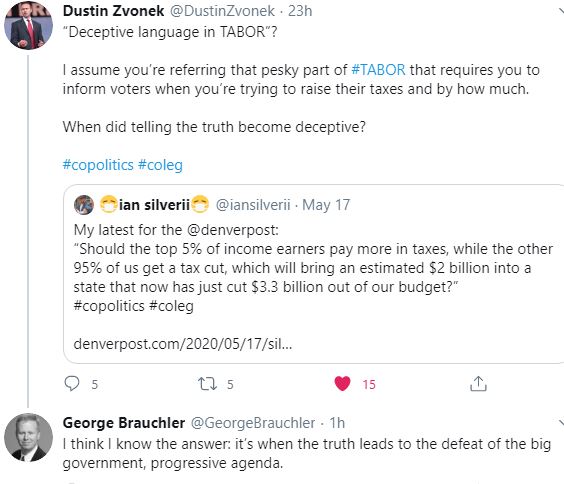

TABOR repeal is off the table for 2020. Now it’s Initiative 271, a $2 billion tax hike targeting the wealthy

Vision 2020 Colorado, a coalition behind a tax system overhaul, tells The Sun it will move forward with a graduated income tax measure that will lower taxes for the vast majority

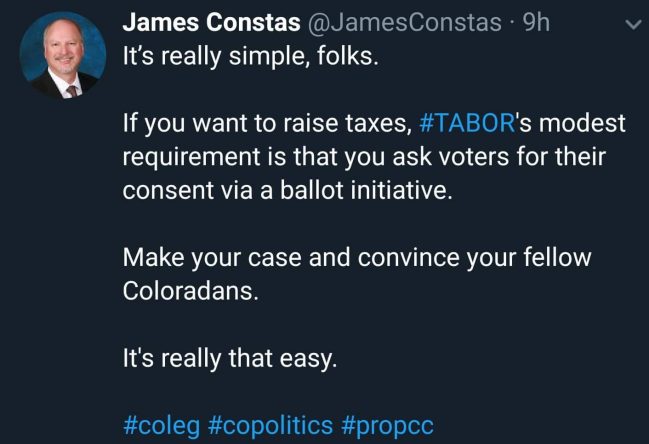

coalition pushing to overhaul Colorado’s tax system will not pursue a complete repeal of the Taxpayer’s Bill of Rights this year, opting instead for a ballot measure in November that would generate billions in new money with higher taxes on the wealthy.

The new initiative — which is expected to receive final legal approval Wednesday — is designed to create a more equitable tax system in Colorado by lowering the current 4.63% tax rate for households making less than $250,000 a year.

MORE: Colorado’s regressive tax system, and a proposed graduated income tax, explained

An estimated 95% of taxpayers who are below the threshold would qualify for the tax cut, which would take effect for 2021. For those who make more than $250,000, the additional earnings are taxed at a higher rate up to the maximum of 8.9% for annual taxable income over $1 million.

The organizations behind the ballot question, known collectively as Vision 2020 Colorado, expect the new graduated income tax to generate an estimated $2 billion a year in new money with at least half earmarked to increase teacher salaries and retention. The remainder would be spent at the discretion of state lawmakers.

“We know middle-income Coloradans are paying a greater share of the tax burden than the wealthy 5%, but our tax code isn’t just unfair, it’s inadequate,” said Scott Wasserman, president of the Bell Policy Center, a leading proponent of the measure. The tough decisions made by state lawmakers about how to spend the $30 billion annual budget, he added, are “a purely consequence of our state not having enough money.”

To continue reading the rest of this story, please click (HERE):

Blog post by Christine Burtt

Blog post by Christine Burtt