Jefferson County is one of more than a dozen counties in Colorado that still enjoys the protections of the Taxpayer’s Bill of Rights (TABOR). This constitutional amendment requires voter approval for tax increases and debt. It also modestly limits how fast government can grow. The formula for automatic tax increases is the prior year’s budget plus adjustment for inflation and local growth.

Jefferson County government is presently allowed to grow 3.9% annually under the formula as described in a Board of County Commissioners agenda for July 19 (page 171). That’s a reasonable amount for government growth – compare it to your household. Have you gotten nearly a 4% increase in your income?

Yet, the county commissioners have spent the last few years claiming they have insufficient revenue to maintain operations. Now they blame the revenue problem on the pandemic, yet the county received close to a couple hundred million in COVID relief money.

That pile of federal money still didn’t calm down the county commissioners’ quest to get rid of our Taxpayer’s Bill of Rights.

To continue reading the rest of this story, please click (HERE) to go to Complete Colorado

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#FollowTheMoney

#FollowTheLaw

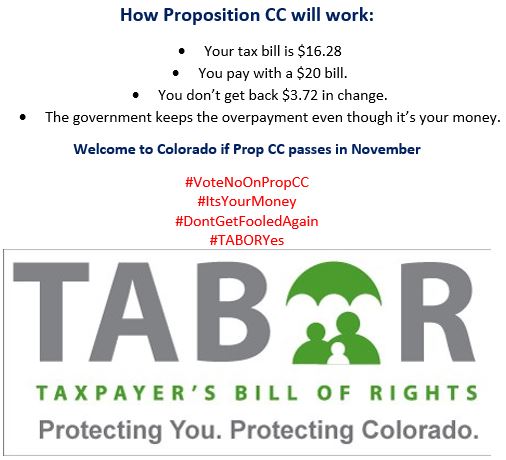

Now that Proposition CC has gone down in flames, what will progressives do next to sabotage TABOR?

Aren’t you sick and tired on politicians trying to weasel their way out of, or ignoring, TABOR?

We need to do something about it, right?

Well then, why not you?

Yes, you read that right.

Why not? It’s a great time to get involved.

If not you, then who?

We could use your help, talents, and skills defending the gold standard, Colorado’s Taxpayer’s Bill of Rights (TABOR).

We’re looking forward to having you help Colorado.

It’s easy to join.

See below on how you can make a difference.

Colorado voters rejected a bid to remove the spending caps in the Taxpayer’s Bill of Rights — but the fiscal fight is only expected to get more intense in the next year.

One interest group is considering a repeal of the Taxpayer’s Bill of Rights and another is testing ideas for a graduated tax system that increases rates for the wealthy. Both are eyeing the 2020 ballot and appear undeterred by Proposition CC’s defeat this year.

“Whatever we do next must be bold enough to drown out the alarmists. That work begins today,” said Scott Wasserman at the Bell Policy Center, the organization seeking to overhaul the tax system, in a statement.

“If we truly want to build a state that works for everyone, then we need to amend the constitution,” added Carol Hedges at the Colorado Fiscal Institute, which is working to unwind TABOR.

If you’re in the Colorado Springs area, join Paul Prentice as he’s speaking on the Taxpayer Bill of Rights (TABOR) and Referendum CC

at Church For All Nations (CFAN)

6540 Templeton Gap Rd, Colorado Springs, CO 80923

Tuesday, October 8 from 7:00-9:00 pm

“TABOR public forum: Jefferson Unitarian Church’s Community Action Network group (JUC CAN) and the League of Women Voters of Jefferson County are co-hosting a TABOR public forum from 1-3 p.m. Oct. 12 at Jefferson Unitarian Church, 14350 W. 32nd Ave., in Golden. A panel will discuss both Proposition CC and Jeffco 1A. The event is free and open to the public. For more information, call JUC CAN at 303-279-5282 or the Jeffco League of Women Voters at 303-238-0032.”

http://wheatridgetranscript.com/stories/election-day-is-coming-jefferson-county,286174

BASALT, COLORADO — The tiny town of Basalt, which lies between Carbondale and Aspen, is facing a difficult choice over a long-term mistake in interpreting the Taxpayer’s Bill of Rights (TABOR). According to the town’s legal consultant, Dee Wisor, a Denver attorney and expert witness on TABOR, the town owes residents a refund for taxes illegally collected due to a misunderstanding of how TABOR works.

TABOR is a constitutional amendment passed in 1992 that, among other things, requires voter consent for new or increased taxes and debt, as well as limiting government revenues to a formula of population growth plus inflation. Under TABOR, governments in Colorado are required to refund excess revenue back to taxpayers, or get voter approval to keep it.

