Category Archives: Fiscal Policy

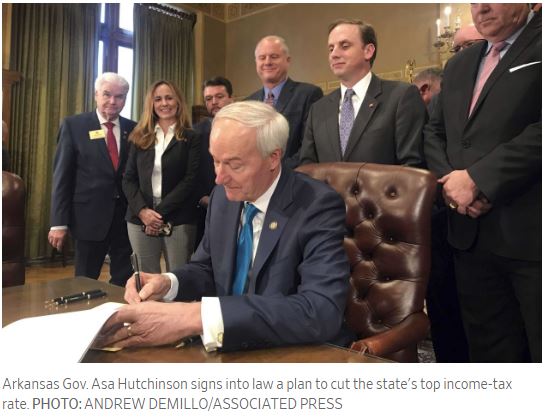

State finances are enjoying flush times and some states are sending that bounty back to taxpayers.

Some States, Flush With Cash, Are Sending Money to Taxpayers

Ten years after the recession, many states have revenue surpluses and plan to boost spending or cut taxes

Taxpayer’s Bill of Rights should be strengthened, not repealed

Taxpayer’s Bill of Rights should be strengthened, not repealed

JAY STOOKSBERRY

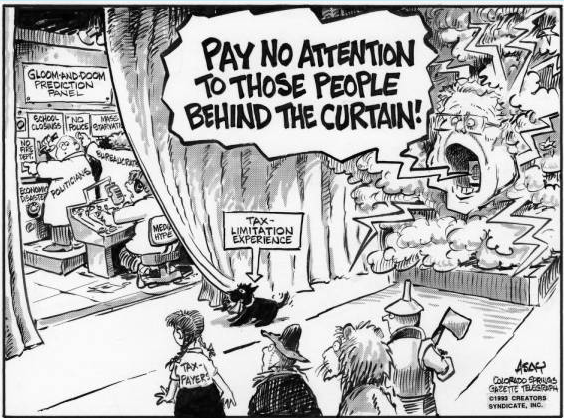

On Jan. 15, a briefly worded initiative was presented to the Colorado Title Board for consideration to be placed on the 2020 ballot. The brevity of the proposal was commendable. Five words was all it needed: “TABOR – Repeal (Full TABOR Repeal).” Though speculative at this point, defenders of Article X Section 20 of the Colorado Constitution — better known as the Taxpayer’s Bill of Rights (TABOR) — should prepare for a fight in 2020.

Well before TABOR became law in 1992, opponents concocted every possible scenario as to how this new constitutional amendment would lead to fiscal armageddon in Colorado. Nearly three decades after its passing, most of this hyperbole — as is the case for most hyperbole — never materialized.

Where is Colorado from a fiscal perspective? According to the States Project, Colorado ranks 30th in the country for total state debt (including unfunded liabilities) as a percentage of gross state product. The Mercatus Center ranks our state as 28th in the nation regarding a combination of solvency for cash, budget, long-run spending, service-level flexibility, and unfunded liabilities. U.S. News ranked Colorado 31st in fiscal stability.

It would seem Colorado is middle of the pack at best. TABOR did not ruin our state’s ability to manage the general fund.

Contrary to popular wisdom of the Chicken Littles who warned about how damaging it would be to Colorado, TABOR doesn’t need to be repealed; it needs to be strengthened. Continue reading

Possible repeal of Taxpayer’s Bill of Rights to get rehearing

Possible repeal of Taxpayer’s Bill of Rights to get rehearing

January 28, 2019 By Sherrie Peif

DENVER — Two Denver residents behind a proposed ballot initiative to repeal the Taxpayer’s Bill of Rights (TABOR) have filed for a rehearing after the Colorado Title Board initially rejected their proposal.

On Jan. 16, the Title Board denied setting a title on an initiative that would ask voters to repeal the 26-year-old constitutional amendment that requires voter approval to increase taxes or take on new debt. TABOR also limits the growth of a portion of the state budget to a formula of population growth plus inflation. The board said the initiative violated Colorado’s single subject rule.

Board member LeeAnn Morrill, who represented the Attorney General’s office, cited a Supreme Court decision over a 2002 proposed initiative that included a provision preventing the complete repeal of TABOR. She pointed out that the court stated in its decision: Continue reading

Colorado Title Board denies attempt to repeal Taxpayer’s Bill of Rights

DENVER — The Colorado Title Board rejected a proposal on Wednesday to put a full repeal of the Taxpayer’s Bill of Rights (TABOR) before voters in a future election.

The board voted 3-0 that the proposal violated the single subject rule and the board did not have jurisdiction to set a ballot title.

Proponents Carol Hedges and Steve Briggs had an initial hearing before the Title Board at 1 p.m. on Wednesday. Although voters several years ago passed new rules that make adding an amendment to Colorado’s constitution harder, it still only takes a simple majority to repeal an amendment.

Proponents Carol Hedges and Steve Briggs had an initial hearing before the Title Board at 1 p.m. on Wednesday. Although voters several years ago passed new rules that make adding an amendment to Colorado’s constitution harder, it still only takes a simple majority to repeal an amendment.

Denver-based attorney Edward Ramey, who represented the proponents, said the proposal was to do “one thing and one thing only.”

