More Evidence that Balanced Budget Rules Don’t Work as Well as Spending Caps

More Evidence that Balanced Budget Rules Don’t Work as Well as Spending Caps

July 16, 2016 by Dan Mitchell

If you asked a bunch of Republican politicians for their favorite fiscal policy goals, a balanced budget amendment almost certainly would be high on their list.

This is very unfortunate. Not because a balanced budget amendment is bad, per se, but mostly because it is irrelevant. There’s very little evidence that it produces good policy.

Before branding me as an apologist for big government or some sort of fiscal heretic, consider the fact that balanced budget requirements haven’t prevented states like California, Illinois, Connecticut, and New York from adopting bad policy.

Or look at France, Italy, Greece, and other EU nations that are fiscal basket cases even though there are “Maastricht rules” that basically are akin to balanced budget requirements (though the target is a deficit of 3 percent of economic output rather than zero percent of GDP).

Indeed, it’s possible that balanced budget rules contribute to bad policy since politicians can argue that they are obligated to raise taxes. Continue reading

Update on Lakewood’s de-TABOR

Update on Lakewood’s de-TABOR

As noted earlier the establishment plan is to put a de-TABOR measure on this November’s ballot.

On Monday, July 18 (starting at 7 pm) there will be a “study session” regarding TABOR (and Council policies & procedures – not sure what they are up to on that). Citizen comments WILL be permitted. Don’t know the specifics of how that will work but I suggest we use this opportunity to demonstrate to Council it is a good idea to have citizens more involved in all study sessions (see my message on study session reform).

I suggest we have a good turnout. The anti-TABOR side has been alerted and will be there in full force.

AGENDA

LAKEWOOD CITY COUNCIL STUDY SESSION

CITY OF LAKEWOOD, COLORADO

LAKEWOOD CIVIC CENTER, 480 SOUTH ALLISON PARKWAY

JULY 18, 2016

7:00 PM

COUNCIL CHAMBERS

ITEM 1 – CALL TO ORDER

ITEM 2 – ROLL CALL

ITEM 3 – DISCUSSION – TABOR

A Public Comment Roster is available immediately inside the Council Chambers.

Anyone who would like to address the Council on TABOR will be given the opportunity

after signing the roster. Speakers should limit their comments to three minutes.

Madison County, Ill., to voters: Want to reduce your property taxes? | Illinois Policy | Illinois’ comeback story starts here

Madison County, Ill., to voters: Want to reduce your property taxes? | Illinois Policy | Illinois’ comeback story starts here

Adopting a taxpayer bill of rights, or TABOR, such as the one found in Colorado’s Constitution, would be another protection for Illinois taxpayers. A TABOR creates a formula that determines how much in taxes a government can collect in a year, based on increases in population and inflation. Any unit of government wanting to raise taxes or create a new tax would be required to seek voter approval first via a ballot referendum.

The Madison County referendum is a small, but positive, step toward reducing the property tax burden on Madison County residents and will provide much-needed relief to the taxpayers’ pocketbooks. Politicians and local officials across the state need to take similar steps to reduce the tax burden on their own residents. And to make sure Illinoisans will have a say in their tax burden in the future, Illinois should adopt a TABOR to the state constitution.

http://www.illinoispolicy.org/madison-county-ill-to-voters-want-to-reduce-your-property-taxes/

Happy 240th Birthday, America!

Spring of inaction: 2016 legislative session proves Illinois needs a taxpayer bill of rights

Spring of inaction: 2016 legislative session proves Illinois needs a taxpayer bill of rights | Illinois Policy | Illinois’ comeback story starts here

Illinoisans need a taxpayer bill of rights so that politicians must ask permission from voters if they want to raise taxes.

Colorado adopted a Taxpayer Bill of Rights, or TABOR, as an amendment to the Colorado Constitution. The Colorado TABOR requires any government to seek voter approval before imposing a new tax or raising existing tax rates. The TABOR also contains a formula that determines how much in taxes a government can collect in a year, based on increases in population and inflation. If more revenues are collected than the formula allows, then the governing entity is required to reimburse the excess money back to the taxpayers.

A provision in Colorado’s TABOR allows excess revenues to be kept by the government if the taxpayers give voter approval through a ballot initiative. Anytime there is a proposal to raise taxes or keep excess tax revenues, the ballot must provide the following: information on the governing entity’s current and previous four years of spending, the proposed tax increase in percentages and estimated dollar amounts, and summaries of support for and opposition to the proposed tax increase.

Vote NO on Initiative 117

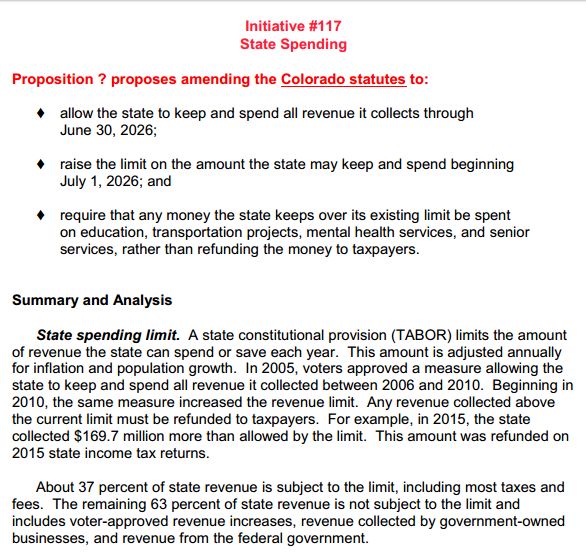

Initiative #117

- allow the state to keep and spend all revenue it collects through June 30, 2026;

- raise the limit on the amount the state may keep and spend beginning July 1, 2026; and

- require that any money the state keeps over its existing limit be spent on education, transportation projects, mental health services, and senior services, rather than refunding the money to taxpayers.

