Initiative backers want voter approval for big state fees; new enterprise bill cited as reason needed

DENVER — A Denver-based group hoping to stop lawmakers from circumventing the Taxpayer’s Bill of Rights (TABOR) is in the signature gathering phase to place an issue on Colorado’s November ballot that, if passed, would require a vote of the people for any new fee imposed by the state that would generate $100 million or more in the first five years.

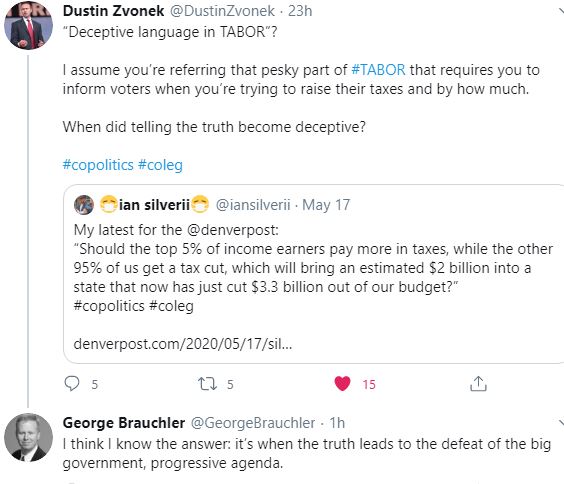

TABOR is an amendment to the state Constitution requiring, among other things, that new or increased taxes be approved by voters.

The executive director of Colorado Rising State Action, Michael Fields, said Initiative 295, which would go into state statute, is more important now than ever as the state grapples with $3.3 billion in budget cuts and looks to find new sources of revenues.

Senate Bill 20-215 is “a perfect example of them trying to go around TABOR to raise revenue by calling them fees,” Fields said. “Clearly, this is the move they are going to make, raising taxes by calling them fees.”

To continue reading this story, please click (HERE):

By: Barry W Poulson

By: Barry W Poulson Blog post by Christine Burtt

Blog post by Christine Burtt