Teachers union endorses Rep. Dave Young for state treasurer

Tyler Silvy

April 12, 2018

Dave Young

JUNE PRIMARY

Rep. Dave Young, D-Greeley, will compete against two other Democratic nominees for state treasurer at the June 26 primary.

The Colorado Education Association has endorsed Rep. Dave Young, D-Greeley, in his campaign for state treasurer, adding to a long list of endorsements punctuated by union support.

Young, who is term limited in Colorado House District 50, is running for treasurer and has two Democratic opponents — Bernard Douthit, a Denver businessman; and Charles Scheibe, Colorado’s chief financial officer.

The most recent campaign filings has Young outraising both, and the most recent endorsement announcement appears to add further momentum.

“I am so proud to be endorsed by the CEA,” Young said in the release, adding he would fight to ensure public schools get the funding they deserve.

Young is a former teacher, serving in Greeley classrooms for 24 years. He was also the president and lead bargainer for the Greeley Education Association, the local chapter of the statewide teachers union.

CEA President Kerrie Dallman had positive things to say.

“Dave has been a crucial force in bringing forth legislation to help our educators and students, and to increase funding for our state’s schools,” Dallman said in the release. “With his leadership, we can make sure that every child in Colorado has access to a high-quality public education.”

Along with the CEA, Young has earned the endorsement of the Pipefitters Local 208 and the Rocky Mountain Farmers Union, as well as the support of more than 50 elected officials, including Congressman Ed Perlmutter and former Governor Bill Ritter, according to the release.

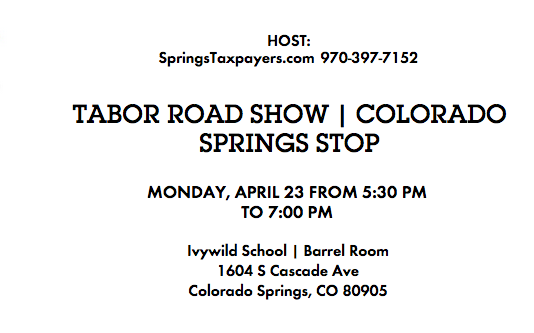

Young said in the release he has first-hand knowledge of teachers going without raises and students going without resources, saying he will fight for more funding and work to fix Colorado Constitutional amendments TABOR and Gallagher.

http://www.greeleytribune.com/news/local/rep-dave-young-announces-teachers-union-endorsement-in-state-treasurer-race/