In 1994, two years after TABOR was enacted, Basalt residents voted 220 to 42 in favor of lifting TABOR revenue limits, thus allowing the town to keep any excess revenues it brings in over the regular revenue restrictions in TABOR. Numerous taxing authorities in Colorado have asked voters to do this to avoid having to pay out refunds when revenues exceed expectations.

To read the rest of this story, click (HERE):

Gee, we wonder what they’re trying to hide?

Why are they being so sneaky?

Don’t lose your #TABOR Rights.

Vote NO on whatever they call it in 2020

The Colorado Title Board on Wednesday approved key language for a possible 2020 ballot initiative that would repeal a highly consequential part of the state constitution.

But which part, exactly? If you ask repeal proponents, it’s Article X, Section 20. If you ask repeal opponents, it’s the Taxpayer’s Bill of Rights, or TABOR. How the ballot question is presented to voters is just the latest high-stakes skirmish in a long war over TABOR, a controversial constitutional amendment passed in 1992 that’s limited government growth in the state.

Both sides presented arguments to the title board, a three-member panel with representatives from the Secretary of State’s office, the state Attorney General and the Office of Legislative Legal Services, that decides if ballot measures meet all requirements and how they should appear on the ballot.

The liberal-leaning Colorado Fiscal Institute is backing the repeal effort, which won a significant victory at the Colorado State Supreme Court last month allowing it to inch closer to the 2020 ballot. Carol Hedges, the group’s executive director, said using the specific term, “Article X, Section 20,” is the most clear, neutral way possible to refer to the amendment.

To read the rest of this story, click (HERE):

Q&A with Penn Pfiffner | On standing up for freedom, and TABOR

· Dan Njegomir, Colorado Politics

The TABOR Foundation’s Penn Pfiffner addresses the Reagan Club of Colorado earlier this year. (Photo courtesy the TABOR Foundation)

Even if you don’t move in Penn Pfiffner’s center-right political circles, you’re probably familiar with his name as the media’s go-to guy for comment on the Taxpayer’s Bill of Rights whenever it comes up in the news. And it comes up a lot, of course.

The groundbreaking taxing and spending limits — venerated by some and vilified by others — have been stirring debate ever since being enacted into Colorado’s Constitution by voters in 1992. Better known by its acronym TABOR, the constitutional provision has prompted lawsuits, legislation and more ballot issues by wide-ranging interests hoping to elude or at least ease its restraints on state and local budgets.

The perennial back-and-forth over TABOR also spawned the TABOR Foundation, which, along with its advocacy counterpart the TABOR Committee, emerged with the help of Pfiffner and other resolute TABOR supporters to stand up for the policy.

Pfiffner, who served as a Republican state representative from Lakewood in the 1990s, has become as distinctive a voice for TABOR over the years as he has for the advocacy of limited government in general.

He expounds on both of those endeavors and more — as always, in his characteristically eloquent and respectful way — in today’s Q&A.

Colorado Politics: Let’s start with a recent headline. The state Supreme Court ruled June 17 that a pending ballot proposal to repeal TABOR in its entirety may proceed — despite a constitutional “single-subject” stipulation on ballot issues that was long believed to have blocked precisely such an all-in-one-shot repeal.

In a public statement from the TABOR Foundation condemning the ruling, you said, “The court has become dangerously unmoored from the clear meaning of the state constitution.” The statement also said the court ”appears to take sides.”

Recap for us what was fundamentally at issue in the case before court — and why you feel the court missed the mark.

Penn Pfiffner: The recent direction of the Colorado courts on constitutional matters should trouble any citizen. Our American system relies on an honest judicial branch to impartially interpret the law. We have seen an absolutely consistent antipathy from the courts towards the Taxpayer’s Bill of Rights.

It’s an understatement to say that the justices from trial level to the Colorado Supreme Court have appeared to argue backwards from predetermined outcomes. Some of the arguments appeared to me to be even juvenile, like an adolescent trying too hard to argue the impossible.

The central finding in the Bridge Enterprise case that the TABOR Foundation brought is an example. Years from now, I surmise historians of Colorado’s system will be amazed and disgusted that it became so partisan during these recent years. Good, experienced attorneys today are urging the TABOR Foundation not to bring any more constitutional issues to the judicial branch — it’s that futile, and all that we end up with is setting bad precedent. In the case you raise, the court explicitly threw out a generation of precedent. It’s as if they never opened the section on TABOR to read all the different pieces in this comprehensive constitutional measure.

A dissent from the bench pointed out that some activist could now substitute Colorado’s extensive “Bill of Rights” for “Taxpayer’s Bill of Rights” (in a ballot proposal) and in one vote overturn all citizen protections. A leftist court looks ready to use its personal political views to put a thumb on the scales of justice.

Penn Pfiffner

CP: Give us your elevator speech on TABOR’s role, and value, in our state constitution.

To read the rest of this story, click (HERE):

Megan Verlee/CPR News

Megan Verlee/CPR News