#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

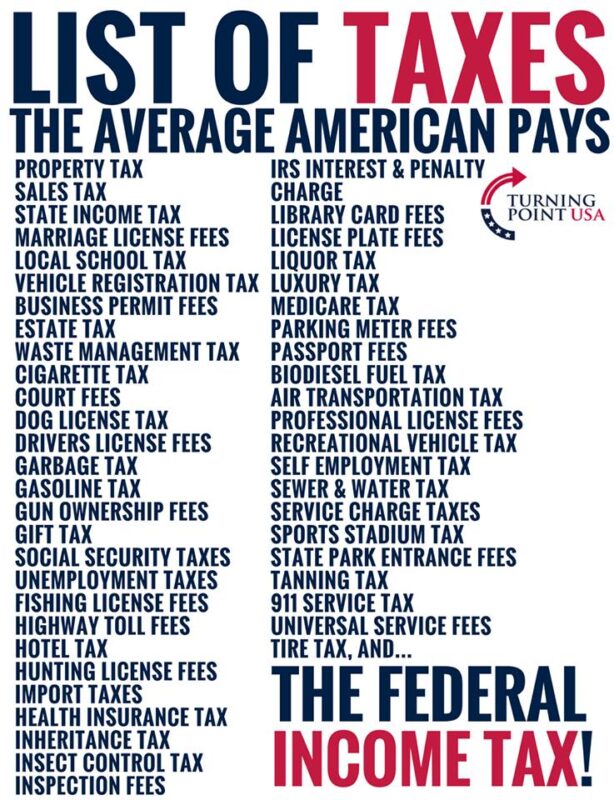

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

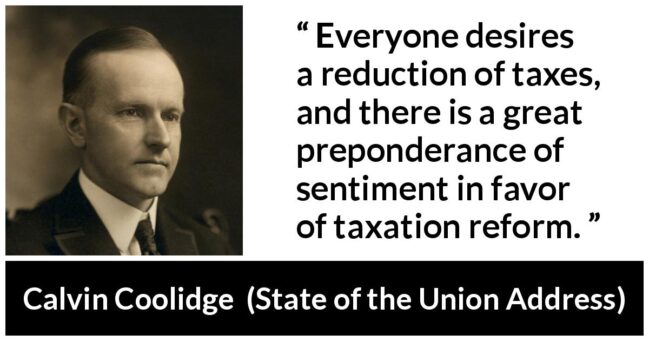

FYI. This was on Twitter yesterday:

BoulderGuyTC@BoulderGuyTC

Replying to @wattystrick @GovofCO and @colorado_tabor

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

#DontBeFooled

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#FollowTheMoney

#FollowTheLaw

One great, though lesser-known benefit provided in the Colorado Taxpayer’s Bill of Rights (TABOR) is the local ballot issue notice. This guide is sent by mail at least 30-days before the election to all households with one or more registered voters.

The ballot issue notice includes content and details about upcoming local ballot measures that increase taxes, add debt, or suspend TABOR revenue limits. It includes a section where registered voters have the opportunity to submit FOR or AGAINST comments, up to 500 words each.

You should know that there are two types of TABOR ballot issue notices. One notice is for the statewide elections and commonly referred to as the “Blue Book.” The notice discussed here is for elections held by local governments such as a city, town, school district, or special taxing district. You could potentially get more than one of these notices in the mail.

Several years back, it was discovered that out that of some 300 local tax issues throughout the state during a ballot year, only 15 had the taxpayer’s voice printed in a ballot issue notice. That’s only 5 percent! You can make a big difference and amplify your voice by being an author of the next ballot issue notice where you live. Considering that you reach thousands of voters, being able to submit comments in the TABOR notice costs almost nothing and takes relatively little time and energy.

What follows is an explanation of how to participate in the local ballot issue FOR or AGAINST comment process. As in so much of government bureaucracy, instructions must be followed with no room for alteration. The deadline for this year is Friday, September 23 no later than noon to have your comments included in the local TABOR notice.

