Justices of the Colorado Supreme Court, 2021

The Colorado Supreme Court will decide whether the paid family and medical leave program that voters enacted in the 2020 election violates the state’s Taxpayer Bill of Rights.

The court announced on Monday that it will review a decision from Denver District Court that dismissed a lawsuit over Proposition 118, the Paid Family and Medical Leave Insurance Program. By a margin of 58% to 42%, voters approved a plan to impose payroll premiums, split between employers and employees, that would entitle workers to up to 12 weeks of paid leave.

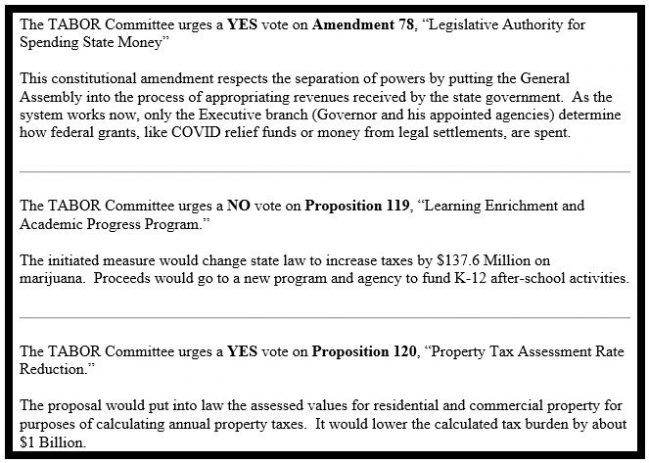

Beginning on Jan. 1, 2023, payments into the program will begin. But Grand Junction-based Chronos Builders is claiming that the funding arrangement violates TABOR, the 1992 constitutional amendment that requires tax increases to be put to a vote of the electorate, among other restrictions.

“Any income tax law change,” TABOR reads, “shall also require all taxable net income to be taxed at one rate … with no added tax or surcharge.”

Click (HERE) to continue reading this story at ColoradoPolitics