Protect Colorado Taxpayers – Vote NO on the Gas Tax

You’ve likely heard about the legislature’s new gas tax proposal, which seeks to raise over $4 billion to “solve” our infrastructure needs. This massive proposal includes new charges at the gas pump, on delivery services like Amazon, ride-sharing services like Uber and Lyft, and more. No matter who you are, they have a new charge for you.

We all agree that our roads and bridges need repair, but Coloradans already pay 22 cents per gallon in State taxes, on top of the 18.4 cents we pay in federal taxes. For certain politicians that’s just not enough.

Much of the debate has focused on the questionable legality of the proposal, due to the passage of Proposition 117 just this past November. That requires governments to receive voter approval before enacting these types of new, large “fees.” The unique protections of our Taxpayer’s Bill of Rights, require the legislature to obtain voter approval before raising taxes. But sponsors won’t let that stop them. Instead, they’re calling these new taxes, “fees,”’ so that Colorado voters won’t have a voice in the process. Continue reading

Objectors unsuccessful at blocking property tax cuts at Title Board

- By MICHAEL KARLIK michael.karlik@coloradopolitics.com

- Apr 30, 2021Updated 23 hrs ago

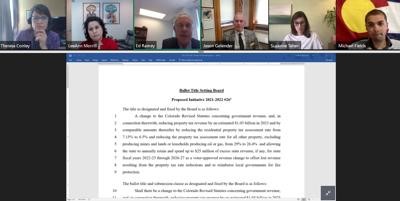

The Title Board reconsidered its ballot titles for three property tax reduction proposals at its April 30, 2021 meeting.

Opponents were unsuccessful at derailing three ballot initiatives that would cost local governments more than $1 billion in property tax revenue as the Title Board on Friday stuck by its original decision to award a ballot title to the measures.

On April 21, the three-member board concluded Initiatives #26-28 contained a single subject, as the state constitution requires, and consequently set a title that would appear before voters. But objectors Carol Hedges and Scott Wasserman challenged the board’s finding, trigging a rehearing at the Title Board’s final meeting to screen proposals for the 2021 statewide ballot.

As introduced, the initiatives would all reduce the residential property tax assessment rate from 7.15% to 6.5% and cut the assessment rate for all other property from 29% to 26.4%. Nonpartisan fiscal analysts estimated the tax cut would constitute a $1.03 billion hit to local governments, affecting services such as K-12 education and police. Because Colorado’s school financing scheme requires the state to backfill funding for local districts, there would be an extra $258 million in additional state spending each year.

Partially offsetting the sizeable loss in local government revenue would be $25 million that the state could temporarily direct toward localities — if excess income exists that normally would be refunded under the Taxpayer Bill of Rights. The three proposed initiatives would funnel the money toward fire protection, toward reimbursements for the senior homestead tax exemption, toward general relief.

To continue reading the rest of this story, please click (HERE):

Conservative advocacy groups look to cut Colorado’s gas tax rate

(The Center Square) – Two of Colorado’s most influential conservative advocacy groups say they will join forces on ballot measure language to reduce the state’s gas tax in 2022.

Americans for Prosperity-Colorado (AFP-CO) and Colorado Rising State Action announced the plan in a statement on Monday in response to a Democratic-backed proposal to hike fees on gasoline to fund the state’s transportation system.

The $3.9 billion fee proposal, which hasn’t been formally introduced in the General Assembly yet, would include fee increases on regular gas, diesel gas, electric vehicle registrations, ride-shares, and online retail deliveries.

To read the rest of this story, please click (HERE):

COLORADO SUPREME COURT School finance tax change arguments heard

By Erica Meltzer

Chalkbeat Colorado

The plain language of Colorado’s Taxpayer’s Bill of Rights says that to raise taxes from one year to the next requires a vote of the people.

But what if voters agreed to keep school property taxes steady more than 20 years ago and state officials lowered them instead? Does it take another vote of the people to return tax rates to the previous level? Or does increasing them simply correct an error?

That’s the question the state Supreme Court took up Tuesday as lawmakers seek a solution to a vexing problem in school funding.

Colorado lawmakers sent the court a formal question — known as an interrogatory — last month seeking a constitutional ruling before they give final approval to a bill that gradually would increase local property taxes over 19 years.

If approved, the change would generate more than $90 million in new revenue for schools next year and more than $288 million a year when fully implemented. That would take a big bite out of the funding gap that Colorado schools experience when lawmakers hold back education dollars to pay for other priorities — but the money would come from local taxpayers, not state coffers.

To continue reading this story, please click (HERE):

Common Sense Institute study says Colorado UI debt will need more payroll tax revenues.

Colorado will need to increase payroll tax revenues to repay the Unemployment Insurance (UI) trust fund according to a new study by the Common Sense Institute. Colorado, alongside states like California, New York, and Connecticut, has one of the country’s highest burdens of federal loans to its unemployment insurance fund. As of April 8th, Colorado is one of 19 states currently reliant upon federal loans and has the 9th-greatest amount of money outstanding in both absolute and population-adjusted dollars. 8 of the top 9 states who need federal loans to support their unemployment insurance are blue states.

