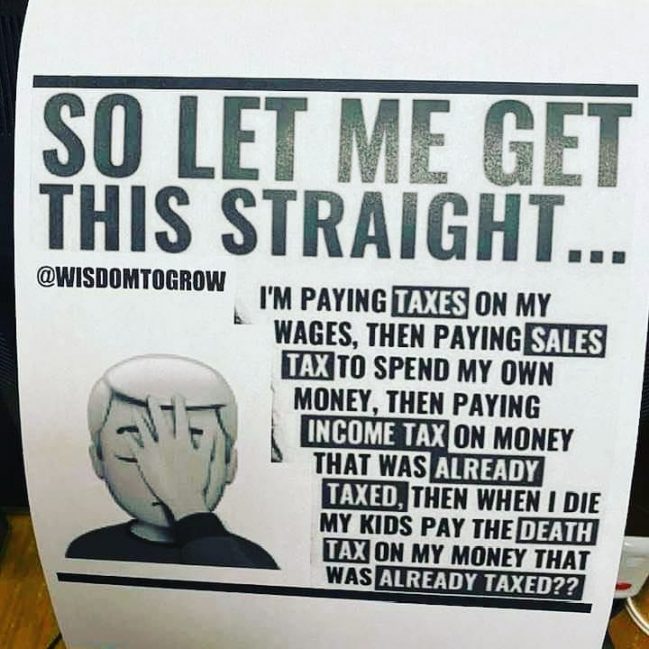

#TABOR

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteNo

#CoLeg

#TABOR

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteNo

#CoLeg

Let us decipher Matt Gray’s comments (…”we need new revenue to go along with it.”)

with our 6-word analysis:

“We’re going to raise your taxes”

#TABOR

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#FixTheDamnRoads

#CoLeg

Don’t believe us? Ask one.

Colorado voters love saying no to giving up more of their money to fix traffic and roads.

Don’t believe us? Look at the state’s history on ballot issues for roads.

Republican lawmakers want to continue using general fund money — the money that the state already collects and spends.

“This building keeps saying to the people of Colorado, ‘give us more money,’ and the people of Colorado are saying, ‘show me you’re going to spend the money we’re already given you on the things we care about, like roads and bridges,'” said Sen. Paul Lundeen, R-Monument.

Lundeen proposed a bill that would have brought back an old Colorado law that used existing money the state already collected.

For years — decades even — Coloradans have called upon the General Assembly to prioritize Colorado’s outdated transportation infrastructure. Our elected officials have for so long kicked this proverbial can down the (potholed) road that the Colorado Department of Transportation now has a backlog of anywhere from $7 billion to $9 billion in projects. To put that in perspective, that’s nearly a fourth of Colorado’s entire budget this year.