EDITORIAL: Celebrate TABOR for Making Colorado strong

EDITORIAL: Celebrate TABOR for Making Colorado strong | Colorado Springs Gazette, News

By: The Gazette editorial board

Colorado is reliably hot, economically. During good times and bad nationally and internationally, the economy typically produces above-average indicators when compared to other states. When Forbes, Business Insider and others rank states by economic performance, Colorado sometimes ranks first and seldom fails to finish among the top five.

One economic factor makes Colorado different than all other states. It’s called the Taxpayer’s Bill of Rights, or TABOR. Only Colorado has such a law.

TABOR is like that persnickety old-school spouse who won’t let the household live beyond its means. The rest of the family may resent the rules, because compulsive spending is fun. But they ultimately benefit from the safety and security of a stable home.

The law restricts government spending with a formula that accounts for inflation and population growth. If revenues exceed what the formula allows, politicians must return the windfalls unless voters say otherwise. All changes to tax policy must be approved by a public vote.

TABOR is constantly under attack because it tells politicians “no.” It limits their ability to spend. But the benefits are not in question if one examines the facts.

Colorado groups on IRS ‘targeting’ list

Colorado groups on IRS ‘targeting’ list

A handful of Colorado-based conservative organizations that sought tax-exempt status from the IRS are on the recently disclosed list of groups that were hit with additional scrutiny in the application process. In 2013, the IRS admitted and apologized for delaying the applications for tax-exempt status to groups with “tea party” or “patriot” in the group name.

A group called “TBD Colorado” is also on the list. Complete Colorado has not confirmed at the moment that the group is the same as the “To Be Determined Colorado” initiative launched by Governor Hickenlooper.

Among the list:

- Citizen Awareness Project

- Clear Information Colorado

- Coalition for a Conservative Majority Colorado Springs

- Coalition for a Conservative Majority Denver Chapter

- Colorado Women’s Alliance

- Common Sense Colorado

- Northwest Colorado Alliance, Inc.

- Tea Party Patriots, Denver

- TBD Colorado

- The TABOR Committee

All of the groups appear to have a conservative or right-of-center leaning with the exception of TBD Colorado, if that group is indeed the non-profit arm of the Governor’s effort “to find solutions to the difficult problems facing the state.”

The list was created as a result of a class action lawsuit against the IRS. According to the Washington Times, which broke the story on Sunday:

The tax agency filed the list last month as part of a court case after a series of federal judges, fed up with what they said was the agency’s stonewalling, ordered it to get a move on. The case is a class-action lawsuit, so the list of names is critical to knowing the scope of those who would have a claim against the IRS.

Complete Colorado reported in May of 2013 that The TABOR Committee felt as though it had received unnecessary and unfair questioning regarding the nature of their organizations. That group is on the list.*

“Certainly, we were damaged by this,” said Penn Pfiffner, Chairman of the TABOR Committee. “It’s very likely that we’ll be looking to recover the costs by the delay in responding to the extraordinary questions we got.”

Among the many questions asked in the letter to The TABOR Committee were such items as:

“…please provide each [board officer’s] names and addresses of each individual’s employer/business, the nature of their employment/business…”

“Please provide copies of agendas and/or descriptions of topics covered at each of the organization’s general meetings and events since inception.”

“Please submit copies of all publications and/or advertising materials that have been distributed or will be distributed.”

The list of 426 names does not include 40 other names of organizations that had already opted out of being a part of any class action suit. However, the list of 426 exceeds the original estimate from the IRS of 298 groups that were targeted.

Group list of extra scrutiny targets by IRS

*The 2013 report names the group as The Tabor Foundation. The TABOR Foundation is the (c)(3), and The TABOR Committee is the (c)(4) arm of the same group.

CORRECTION: The original publishing of this article listed Common Sense Colorado as an organization that would not be considered right-of-center or conservative. That is incorrect.

Send us tips at CompleteColorado@gmail.com.

http://completecolorado.com/pagetwo/2016/06/07/colorado-groups-on-irs-targeting-list/

Anti-TABOR lawsuit deserved latest setback in federal court

Anti-TABOR lawsuit deserved latest setback in federal court

Cyrus McCrimmon, Denver Post file

Colorado Attorney General Cynthia Coffman is defending the state against a lawsuit regarding TABOR.

By The Denver Post Editorial Board |

June 7, 2016 |

The Taxpayer’s Bill of Rights has multiple flaws that this editorial page has documented repeatedly over the years while urging lawmakers and voters to fix them.

We’re also on record as recently as last month urging the legislature to adopt a budgetary mechanism to free up revenue that otherwise would have to be refunded under TABOR.

But our critique of TABOR doesn’t extend to questioning the right of voters to enact or defend it. The 5-year-old lawsuit arguing that TABOR violates the U.S. Constitution’s mandate that states have a “Republican Form of Government” is too strained and exotic for our taste. It deserved the setback it suffered last week in federal court.

The 10th U.S. Circuit Court of Appeals ruled that several Colorado lawmakers who are plaintiffs lacked legal standing to sue because they do not represent the General Assembly as a whole.