Main Street in Telluride during Peak Autumn Color

Getty

The new year has brought reduced income tax rates to two Democrat-run states: Colorado and Massachusetts. These income tax cuts were the result of two and nearly three decade old laws that triggered this new round of income tax relief in the face of opposition from progressive politicians who control state government in Denver and Boston.

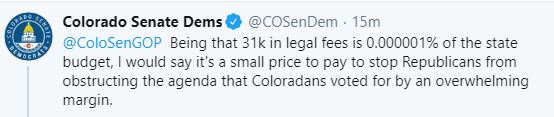

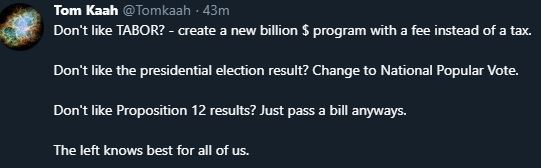

Massachusetts’ flat income tax rate dropped from 5.05% to 5.00% on New Years Day 2020, the result of a ballot measure approved by Massachusetts voters in the year 2000, the implementation of which was subsequently delayed by Massachusetts legislators. Colorado, like Massachusetts, is another state where the ruling political class saw an income tax cut that it opposed take effect on January 1, with the rate dropping from 4.63% to 4.5% for one year. This temporary rate cut is the result of a law approved by Colorado voters eight years before Massachusetts’ two decade-old tax cut-triggering ballot measure.

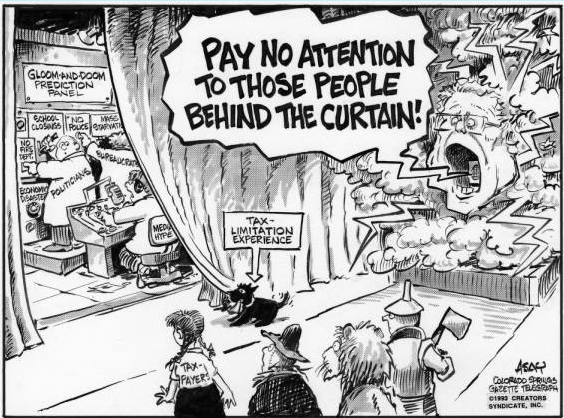

The temporary income tax cut that recently took effect in Colorado is due to the state’s Taxpayer Bill of Rights (TABOR), an amendment to the state constitution approved by voters in 1992 that to this day is the strongest taxpayer safeguard in the nation. Under TABOR, state revenue cannot grow faster than the combined rate of population growth and inflation. Any state revenue collected in excess of the TABOR cap must be refunded to taxpayers.