To continue reading this story at Complete Colorado, please click (HERE):

#DontBeFooled

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#FollowTheMoney

#FollowTheLaw

#DontBeFooled

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#FollowTheMoney

#FollowTheLaw

September 8, 2022 By Sherrie Peif

LAKEWOOD — A Colorado State Senate candidate has added her name to a long list of Democrats trying to take credit for this year’s Taxpayer’s Bill of Rights (TABOR) refunds, despite a history of trying to eliminate the constitutionally required return of overcollected tax revenue.

Lisa Cutter, who until this year has represented House District 25 and served as the House Majority Caucus Co-Chair, is featured in a social media ad telling voters she was responsible for the refund checks that recently went out to Coloradans, that are actually the result of TABOR, an amendment to the Colorado Constitution that limits the state from raising taxes or exceeding a revenue limit on a portion of the state budget without first asking voters. The ad, which links back to Cutter’s campaign website, makes no mention of TABOR, instead claiming she “Delivered Colorado’s biggest tax relief checks ever.” Continue reading

A small housing complex in Lyons. (Moe Clark/Colorado Newsline)

Colorado voters will decide this November whether to boost state spending on affordable-housing initiatives by tapping into funds that could otherwise be returned under the Taxpayer’s Bill of Rights.

Initiative 108, which officially qualified for the 2022 ballot last month, would dedicate an additional $300 million annually to the state’s affordable housing efforts. It would protect the additional revenue by exempting the funds from the annual limits set by TABOR, the 1992 constitutional amendment that places restrictions on Colorado’s taxation and spending levels.

“This measure is desperately needed if we want future generations of Coloradans to thrive,” Brian Rossbert, the executive director of the nonprofit Housing Colorado, part of a coalition supporting the measure, said in a statement.

“Too many Coloradans can no longer afford to live in the neighborhoods where they set down roots,” he said. “That’s forcing families to make difficult relocation decisions, robbing communities of essential services and intensifying our homelessness crisis.”

If approved by voters, Initiative 108 would establish a new State Affordable Housing Fund and exempt it from TABOR limits. Each year, 60% of its funding would support a housing program overseen by the state’s Office of Economic Development and International Trade, with the remaining 40% distributed by the Department of Local Affairs.

The measure requires the bulk of the OEDIT funding to be directed towards “equity investments in low- and middle-income multi-family rental developments.” Efforts overseen by DOLA would include grants to assist first-time homebuyers with their down payments and a separate program to provide rental assistance and housing vouchers to people experiencing homelessness.

A state issue committee in support of Initiative 108, Coloradans for Affordable Housing Now, raised $2.8 million to fund its campaign earlier this year. Its largest donor by far is Denver-based charitable organization Gary Community Ventures, which has contributed $2 million. Other donors include Habitat for Humanity Denver and the National Association of Realtors.

The measure has drawn opposition from Advance Colorado Action, a deep-pocketed, “dark money” nonprofit that has helped fund and coordinate a wide range of conservative causes in recent Colorado elections.

“There is nothing ‘affordable’ about taking $300 million of our TABOR tax refunds for a flawed housing measure,” Advance Colorado’s Michael Fields said in a statement last month. “To fix our state’s housing crisis, we need to build more, not tax more.”

Backers say the measure could help fund the construction of 170,000 new homes in the coming years, offsetting what is projected to be a worsening housing crunch in fast-growing Colorado.

In May, a fiscal impact statement by the nonpartisan Legislative Council Staff noted that the measure’s TABOR impact would vary from year to year depending on revenue levels and how lawmakers choose to distribute refunds.

“If refunds are paid via current law mechanisms, the measure is expected to reduce refunds by approximately $40 per taxpayer, on average, for tax year 2023 and $80 per taxpayer, on average, for tax year 2024,” analysts wrote.

“The measure will increase investments in affordable housing developments, boosting incomes for developers and construction firms,” nonpartisan staff wrote in a separate fiscal summary. “Some households that would otherwise face housing insecurity may find stable housing under the measure, increasing their financial security and opportunities for employment.”

Other measures up for a vote on Colorado’s 2022 ballot include three proposals to change the state’s liquor laws.

https://coloradonewsline.com/2022/09/07/affordable-housing-reduce-tabor-refunds-2022-ballot/