax increase in Colorado history, enacted as Referendum C in 2005. Decade-2 was also marked by increasing efforts to evade TABOR by defining nearly 60% of the state budget as “exempt” from TABOR.

Conclusion:

Tax-and-Spending Limitation Results

The Taxpayer’s Bill of Rights Amendment has worked well to achieve its stated intention to “slow government growth.” Although government has still continued to grow significantly faster than the rate of population-plus-inflation, the Taxpayer’s Bill of Rights did partially dampen excess government growth. It did not cut or reduce reasonable government growth.

In terms of economic vitality, Colorado’s Decade-1 was best for Colorado. Unlike in the pre-TABOR decade, or in TABOR Decade-2 with its record increase in taxes and spending, because of Referendum C, Colorado’s first TABOR decade saw the state economy far outperform the national economy.

http://www.i2i.org/wp-content/uploads/2015/01/IP-4-2016_b.pdf

GUEST COLUMN: Say “no” to a special session

GUEST COLUMN: Say “no” to a special session

By: Michael Fields

May 21, 2016

Not even 48 hours after the legislative session ended, the governor floated the idea of convening a special session to address the hotly debated hospital provider fee.

This drumbeat has continued in the press, with pressure from countless special interest groups who didn’t get their way during the normal 120-day session. And this all comes after the Senate Finance Committee voted down a bill to move the $750 million hospital provider fee into a separate enterprise fund for the second year in a row.

Proponents of this move want you to believe that to fix roads and help schools, this budget gimmick is desperately needed. They have grabbed onto compelling buzzwords, cleverly invoked as rationale to adopt this plan. These messages are used to pull on people’s heart strings and convince them that enterprising the hospital provider fee would somehow fix our transportation and education needs. The fact is creating this enterprise would be an end-run around our Taxpayer’s Bill of Rights (TABOR) and would not fix our long-term funding problems.

To fully understand what has been going on with our state budget, let’s look at a few numbers:

– The state budget has gone from $19 billion to $27 billion in just seven years. Continue reading

Partisan posturing trumps a better Colorado

Perspective

Partisan posturing trumps a better Colorado

By Henry Dubroff and John Huggins

Posted: 05/21/2016 05:00:00 PM MDT

Local leaders discuss possible changes to the state’s constitutional initiative process in a small group during the Building a Better Colorado community summit at Northeastern Junior College on Dec. 7. (Sterling Journal-Advocate)

Local leaders discuss possible changes to the state’s constitutional initiative process in a small group during the Building a Better Colorado community summit at Northeastern Junior College on Dec. 7. (Sterling Journal-Advocate)

The tensions between populism and policymaking that are so evident in this year’s presidential primaries have trickled down to the state level.

In Colorado’s case, major policy reforms — including those that emerged from last fall’s Building a Better Colorado process of town hall meetings — have at times taken a back seat to partisan posturing.

But the Building a Better Colorado reforms remain a key part of the civic agenda, especially in these three areas:

- Reform or replace the Taxpayer’s Bill of Rights (TABOR), or put in place a “TABOR relief valve” so that the state may keep a bigger share of tax revenue to fund roads, schools and other infrastructure necessary to serve Colorado’s growing population.

- Reform our primary election process so that the results better reflect the will of voters and also put Colorado where it belongs on the national political map, as the most influential swing state in the Rocky Mountain region.

- Establish somewhat higher though reachable hurdles for qualifying and approving constitutional amendments, taking into account Colorado’s diverse geographic and demographic interests.

The difficulty in getting TABOR relief approved in the just-finished legislative session underscores how tricky it is to enact reforms in an election year where the Donald Trump and Bernie Sanders insurgencies are having a big impact. In the state Senate, for example, majority Republicans were pushed by the Colorado chapter of the Koch brothers-funded Americans for Prosperity not to tweak the language of the state’s hospital provider fee and exempt it from TABOR limits. The penalty: facing a more conservative primary opponent at the next election.

To read the rest of this Denver Post story about TABOR, click (HERE):