Taxpayers Have Their Own Bill of Rights in Colorado. But Who Benefits?

The unique anti-tax tool has defined spending in the state, and it may spread to more states.

The blue tag on the streetlight outside Robert Loevy’s Colorado Springs home in 2010 didn’t signal an upcoming utility project. It was a receipt to show he had paid the $100 to keep his light on for the year. The city was facing a decimating $40 million budget gap and, among many other cuts, it was turning off one-third of its streetlights. That is, unless residents could come up with the money themselves. “I could afford to pay it,” Loevy says today, “but I have to think that would have been a stretch for many lower-income people.”

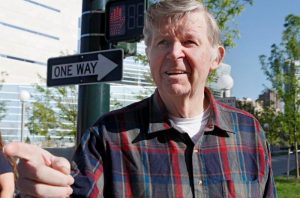

Loevy, a retired Colorado College professor, says the lights-out incident — which earned Colorado Springs international infamy that year — is just one of the many instances in which Colorado’s Taxpayer Bill of Rights (TABOR) has only benefited those taxpayers who can afford to pay for services out of their own pocket. Loevy has been a vocal critic of the law. As he sees it, “TABOR has had its worst effects on poor people.”

TABOR was approved by Colorado voters 25 years ago next month. The constitutional amendment limits the state’s year-to-year revenue growth to a formula based on inflation plus the growth in population. If revenues exceed TABOR limits, the money has to be rebated to voters, unless they approve an increase in spending.