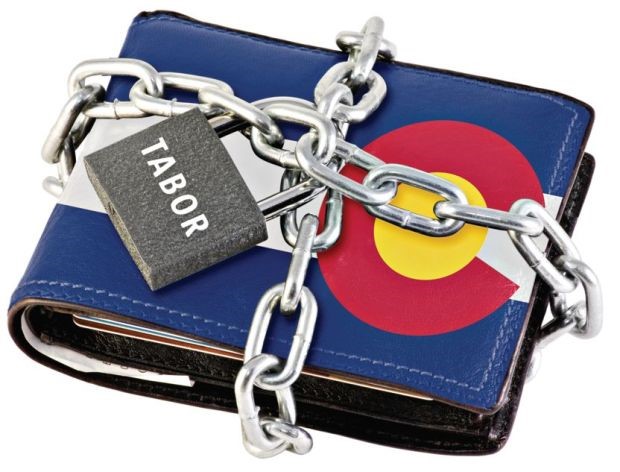

DENVER – One of three Republican sponsors on a bill that would change the way revenue is capped under the Taxpayers Bill of Rights (TABOR) has had a change of heart.

Despite the fact supporting TABOR is one of the many issues that normally binds conservatives, Representatives Phil Covarrubias, (R-Adams/Arapahoe), Dan Thurlow (R-Mesa) and Lois Landgraf, (R-El Paso) all originally advocated for a change to the 25-year-old constitutional amendment that restricts tax increases without a vote of the people and caps state revenue.

Covarrubias, however, said he took enough backlash for his role in it that he announced via social media that he was pulling his name from the sponsorship of HB17-1187.

“In case you have not heard: per the request of my constituents, I have decided to take my name off HB 1187 and will be voting against it,” Covarrubias said on his Twitter feed.

The Tweet came as welcome news to many fellow Republicans who immediately retweeted the announcement with words of gratitude.

Senate Bill 1187 would ask voters in November to change the revenue cap from one that is based on percentage increase in state population plus the rate of inflation to one that is based on Colorado personal income growth over a rolling calendar of the previous six years.

The bill passed third and final reading Friday and now moves to the Senate, where Republicans hold a one-vote majority. It is expected to be heavily debated again.

Opponents say the current formula takes into consideration that a larger population requires more government services while proponents argue the current formula is outdated. Continue reading

An effort to reform the Taxpayer’s Bill of Rights, or TABOR, passed its first test on Monday with Republican support. File photo.An effort to reform the Taxpayer’s Bill of Rights, or TABOR, passed its first test on Monday with Republican support, though the legislation faces an uphill battle.

An effort to reform the Taxpayer’s Bill of Rights, or TABOR, passed its first test on Monday with Republican support. File photo.An effort to reform the Taxpayer’s Bill of Rights, or TABOR, passed its first test on Monday with Republican support, though the legislation faces an uphill battle.