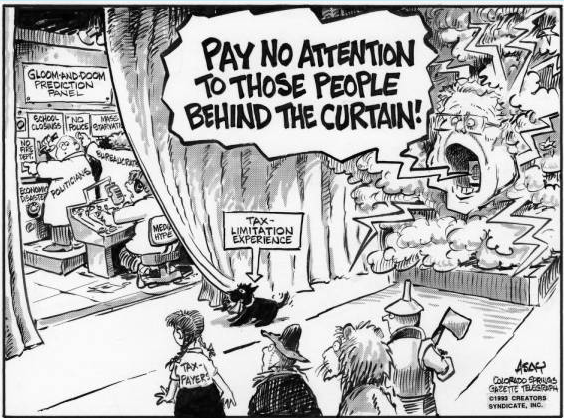

Vote NO on this attack on your Colorado Taxpayer’s Bill of Rights

TABOR exemption question to be on fall ballot

Under House Bill 1257 and a companion measure, HB1258, all of the taxes and fees the state collects over the revenue cap under TABOR would be evenly divided between transportation, public schools and higher education.

TABOR limits growth in revenue collections year over year based on inflation and population growth.

“In the last 27 years since TABOR was voted into the Constitution, our state population has increased by 50 percent,” said House Speaker KC Becker, D-Boulder, who introduced the bill with Rep. Julie McCluskie, a Democrat whose district includes the eastern half of Delta County.

Voters would be asked this fall if the state should be able to retain surplus revenue over what the Taxpayer’s Bill of Rights allows under a bill that won final approval in the Colorado House on Tuesday.

Voters would be asked this fall if the state should be able to retain surplus revenue over what the Taxpayer’s Bill of Rights allows under a bill that won final approval in the Colorado House on Tuesday.