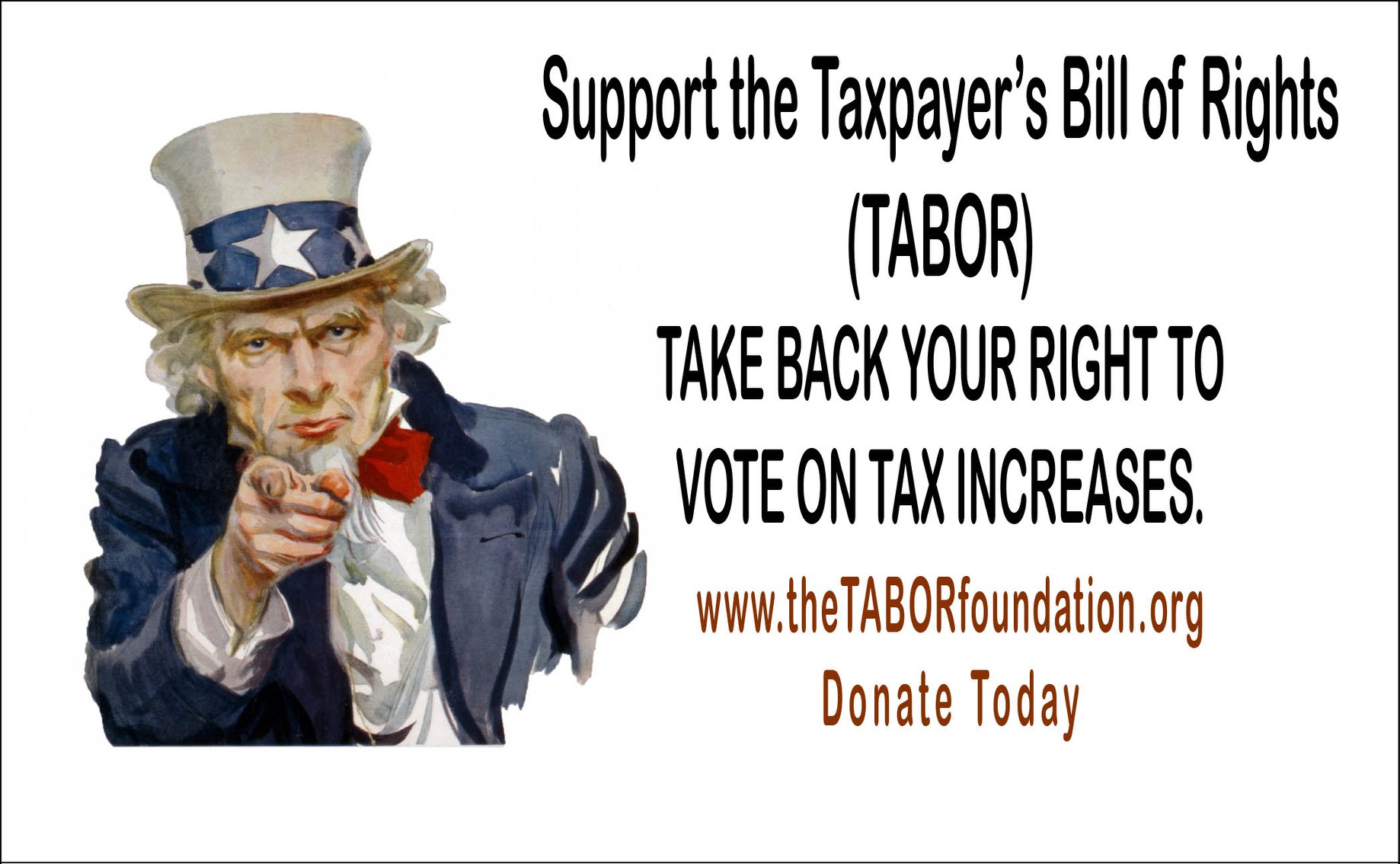

Thomas Jefferson pointed out that “My reading of history convinces me that most bad government results from too much government. That government is best which governs least.” As taxpayers, our wisdom was used by voting on an amendment back in 1992 to limit state spending to about the same as state growth — well known as the TABOR Amendment.

This has almost worked to keep the state from taxing us out of our hard-earned wages or profits. The problem is those in government always want to spend on their pet programs and have found a way around what we taxpayers have established as a very fair limit on government spending. We elect those to our legislature to care for our state and control our government so we can carry on with our own lives and families. That confidence really can be disappointing as the con in confidence can also be the con in conman.

According to The Common Sense Institute, a business-oriented coalition, the state budget was spending 46% or $2,403 per taxpayer outside of TABOR limits in 1993. Fast forward to 2019 and spending has increased so 69% of the sate budget is outside of Tabor limits which amount to $5,787 per taxpayer. The con seems to be with fees versus taxes.

To continue reading this Letter-to-the-Editor, please click (HERE):