Repaying the UI Trust Fund’s debt will require nearly 25% more payroll tax revenue per year, on average. Between FY20 and FY23, total revenue to the fund is projected to grow at an average annual rate of 24.8%. For the fund to be restored to its pre-pandemic solvency by 2028, five years after the end of the latest projection, contributions will have to exceed payments by an average of almost $316 million in each year after 2023.

To continue reading this story, please click (HERE):

2021 Colorado Legislature: Bigger Government, Smaller Us

By Christine Burtt, TABOR Foundation Board Member

By Christine Burtt, TABOR Foundation Board Member

4/13/2021

There are several onerous pieces of legislation in Colorado this year that will negatively impact your standard of living, if not your way of life.

Here are three notable examples.

- HB21-1083, the so-called “Don’t dare to challenge the government’s valuation on your home” bill, was designed to create a chilling effect on homeowners questioning the assessment that calculates their property tax.

The bill, which has been signed into law by Governor Polis, was initiated by the Colorado Assessors. It changes existing law that prevented a county assessor from raising taxes on a property if the homeowner challenged an assessment. The previous law gave homeowners an appeals process if they believed their property had been assessed at a value higher than was warranted.

, with the new law, if you challenge the valuation set by the county assessor, the assessor may keep the valuation as stated, or may even increase your property tax. It won’t go down. Continue reading

State-Based Policy Groups Launch New Coalition to Oppose Gas Tax Proposal

State-Based Policy Groups Launch New Coalition to Oppose Gas Tax Proposal

APR 6, 2021 BY AFP

Battle Intensifies After Introduction of Framework, Initial Coalition Expands

DENVER – Americans for Prosperity-Colorado (AFP-CO) and partners formally launch the Colorado Taxpayers Coalition, a group of local advocacy partners set out to protect Colorado taxpayers by defeating the legislature’s current gas tax proposal and protecting the Taxpayer’s Bill of Rights (TABOR).

AFP-CO is also running a statewide campaign that urges Coloradans to contact their elected official to advise against the bill. These efforts included a poll that revealed constituents in several state senate districts strongly oppose the proposal.

AFP-CO State Director Jesse Mallory issued the following statement: Continue reading

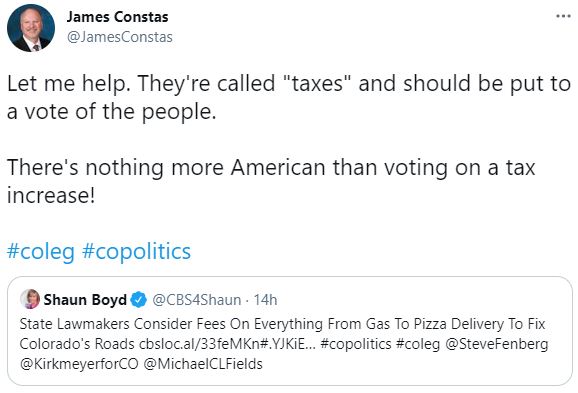

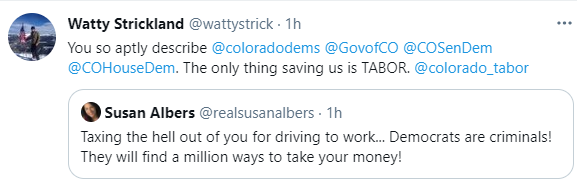

Today On Twitter

#TABOR

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteOnTaxesAndFees

#ProtectTABOR

Millions more for Colorado K-12 schools? Lawmakers seek court opinion first.

Current Colorado lawmakers want to slowly increase local school district property taxes without a vote. They say it doesn’t violate the Taxpayer’s Bill of Rights because a generation ago voters agreed to higher rates and state officials improperly lowered them.

This story was originally published by Chalkbeat Colorado. More at chalkbeat.org.

Democratic lawmakers are asking the Colorado Supreme Court to decide whether a proposed tax change that could generate millions for K-12 education is constitutional.

Colorado’s Taxpayer’s Bill of Rights typically requires voter approval for tax increases. This proposal would gradually increase local school district property taxes without a vote under the premise that voters a generation ago agreed to higher rates and that state officials improperly lowered them.

On Friday, after giving initial approval to a bill to phase in higher local tax rates over 19 years, senators took the unusual step of sending what’s called an interrogatory seeking the opinion of the state’s highest court. Republicans Sen. Kevin Priola of Brighton and Bob Rankin of Carbondale joined Democrats in what was otherwise a party-line vote on the resolution.

Supporters hope to get a clear answer before the end of the legislative session and include the prospect of additional revenue in the 2021-22 budget. New local taxes would generate more than $90 million next year and could bring in the equivalent of around $288 million a year when they’re fully implemented.

Supporters believe previous case law indicates the court would agree with their interpretation. Legal experts have said the decision could go either way.

To continue reading this story, please click (HERE):