Do you want to pay more in taxes and give up your legally mandated TABOR refund?

Category Archives: TABOR news story

TABOR & Denver’s 7 Bond Questions On The November 7th Ballot

TABOR Board member Brian Vande Krol did a televised debate last week regarding Denver’s Bond issues on your November 7th ballot. Here is his opening comments:

Taxpayers Have Their Own Bill of Rights in Colorado. But Who Benefits?

Taxpayers Have Their Own Bill of Rights in Colorado. But Who Benefits?

The unique anti-tax tool has defined spending in the state, and it may spread to more states.

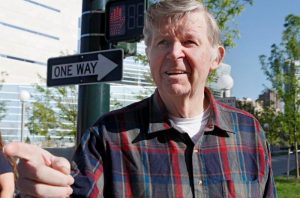

The blue tag on the streetlight outside Robert Loevy’s Colorado Springs home in 2010 didn’t signal an upcoming utility project. It was a receipt to show he had paid the $100 to keep his light on for the year. The city was facing a decimating $40 million budget gap and, among many other cuts, it was turning off one-third of its streetlights. That is, unless residents could come up with the money themselves. “I could afford to pay it,” Loevy says today, “but I have to think that would have been a stretch for many lower-income people.”

Loevy, a retired Colorado College professor, says the lights-out incident — which earned Colorado Springs international infamy that year — is just one of the many instances in which Colorado’s Taxpayer Bill of Rights (TABOR) has only benefited those taxpayers who can afford to pay for services out of their own pocket. Loevy has been a vocal critic of the law. As he sees it, “TABOR has had its worst effects on poor people.”

TABOR was approved by Colorado voters 25 years ago next month. The constitutional amendment limits the state’s year-to-year revenue growth to a formula based on inflation plus the growth in population. If revenues exceed TABOR limits, the money has to be rebated to voters, unless they approve an increase in spending.

Republicans block pot-tax fix in Colorado Legislature’s special session

Colorado state Senate Republicans killed a second attempt Tuesday to re-establish a tax that could cost special districts some $6.9 million this fiscal year and then adjourned what might have been the least productive special session in the history of the state Legislature.

The final gavel, which came down at 2:23 p.m., ended two official days and several unofficial weeks of wrangling over whether the Legislature could fix an error it made in Senate 267 — the omnibus bill from the 2017 regular legislative session that boosted transportation funding, reduced business personal property taxes and freed up room under the state’s revenue cap by turning the hospital provider fee into an enterprise fund.

The error occurred when the bill inadvertently eliminated the ability for special districts to levy sales taxes on retail marijuana — a change that most affected the Regional Transportation District, which is slated to lose $6 million through June 30 because of it.

Legislative Democrats, with the backing of Gov. John Hickenlooper, offered two bills during the two-day special session that sought to clarify that special districts do have the ability to collect sales taxes on that uniquely Colorado project.

Colo. Taxpayer Rights Act Suit Appealed To 10th Circuit

Colo. Taxpayer Rights Act Suit Appealed To 10th Circuit

Law360, New York (October 2, 2017, 2:56 PM EDT) — A group of Colorado political subdivisions have returned to the Tenth Circuit to argue that they have standing to challenge the constitutionality of the state’s Taxpayer Bill of Rights.

Eight school boards, a county commission and a special district board, in their opening brief on Sept. 27, claimed extensive injury from TABOR, a state constitutional provision requiring popular approval of any tax increase at any level of government.

“TABOR has deprived all of Colorado’s legislative bodies — from the state Legislature to boards of county commissioners…

TABOR questions stymie special Colorado legislative session

TABOR questions stymie special Colorado legislative session

October 2, 2017

The biggest fight over whether to fix a drafting error in a state rural sustainability bill is whether the fix requires voter approval.

Senate Republicans are adamant that voters in affected special districts should weigh in. Democrats and those who have fought similar battles in the courts disagree.

Monday, the Legislature returned to the Capitol to fix a drafting error in Senate Bill 17-267, as ordered by Gov. John Hickenlooper, who had signed the bill May 30.

The bill consolidated two sales taxes on recreational marijuana – a state tax of 2.9 percent and a special tax of 10 percent – and raised the tax to a voter-approved maximum of 15 percent.

Rifts develop quickly during Colorado legislative special session

Day one of the Colorado legislative special session ended with House Democrats advancing a bill to fix a mistake that could cost special districts as much as $6.9 million this year — but providing little reason to be optimistic that the measure can make it through the Republican-led Senate.

