Category Archives: RTD

Colorado legislature moves transportation bond issue to 2020, leaving TABOR refund issue alone on the 2019 ballot

Colorado legislature moves transportation bond issue to 2020, leaving TABOR refund issue alone on the 2019 ballot

Sharf: Opponents of the Taxpayer’s Bill of Rights prove why we need it

Sharf: Opponents of the Taxpayer’s Bill of Rights prove why we need it

May 6, 2019 By Joshua Sharf

Look at the list of organizations supporting House Bill 19-1257, the bill to ask Colorado voters to permanently repeal Colorado’s Taxpayer ‘s Bill of Rights (TABOR) spending limits. No fewer than 60 groups hired lobbyists to push for the measure, which will appear on November’s state-wide ballot.

Everyone is represented – governments, non-profits, business groups, unions, school districts, government employees.

Everyone is represented.

Well, everyone except the taxpayer.

Which is why we need a constitutional amendment protecting the taxpayer in the first place.

While TABOR has a number of provisions designed to limit government, there are three main ones. The first requires a citizen vote on all general tax increases – income tax, payroll tax, sales & property tax, etc. Fees directly related to delivering a specific government service are exempt. So-called enterprises, which do not receive general tax revenue, are also allowed to raise their fees and charges without a vote, and what’s more, their revenue doesn’t count towards the overall cap the way than regular fees do. Continue reading

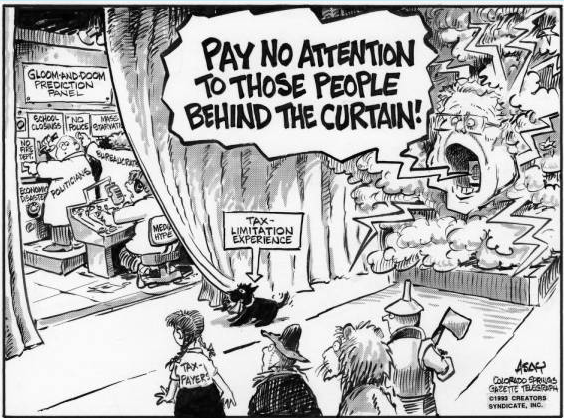

The Liberals Modus Operandi

Collecting More Taxes Than Is Absolutely Necessary Is Legalized Robbery

President Calvin Coolidge And Taxes

Ending Taxpayer’s Bill of Rights refunds a deservedly tough sell to voters

Sharf: Ending Taxpayer’s Bill of Rights refunds a deservedly tough sell to voters

Another year, another legislative attempt to erode Colorado’s Taxpayer’s Bill of Rights (TABOR).

TABOR opponents, bored with chipping away at the law’s foundations, have broken out the chainsaws. On the one hand, legislative Democrats are ignoring the plain language of TABOR and unilaterally enacting a universal income tax increase without a statewide vote, by calling it a “fee.”

And on the other hand, they are proposing a ballot referendum to waive the law’s taxation restrictions. According to TABOR, any increase in general revenue above the previous year’s plus inflation and population increase must be refunded to the people. House Bill 19-1257 would remove that restriction, allowing the state to keep any and all tax revenue, forever.

In return, the money that was kept would go to transportation, transit, public education, and higher education. Theoretically, anyway. Such a deal might seem to have some superficial appeal to Colorado voters, but recent experience strongly suggests this may be a harder sell than proponents expect.

We don’t know where Referendum C dollars go

HB 1257 is Referendum C on steroids. In 2005, voters approved a temporary “time-out” from TABOR’s spending restrictions, allowing the baseline to grow at the inflation plus population formula regardless of what revenues actually did. Referendum C has allowed the state to keep about $17 billion, including over $1.2 billion in the last fiscal year alone.

Fiscal conservatives see priority problem in Colorado’s new budget

Fiscal conservatives see priority problem in Colorado’s new budget

The new budget includes $300 million for road funding, which took much negotiating between majority Democrats and minority Republicans. It also includes $175 million for full-day kindergarten, less than Gov. Jared Polis requested, and a 3 percent raise for state employees.

Budget writers also had to pull $40 million from some state reserve funds.

Follow The Money & You’ll Find Out Who Is Against #TABOR

It’s Not Too Late….

The World Happiness Report provides data and research used around the world to help shape and inform policy.

Among its findings: giving to others is good for you. It makes you feel happy.1-8

Since 1992, the TABOR Foundation protects the Taxpayer’s Bill of Rights. We educate citizens on why it matters to have a vote on increased taxes and how a formula for predictable growth creates a sound economy.

We are all volunteers.

We give advice and direction to citizens working at their local level to stop TABOR violations. We assist as plaintiffs and “friends of the courts in lawsuits to stop such violations.

The biggest trick of politicians is calling a new tax a “fee” – whether it’s for plastic grocery bags, living in a special district, running a hospital, driving over a bridge, or funding a mandatory family leave program with an insurance “fee.” We’ve responded to inquiries not just in Colorado, but in states like South Dakota, Kansas, Arizona, Alaska and Florida.

Please donate:

- Help fund our Speaker’s Bureau to educate fellow taxpayers about their rights.

- Help produce the TABOR 101 series of policy/how-to videos.

- Help fund the legal fees for amicus briefs.

Please donate. You – and we – will be happy you did.

Thanks – and Happy New Year!

Your friends at the TABOR Foundation