TABOR Committee responds to Court ruling on TABOR repeal

Colorado’s Constitution contains a provision which requires that all matters proposed by ballot initiatives can address only one subject. Yesterday, the Colorado Supreme Court allowed a ballot measure to proceed that would wipe out the Taxpayer’s Bill of Rights in its entirety. The Court explicitly threw out a quarter-century of precedent.

The TABOR Committee adamantly condemns the Court’s determination.

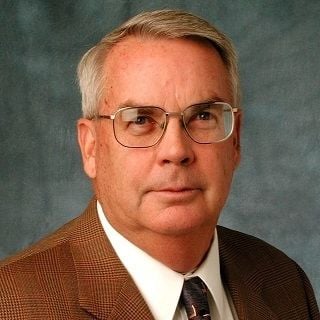

“The Court has become dangerously unmoored from the clear meaning of the state constitution,” protested Penn Pfiffner, the Committee’s chairman. The TABOR Committee points out that the Taxpayer’s Bill of Rights includes not only the frequently-debated provisions for slowing the growth of government, but also for example

- election provisions that call for, among other things, notification of the citizens by any Colorado government of any election,

- requirements for emergency reserves at all levels of government

- a state-wide prohibition on real estate transfer taxes ,

- rules for property tax assessments

- rights of local districts to resist state-imposed mandates.

Committee Board director Rebecca Sopkin observed, “It is strange that the Court found all of this to be one subject. The Court held that all of the above provisions and rights are ‘necessarily and properly connected,’ as though no one of them could exist without the others. We find that to be preposterous.”

In a scathing dissent, Justice Marquez pointed out that using the Court’s logic, a single measure could repeal the entire Colorado Bill of Rights. Petitioners could simply substitute the Bill of Rights[1] for the Taxpayer’s Bill of Rights[2].

The TABOR Committee finds it unsettling that the Colorado Supreme Court appears to take sides. It specifically addresses[3] what seems to be at the heart of issue – that it would be difficult and expensive to repeal the Taxpayer’s Bill of Rights in a “piecemeal” manner. Does the Court step into the political arena in an attempt to collaborate and cooperate with TABOR opponents? The Court should be impartial rather than act to relieve TABOR opponents of “expense and difficulty.”

The single subject issue arose as a ballot initiative in 1994. TABOR was very much part of the debate. The official summary (Blue Book) specifically noted that if the Single Subject Rule were to be passed, then it would not be possible to repeal TABOR in a single vote. Instead, it would be necessary to address its provisions one at a time. Citizens passed the measure. The Court ignored the will of the people, history, established law, and common sense in its Opinion.

[1] Colorado Constitution Article 2

[2] Colorado constitution Article 10, Section 20

[3] Opinion, page 12