“That’s to repeal Article X, Section 20 of the Constitution,” Ramey told the board. “I emphasize that because we’re not adding anything to it. We’re not trying to tweak anything. We’re not repealing and ellipsis doing anything. This is just a straight repeal.”

Ramey said the single subject debate keeps coming up because the consensus is TABOR itself contains more than one subject, but he disagreed with those findings. He cited a couple of Colorado Supreme Court rulings that addressed the subject in a manner that he believed favored his clients in this case. Continue reading

Effort launched to repeal Taxpayer’s Bill of Rights

Effort launched to repeal Taxpayer’s Bill of Rights; possible ballot issue before the Title Board

DENVER — On the same day Democrats were sworn into all the top elected offices in Colorado, new Secretary of State Jena Griswold announced one of the first potential state-wide ballot initiatives to go before the Colorado Title Board will be a complete repeal of the Taxpayer’s Bill of Rights (TABOR).

The Title Board is the first step in putting a citizen-initiated question before voters.

TABOR is a constitutional amendment that was passed by voters in 1992 that requires voter approval to increase taxes or take on new debt. It also limits the growth of a portion of the state budget to a formula of population growth plus inflation. It has been a controversial topic since its inception, and it’s been debated in the courts numerous times.

Many Democrats say it is a threat to Colorado’s education, transportation and health care funding, while Republicans counter that it is what has allowed the Colorado economy to prosper, as well as allowing Colorado to more easily weather economic downturns than states that lack taxpayer protections such as TABOR.

Many attempts to repeal or tweak portions of the amendment have come before the Title Board. This is the first time, however, that anyone can recall where a full repeal of the amendment has been proposed.

It’s Not Too Late….

The World Happiness Report provides data and research used around the world to help shape and inform policy.

Among its findings: giving to others is good for you. It makes you feel happy.1-8

Since 1992, the TABOR Foundation protects the Taxpayer’s Bill of Rights. We educate citizens on why it matters to have a vote on increased taxes and how a formula for predictable growth creates a sound economy.

We are all volunteers.

We give advice and direction to citizens working at their local level to stop TABOR violations. We assist as plaintiffs and “friends of the courts in lawsuits to stop such violations.

The biggest trick of politicians is calling a new tax a “fee” – whether it’s for plastic grocery bags, living in a special district, running a hospital, driving over a bridge, or funding a mandatory family leave program with an insurance “fee.” We’ve responded to inquiries not just in Colorado, but in states like South Dakota, Kansas, Arizona, Alaska and Florida.

Please donate:

- Help fund our Speaker’s Bureau to educate fellow taxpayers about their rights.

- Help produce the TABOR 101 series of policy/how-to videos.

- Help fund the legal fees for amicus briefs.

Please donate. You – and we – will be happy you did.

Thanks – and Happy New Year!

Your friends at the TABOR Foundation

Nicolais: An attack on TABOR could leave Colorado Democrats feeling the squeeze

Nicolais: An attack on TABOR could leave Colorado Democrats feeling the squeeze

A court composed of mostly Hickenlooper appointees turns the governor down cold, setting up a possible legislative showdown

PUBLISHED ONDEC 9, 2018 5:55AM MST

Mario Nicolais@MarioNicolaiEsq

Special to The Colorado Sun

Before walking out the door from the governor’s office, John Hickenlooper took one last shot at a Democratic boogeyman. Last week, the Colorado Supreme Court denied Hickenlooper’s parting attempt to undercut TABOR, the conservative taxpayer’s bill of rights enshrined in the Colorado constitution.

Democrats, have long derided TABOR for the constraints it places on government. Not only does TABOR require a vote of the people to approve tax increases, but several of its provisions work in conjunction with other laws to create a “ratcheting effect” on government spending.

Mario Nicolais

If revenues drop during an economic downturn, they cannot return to prior levels as the economy rebounds. Instead, growth is artificially tied to the down year plus a pittance for inflation.

The ratchet works like boa constrictor wrapped around a person. With every breath out, the snake squeezes a little tighter and the next breathe in is a little shallower.

Eventually, no breath can be drawn, and the person dies. I’m sure it delights TABOR’s progenitor, the eccentric Douglas Bruce, to imagine the government being asphyxiated.

Democrats have a little different view; they see a snake crushing the life from Colorado citizens. Gasping for funds no longer available, state and local services wither and waste away. Continue reading

Follow the money and you’ll find out who is against TABOR

TABOR supporters: ‘Sigh of relief’ but threat to taxpayers not over after court ruling

- By Bethany Blankley | Watchdog.org

- Dec 6, 201

Outgoing Gov. John Hickenlooper asked the state Supreme Court to review the compatibility of two constitutional amendments governing the calculations of taxes to determine if one should be removed. The court rejected his request.

The 1982 Gallagher Amendment and the 1992 Taxpayer’s Bill of Rights (TABOR), designed to protect taxpayers, Hickenlooper wrote, created an “irreconcilable conflict in Colorado’s Constitution.”

The Gallagher Amendment sets the percentage for taxing residential and commercial property owners according to a specific formula that allows the residential assessment rate (RAR) to fluctuate and maintain the ratio to prevent large, unexpected spikes in tax bills.

TABOR prevents local and state governments from increasing taxes without voter approval, including any changes to the Gallagher formula. Continue reading