Speaker will make case to preserve TABOR

The Mesa County Republican Party is inviting the public to come to a free presentation on the Taxpayer’s Bill of Rights, delivered by conservative think-tank leader Jon Caldara on March 27.

Caldara, the president of the Denver-based Independence Institute, is a proponent of limited government and plans to speak in favor of keeping TABOR intact, despite talk from both sides of the political aisle recently about tweaking the formula that limits government spending and requires taxpayer consent to use funds in excess of spending limits.

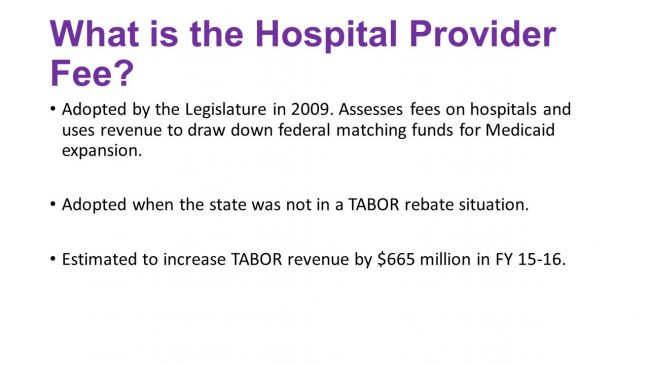

TABOR was voted into the Colorado Constitution 26 years ago, and the original intent of the law was to limit government growth and require taxpayers to approve tax-rate increases.

Critics have said the ratcheting effect TABOR has on spending has prevented governments from recovering from leaner times, especially in local governments that depend on property taxes for funding when those property valuations decrease.

Caldara has defended TABOR in the past, stating it prevents further problems during recession and helps keep governments from experiencing vast budget shortfalls. He also used an analogy comparing TABOR to obtaining consent for sexual contact in a column last year for the Denver Post, titled, “Why date rapists hate TABOR.”

Bringing Caldara to speak in Grand Junction on TABOR is timely, said Marjorie Haun, who handles publicity for the Mesa County Republican Party. Haun said she noticed some confusion about TABOR during the 2017 election, in which the Mesa County Sheriff’s Office and the Mesa County District Attorney’s Office asked voters to raise sales taxes to support their budgets in the “Back the Badge” campaign. Continue reading →