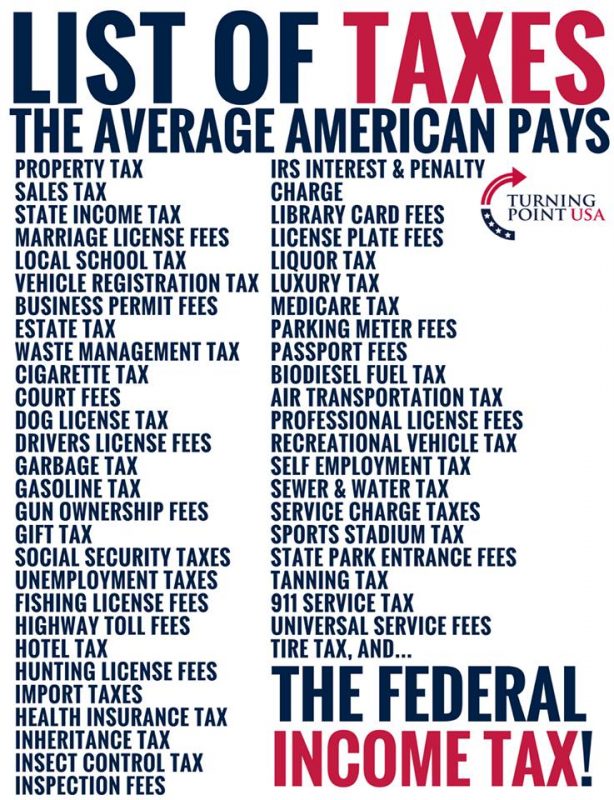

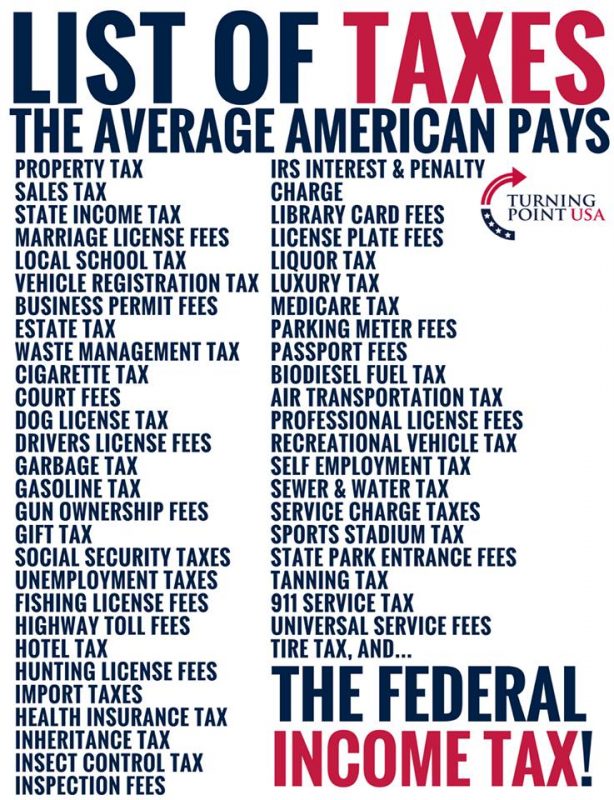

We hear it all the time — where are the taxes we already pay going?

The truth is that the legislature has been using your tax dollars as a piggy bank for pet projects instead of utilizing them to fill potholes and add new highway lanes. Pet projects such as Senate Bill 19-173, a $800,000 study on the feasibility of the state government getting involved in your retirement savings, the creation of an “Office of Just Transition” that has been covered extensively in the press, and $6 million for unnecessary census outreach that wasn’t required by the federal government. These have all been priorities of legislative Democrats — not transportation.

The front page of the Denver Post features an article by Shelly Bradbury that specifically accuses TABOR for the early release of Jefferson County jail inmates. (See 8th paragraph—highlighted in yellow).

Please see: Inmates out early

Editor’s Note: Denver7 360 stories explore multiple sides of the topics that matter most to Coloradans, bringing in different perspectives so you can make up your own mind about the issues. To comment on this or other 360 stories, email us at 360@TheDenverChannel.com. See more 360 stories here.

DENVER — With more drivers using Colorado roads, there’s not only more traffic, but more wear and tear on the infrastructure. The Colorado Department of Transportation (CDOT) has identified $9 billion in needs from repair and replacement to improvements to help alleviate congestion.

“Without funding, these can’t get fixed,” said CDOT executive director Shoshana Lew.

For decades, the gas tax has served as the state’s main source of funding for transportation projects. Each time a driver fills up their gas tank, 18 cents go to the federal government and another 22 cents go to the state.

However, the state gas tax hasn’t been raised in nearly three decades.

So, is it time to raise the gas tax or are there other ideas to raise money for Colorado roads? Denver7 went 360 to hear multiple perspectives on the issue of transportation funding.

DENVER–Governor Polis and the majority Democrats have an ambitious agenda this legislative session. Question is, how will they pay for it all? With the failure of Proposition CC in November, those who were hanging their hats on voters giving up future tax refunds, allowing the state to keep and spend overcollected tax revenue, will need to find new pots of money. Indeed, not only did Coloradans vote to keep the Taxpayer’s Bill of Rights (TABOR) revenue limit in place, that limit has been hit and the state income tax rate is actually ratcheting down for the year.

Republican strategist Roger Hudson and Democrat strategist Miller Hudson recently sat down with Complete Colorado editor-in-Chief Mike Krause on the public affairs TV show Devil’s Advocate (airs Friday nights at 8:30 on Colorado Public Television, channel 12) to talk about where Democrats might turn to bring in new revenues. Both agree that one option is more more fee-funded government-run enterprises, which operate outside the TABOR budget cap. Check out the video below to find out more.

The board of the Western Slope’s Colorado River District is considering whether to ask residents in the 15 counties it serves, including Mesa County, to approve a tax hike.

The district’s general manager, Andy Mueller, is recommending that the board consider seeking voter approval in November to raise the district’s property tax mill levy to 0.5 mills. That would boost annual revenues by about $4.9 million, much of which the district could use to work with partners to fund water projects.

The increase would cost the average homeowner in the district an estimated $8.63 a year, but that amount would vary widely across the district due to disparities in property values, ranging from about $3.71 a year in Moffat County to $23 a year in Pitkin County. The increase would cost about $1.90 a year per $100,000 of assessed valuation.