2024 Election, Elections, Natalie Menten, TABOR, Uncategorized

Menten: Weighing in on local TABOR measures for the 2024 ballot

August 29, 2024 By Natalie Menten

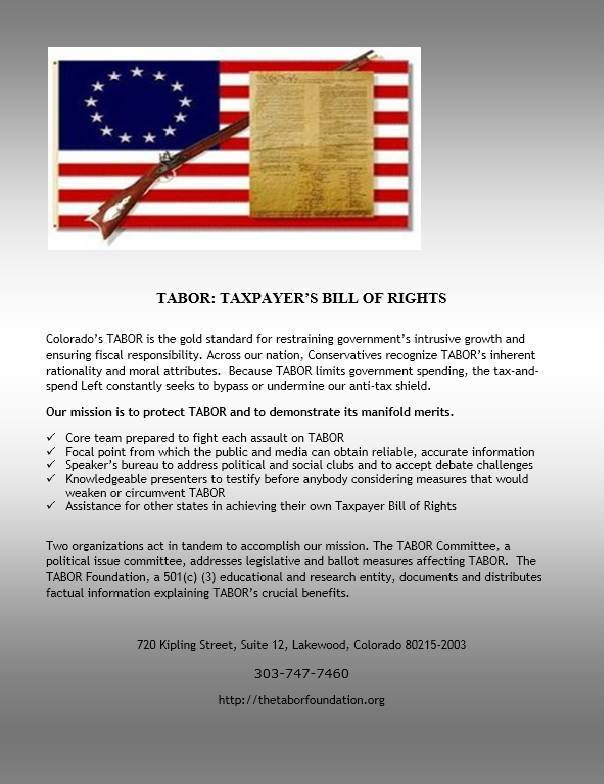

One great, though lesser-known benefit provided in the Colorado Taxpayer’s Bill of Rights (TABOR) is the local ballot issue notice. This guide is sent by mail at least 30-days before the election to all households with one or more registered voters.

The notice includes details about upcoming local ballot measures that increase taxes, add debt, or suspend TABOR revenue limits. It includes a section where registered voters have the opportunity to submit FOR or AGAINST comments, up to 500 words each.

You should know that there are actually two types of TABOR ballot issue notices. One notice is for the statewide measures and commonly referred to as the “Blue Book.” The notice discussed here is for elections held by local governments such as a city, town, school district, or special taxing district. It’s important to know the difference as you could potentially get more than one of these notices in the mail.

Several years back, it was discovered that out that of some 300 local tax issues throughout the state, only 15 had the taxpayer’s voice printed in a ballot issue notice. That’s only 5 percent! You can make a big difference and amplify your voice by being an author of the next ballot issue notice where you live. Considering that you reach thousands of voters, submitting comments in the TABOR notice costs almost nothing and takes relatively little time and energy.

What follows is an explanation of how to participate in the local ballot issue comment process. As in so much of government bureaucracy, instructions must be followed with no room for alteration. The deadline for this year is Friday, September 20 no later than noon to have your comments included in the local TABOR notice. Continue reading