Category Archives: Fiscal Policy

Why TABOR Matters on August 14

Ex-Basalt mayor touts new ‘social capital’ group

Ex-Basalt mayor touts new ‘social capital’ group

- John Fayhee, Special to the Aspen Daily News

Tim Belinski, developer of Willits Town Center, supports Rick Stevens’ idea of starting a social capital group in Basalt.

Madeleine Osberger/Aspen Daily News

A potentially positive proposal to salve some of the wounds caused by the contentious and increasingly expensive TABOR controversy in Basalt may end up butting heads with the same town government that had been inadvertently collecting property tax revenues for 10 years in violation of the state’s constitution.

All told, town officials estimate that about $2 million had been collected illegally, according to the fine print of TABOR — the so-called Taxpayer Bill of Rights — which was added to the state constitution by citizens’ referendum in 1992.

TABOR restricts revenues for all levels of government — state, local, special districts and schools. Under TABOR, state and local governments cannot raise tax rates without voter approval.

Two years after TABOR was enacted, Basalt voters approved a property tax rate of 6.151 mills. Soon thereafter, given the increase of real estate values in town, that rate was lowered, finally bottoming out at 2.56 mills in 2010. As real estate values struggled to recover from the Great Recession, Basalt was forced to gradually raise the mill levy to meet its basic operating costs.

As Colorado’s governor, lawmakers target tax breaks, a program that covers 75% of the state’s land could be in the crosshairs

Colorado has awarded $7.6 million in Enterprise Zone tax credits to Comanche Solar PV in Pueblo County. The 156-megawatt Comanche solar array, shown here on Jan 20, 2019, is the largest solar project in the state of Colorado. (Mike Sweeney, Special to The Colorado Sun)

Colorado has awarded $7.6 million in Enterprise Zone tax credits to Comanche Solar PV in Pueblo County. The 156-megawatt Comanche solar array, shown here on Jan 20, 2019, is the largest solar project in the state of Colorado. (Mike Sweeney, Special to The Colorado Sun)

As Colorado’s governor, lawmakers target tax breaks, a program that covers 75% of the state’s land could be in the crosshairs

A Colorado Sun analysis of $223 million in tax credits awarded from 2013 to 2018 found that the state is often doling out taxpayer dollars without much evidence that each tax credit is producing economic activity that wouldn’t have occurred otherwise

Why TABOR Matters on August 12

Why #TABOR Matters on August 10

AG Weiser fails to appeal TABOR decision in federal court

DENVER — Although he campaigned on a promise to defend the Taxpayer’s Bill of Rights (TABOR) despite his personal opinion of the nearly three decades old constitutional amendment, Colorado Attorney General Phil Weiser made his first move in the opposite direction by letting a deadline pass to argue an ongoing TABOR case in federal court.

DENVER — Although he campaigned on a promise to defend the Taxpayer’s Bill of Rights (TABOR) despite his personal opinion of the nearly three decades old constitutional amendment, Colorado Attorney General Phil Weiser made his first move in the opposite direction by letting a deadline pass to argue an ongoing TABOR case in federal court.Weiser had until Tuesday to ask that the entire circuit court hear the case after a 3-judge panel from the Tenth Circuit Court of Appeals reversed a lower court’s ruling. The lower court had ruled that local governments do not have the right to sue.

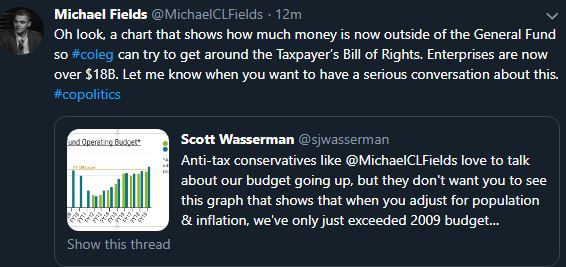

“It’s disappointing that AG Weiser is not fully following through on his campaign promises,” said Michael Fields, Executive Director of Colorado Rising Action. “The rubber will hit the road when the merits of the TABOR case are heard, and he actually has to defend the constitution.”

Fields added that everyone should be concerned that Weiser chose not to defend the state’s constitution knowing he is not a TABOR supporter.

Basalt wrestles with Taxpayer’s Bill of Rights violations

Basalt wrestles with Taxpayer’s Bill of Rights violations

BASALT, COLORADO — The tiny town of Basalt, which lies between Carbondale and Aspen, is facing a difficult choice over a long-term mistake in interpreting the Taxpayer’s Bill of Rights (TABOR). According to the town’s legal consultant, Dee Wisor, a Denver attorney and expert witness on TABOR, the town owes residents a refund for taxes illegally collected due to a misunderstanding of how TABOR works.

TABOR is a constitutional amendment passed in 1992 that, among other things, requires voter consent for new or increased taxes and debt, as well as limiting government revenues to a formula of population growth plus inflation. Under TABOR, governments in Colorado are required to refund excess revenue back to taxpayers, or get voter approval to keep it.

In 1994, two years after TABOR was enacted, Basalt residents voted 220 to 42 in favor of lifting TABOR revenue limits, thus allowing the town to keep any excess revenues it brings in over the regular revenue restrictions in TABOR. Numerous taxing authorities in Colorado have asked voters to do this to avoid having to pay out refunds when revenues exceed expectations.

To read the rest of this story, click (HERE):

Trump’s Greek-Style Budget Deal

In other words, we’re on the path to fiscal crisis. Is there a solution?

Yes, we could adopt constitutional restraints on the growth of government. I mentioned Colorado’s Taxpayer Bill of Rights in the interview, as well as the “debt brake” in Switzerland.

Why TABOR Matters on July 31st

Proposition CC, on the November 2019 ballot, gives government all extra tax monies collected above the TABOR limits – forever!

Vote No on Prop CC.