While visiting Western Slope resort towns, tourists count on some of Colorado’s most aggrieved workers. Few consider how these employees live.

Recent immigrants, students on summer break and others wait tables, clean hotel rooms, park cars, guide rafting tours, teach ski lessons and provide a large assortment of other services required for tourism.

Visitors typically don’t think about the commutes tourism workers make for jobs in Steamboat Springs, Aspen, Vail, Telluride, Glenwood Springs and other resort towns with exorbitant costs of living.

Sperling’s Best Places finds housing in Aspen costs 707.4% more than the national average. Vail housing costs 397% more than the average; Glenwood Springs, 215.7% more; Steamboat Springs, 257% more; and Telluride 391% more. That’s to be expected in communities that provide second homes for wealthy consumers who fly in and out from around the globe.

As the tourism economy spreads to neighboring towns, workers find themselves commuting farther and farther to find basic shelter. The housing cost in Edwards — 11 miles east of Vail — exceeds the national average by 438.4%.

Low-wage employees in Vail often commute 80 miles round trip, or more, to live in mobile homes in Gypsum and other places far from their jobs. Local affordable housing initiatives have helped a fortunate few but not most.

Colorado needs tourists and the industry needs workers. Yet, economic forces prevent restaurants and hotels from paying the wages required to rent or buy in markets with housing costs beyond the universe of normal. Average tourists simply cannot pay $100 for a cheeseburger or $1,000 a night for a midgrade hotel room.

Given this socioeconomic dilemma, we hoped Initiative 108 might help more Colorado tourism workers live closer to their jobs. Called the Make Colorado Affordable Act, the November ballot measure proposes diverting 0.1% of the general fund into a state affordable housing program.

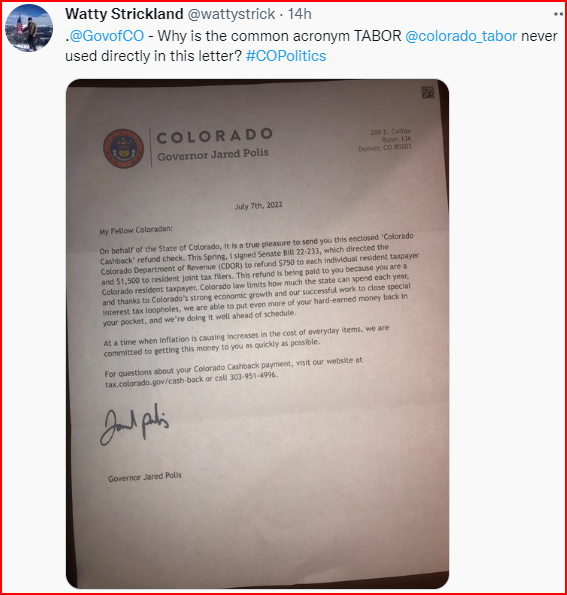

The state would fund this by dipping into future TABOR refunds, such as the $750 in direct payments each taxpayer received this year by mandate of the Colorado Constitution’s Taxpayer’s Bill of Rights. By 2024, the proposed TABOR retention would generate about $300 million for the fund.

That massive diversion of taxpayer earnings must ease the burdens of tourism workers, or it’s not a good plan. Sadly, it would do no such thing.

To continue reading this editorial, click (HERE) to go to the Colorado Springs Gazette.