Denver, CO – New taxes may be on their way to the ballot. Colorado Initiative Title Setting Review Board approved language for 12 new taxes. The next step will be collecting the two hundred thousand or more signature to have these ballot initiatives appear on your November 2020 ballot.

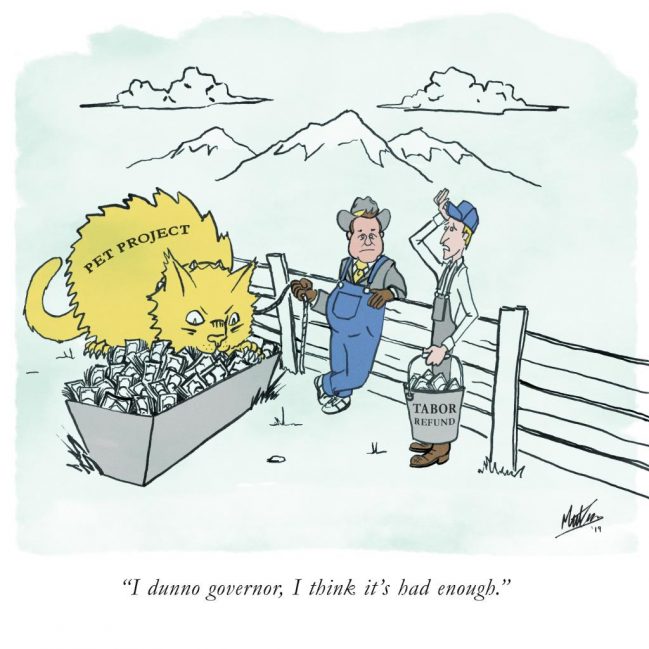

After the sound defeat of Proposition CC in 2019, the tax and spend crowd would go away for a while. The simple answer is no. As long as liberal billionaires fund “think tanks” like the Colorado Fiscal Policy Institute and the Bell Center For Policy, they will always be pushing for tax increases and the repeal of the Taxpayer’s Bill of Rights (TABOR).

From Colorado Politics:

The board also approved 12 initiatives from Carol Hedges and Steve Briggs of Denver that would create a graduated income tax system, raising approximately $2 billion to $2.4 billion. The money would go toward education and addressing “the impacts of a growing population and a changing economy.”

Voters have turned down tax increases and eliminating spending caps every election they have been on the state-wide ballot. The last successful attempt was Referendum C in 2005 after too many Republicans campaigned hard for it. In a related note, those Republicans political careers ended that day.