Colorado voters in 1992 authorized TABOR so that citizens would have to say yes or no on tax increases. Over the years voters appreciate this simple and effective check on out-of-control, tax-and-spend politicians. Colorado is one of the best states economically thanks to TABOR.

Colorado voters in 1992 authorized TABOR so that citizens would have to say yes or no on tax increases. Over the years voters appreciate this simple and effective check on out-of-control, tax-and-spend politicians. Colorado is one of the best states economically thanks to TABOR.

So, what is TABOR and how does it affect you?

Penn Pfiffner, former state legislator and currently the Chairman of TABOR, will provide a TABOR 101 discussion with time for questions.

Admission is $5 for Reagan Club members and $10 for non-members. The doors open at 6:00pm with food and drinks available to order from CB & Potts. The meeting begins at 7:00pm and should be over around 8:30pm. You can order your admission tickets online at the Reagan Club website, www.ReaganClubCo.com/meeting-tickets

| Thursday, April 11, 2019 at 6 PM – 9 PM MDT

|

| C. B. & Potts – Westminster

1257 W 120th Ave, Westminster, Colorado 80234 |

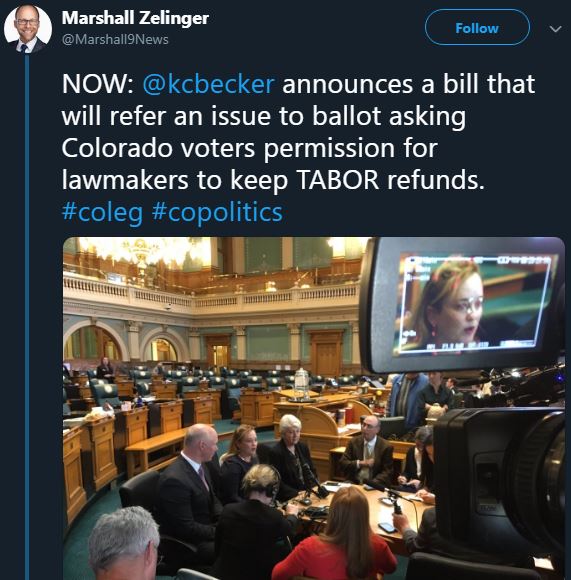

Power grabs in a republic rarely happen by brute force. They often happen quietly and steadily without fanfare or publicity. Marxist Antonio Gramsci called it “the long march through the institutions.” C.S. Lewis said “…the safest road to Hell is the gradual one–the gentle slope, soft underfoot, without sudden turnings, without milestones, without signposts.” TABOR opponents use this incremental strategy in an effort to undermine TABOR support and enforcement. How do they do this?

Power grabs in a republic rarely happen by brute force. They often happen quietly and steadily without fanfare or publicity. Marxist Antonio Gramsci called it “the long march through the institutions.” C.S. Lewis said “…the safest road to Hell is the gradual one–the gentle slope, soft underfoot, without sudden turnings, without milestones, without signposts.” TABOR opponents use this incremental strategy in an effort to undermine TABOR support and enforcement. How do they do this?

Michael Fields

Michael Fields