Category Archives: TABOR Refunds

Massive Property Tax Increases Coming for Colorado Homeowners (Intro)

Proposed Solutions to Colorado’s Property Tax Crisis (pt. 4)

Colorado Property Taxes – Where Things Stand TODAY (pt.3)

Colorado Legislators Conspired to Increase Property Taxes? (pt. 2)

THIS is Causing Colorado Property Taxes to Skyrocket! (pt. 1)

Lewis: A wolf in sheep’s clothing

Lewis: A wolf in sheep’s clothing

Colorado’s Taxpayer Bill of Rights, approved by voters in 1992, was intended to limit the tax revenue that the state government can retain for spending ensuring that government spending doesn’t spiral out of control. However, it seems that a cunning wolf is attempting to enter the flock.

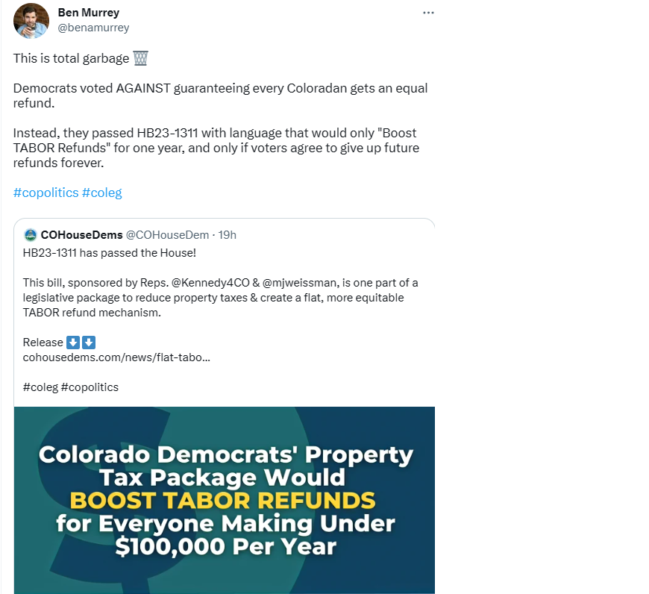

Prior to 2022, TABOR refunds were tiered based on the amount taxpayers paid. The more you paid in taxes, the higher refund you received. However, last year, Gov. Polis and the Democrats accelerated the refund process and sent out identical amounts to everyone, regardless of their actual tax payments. At the time it seemed innocuous, but now I’m not so sure.

As homeowners, many of us have just received our new property valuations. While I’m happy that my home value has increased dramatically, the thought of my new impending tax bill sent chills down my spine. The prospect of my taxes nearly doubling made me cringe. Fortunately, Colorado has a provision that limits property tax revenue increases to 5.5% so hopefully, the blow won’t be too severe.

Recently, the Colorado legislature passed a proposal to “lower” property tax rates, which sounds promising. However, upon closer examination, it’s apparent that this proposal is a wolf in sheep’s clothing. Rather than reducing taxes, it merely restricts increases while diverting money from our TABOR refunds to more than cover any revenue loss. Moreover, an attached provision effectively establishes a state-administrated welfare system funded by TABOR dollars. Talk about deceiving the flock.

Allow me to break it down for you. The property tax reduction proposition (Proposition HH) includes a provision to fund any loss of revenue from the general fund. Essentially, it’s a shell game. While the proposal claims to lower taxes, the net result is zero savings for taxpayers. Additionally, while it mandates limits on assessment rates, that actually won’t necessarily curb taxes since municipalities remain free to adjust their levies. There is a limit on tax revenue increases but, with today’s inflation, that limit would be higher than the existing 5.5% limit in place today. It’s like chasing your tail, going in circles with no progress.

Within this proposition, there is a second provision (HB 23-1311) regarding TABOR refunds, which would change the refund method to the single fixed value payout (as used in 2022) regardless of taxpayers’ actual contributions. Interestingly, this provision passes automatically if voters approve the property tax proposition. The reason behind connecting these two provisions is a mystery. It appears like a wolf is trying to sneak into the flock.

State Senate Majority Leader Dominick Moreno argues for equal distribution claiming that a tiered rebate system is not “equitable,” and that the money should go to those with the most need. But let’s pause for a moment. TABOR is not a welfare program — it is a tax refund program.

When it comes to refunds, rebates, or dividends, the amount you receive is typically based on your investment. If you’re a stockholder, the dividend you get depends on the number of shares you own. It’s straightforward. If you tax people based on their income and then rebate them a flat amount, it is no longer a taxpayer bill of rights — it’s a welfare program in disguise. In this case, an 18-year-old kid who plays video games all day in the basement of his parent’s house would get the same “rebate” as the parent who works 60-hour weeks and pays thousands in taxes. Is that truly equitable?

We strive for a society that strikes a balance between capitalism and socialism, supporting those in need while motivating everyone to work hard and enjoy the fruits of their labor. We already have various programs to aid those in need and always have the option to create more, but transforming TABOR into a socialistic welfare program administered by the state is disingenuous as that was never its intended purpose.

So, it all becomes clear now. There is a proposition to lower property taxes which most people will likely vote for, believing it will provide relief. The only problem is that it doesn’t actually lower taxes. I am going to dig into this further, but I actually think this bill could actually significantly increase taxes. Meanwhile, a hidden second proposition, covertly transforms a tax rebate program into a social welfare program, effectively turning TABOR into a new tax on higher-income residents. That is one sneaky wolf.

Mark Lewis, a Colorado native, had a long career in technology, including serving as the CEO of several tech companies. He retired from technology and is now writing thriller novels. Mark and his wife, Lisa, and their two Australian Shepherds — Kismet and Cowboy, reside in Edwards.

https://www.vaildaily.com/opinion/lewis-a-wolf-in-sheeps-clothing/

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

HB23-1311 By The Colorado Dems Would Eliminate Future TABOR Refunds

Twitter Post By Roger D. Hudson About TABOR, Gov. Polis, & Colorado’s Property Tax Problem

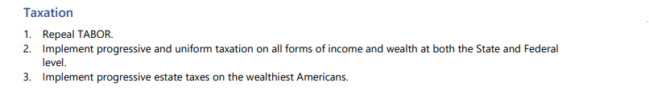

Bullet Point #1 Under Taxation In The Colorado Democrat Party Platform

Did you know?

The Colorado Democrat’s party platform states that they want to eliminate TABOR?