Legislators are grappling with a drafting error in the signature bill of the 2017 session that removed the ability of special districts to charge sales tax on retail marijuana, a gaffe that could leave districts a combined $6.9 million short on revenue this year if not fixed. The vast majority of that shortage — about $6 million — would be incurred by the Regional Transportation District that provides public transit in the Denver area.

Douglas Bruce addresses the Special Session called this week by Governor Hickenlooper

From: Douglas Bruce <Taxcutter@msn.com>

To: “randy.baumgardner.senate@state.co.us”

<randy.baumgardner.senate@state.co.us>, “john.cooke.senate@state.co.us”

<john.cooke.senate@state.co.us>, “don.coram.senate@state.co.us”

<don.coram..senate@state.co.us>, “larry.crowder.senate@state.co.us”

<larry.crowder.senate@state.co.us>, “bob.gardner.senate@state.co.us”

<bob.gardner.senate@state.co.us>, “President Kevin J. Grantham”

<kevin.grantham.senate@state.co.us>, “owen.hill.senate@state.co.us”

<owen.hill.senate@state.co.us>, “chris.holbert.senate@state.co.us”

<chris.holbert.senate@state.co.us>, “kent.lambert.senate@state.co.us”

<kent.lambert.senate@state.co.us>, Senator Kent Lambert

<senatorlambert@comcast.net>, “kevin@kevinlundberg.com”

<kevin@kevinlundberg.com>, “kevin.lundberg.senate@state.co.us”

<kevin.lundberg.senate@state.co.us>, “vicki.marble.senate@state.co.us”

<vicki.marble.senate@state.co.us>, “beth.martinezhumenik.senate@state.co.us”

<beth.martinezhumenik.senate@state.co.us>, “tim..neville.senate@state.co.us”

<tim.neville.senate@state..co.us>, “kevin.priola.senate@state.co.us”

<kevin.priola.senate@state.co.us>, “ray.scott.senate@state.co.us”

<ray.scott.senate@state.co.us>, “jim.smallwood.senate@state.co.us”

<jim.smallwood.senate@state.co.us>, “senatorsmallwood@gmail.com”

<senatorsmallwood@gmail.com>, “senatorsonnenberg@gmail.com”

<senatorsonnenberg@gmail.com>, “jack.tate.senate@state.co.us”

<jack.tate.senate@state.co.us>

To all 18 Republican senators,

You are the only barrier to yet another TABOR violation. Just like the U. S. Senate on health insurance, we know 90% unanimity is not enough; you must be 100% united and show the public and your constituents it means something to be a Republican.

House Democrats and the governor are united in this latest effort to destroy TABOR. They will support any illegal action that puts government first and taxpayers last.

Even 17 GOP senators are not enough to prevent passing this “fix” that has already cast legislators into disrepute and ridicule. Continue reading

Colorado Legislature’s special session this week could aid special districts — or go up in flames

Gov. John Hickenlooper called a special legislative in mid-September, arguing it was the “most expedient way” to fix an error in the centerpiece bill of 2017 that will cost a number of special districts, including Denver’s Scientific and Cultural Facilities District hundreds of thousands of dollars in funding.

But what may have seemed a simple and expedient way to restore funding that those districts expected to get has turned into a political firestorm that, in all likelihood, will not get solved in the abbreviated session.

Program scheduled to explain tax issues, laws

A program to explain how the state budget works, how the Gallagher Amendment impacts property taxes and how the Taxpayer Bill of Rights (TABOR) affects local government will be held from 5-6:30 p.m. Friday at the Pueblo Convention Center.

The program, sponsored by the Pueblo West Citizens’ Council, will feature a presentation by the Colorado Fiscal Institute, an independent nonprofit, nonpartisan think tank.

According to the institute’s website, it “provides credible, strategic, independent and accessible information and analysis of fiscal and economic issues facing Colorado. Our aim is to inform and influence public policy debates and contribute to sound decisions that improve the well-being of individuals, communities and the state as a whole.”

A spokeswoman for the Pueblo West Citizens’ Council said the event is being put on because the group believes “that ‘we the people’ do a much better job of governing ourselves when we have all the available information in its most basic form. The truth, without spin, without any hidden profit agenda or emotional bias, no grandstanding or campaigning.”

The event is free and open to the public.