#TABOR

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteNo

#CoLeg

#TABOR

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteNo

#CoLeg

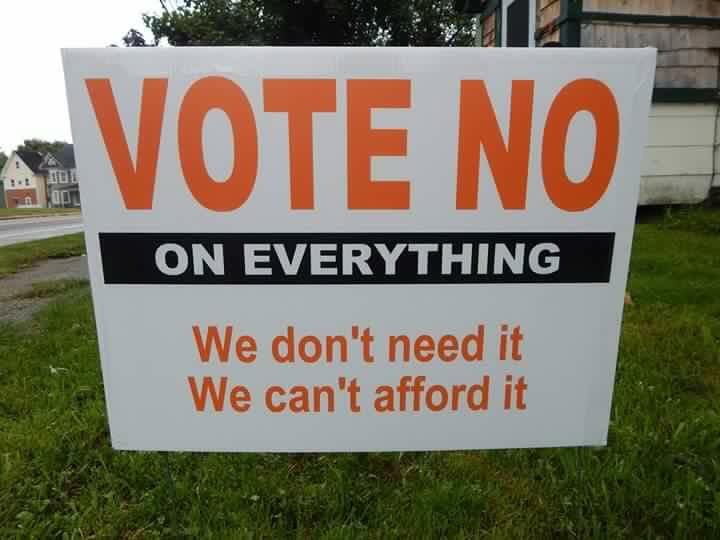

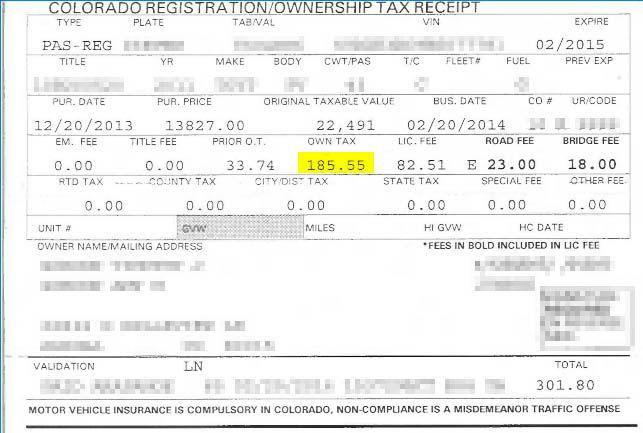

Just received my annual registration for my 2004 Subaru Outback and just reading the receipt my blood again begins to boil. The only “tax” listed is $3 for specific ownership tax, the next 12 items are all “fees”. Age of vehicle fee $7, bridge safety surcharge fee $23, clerk hire fee $4, county road and bridge fee $1.50, emergency medical services fee $2, emissions-statewide air account fee, $0.5 and many more, for a grand total of $70.17.

These are in addition to all of the gas taxes we all pay each time we fill up. I don’t mind being charged for normal needs-based surcharges such as those required to maintain our infrastructure but lets call it what they are.. Taxes! Since I/we are already paying all of these “fees” to the state, it’s another reason why I am appalled at the thought of eventually having to also pay more and more for the myriad of oncoming toll lanes throughout the state.

State lawmakers consider reforms in 2020 that would limit the growth of government.

GETTY

Americans are frequently told – by members of the media, candidates, and others – that political division is heightened in this consequential election year. Members of Congress, however, have reached bipartisan agreement that the federal government should spend more money than it brings in, even when the economy is growing and unemployment is low. Fiscal profligacy carries the day in Washington, yet lawmakers in state capitals are taking action to ensure that state spending and the size of government grows at a sustainable clip.

A member of the Wyoming Legislature, Representative Chuck Gray (R), introduced a joint resolution last week that seeks to limit the growth of the state budget and require voter consent for the approval of future tax increases. House Joint Resolution 2, introduced by Representative Gray on February 7, would amend the state constitution to include a “Taxpayer’s Bill of Rights” that would do two things: limit state spending to the rate of population growth plus inflation, and require all state tax hikes receive voter approval.

Representative Gray’s bill is inspired by Colorado’s Taxpayer’s Bill of Rights (TABOR). Like the TABOR measure now pending in the Wyoming statehouse, Colorado’s TABOR, which has been the law since it was approved by Colorado voters in 1992, requires that all state tax hikes receive approval from Colorado voters. Colorado’s TABOR also caps the increase in state spending at the rate of population growth plus inflation.

Colorado’s TABOR is the reason why Democrats who control the Colorado Legislature and would like to impose a host of tax increases are unable to do so. In November of 2019, Colorado voters affirmed their support for TABOR by rejecting Proposition CC, a measure referred to the ballot by legislative Democrats that would’ve gutted TABOR by ending the taxpayer refunds due in accordance with it.

![]() If

If

The #coleg is discussing the possibility of raising the #gastax. Luckily, our Taxpayer’s Bill of Rights makes you the decisionmaker, not politicians.

A bill that sponsors say would add revenue to funding for Colorado’s roads and bridges without raising taxes was shelved by Democrats in a Senate committee hearing on Wednesday.

Senate Bill 044 was postponed indefinitely by the Democratic-controlled State, Veterans, & Military Affairs Committee on Wednesday.

The bill would allocate 10 percent of revenue from sales and use taxes on vehicles toward the state’s highway users tax fund and local governments. That revenue would be moved from the general fund under the legislation.

A fiscal note for the bill says it would transfer $366.3 million in fiscal 2021 from the general fund to the highway users tax fund, and $380.7 million in the following year.

#TABOR

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteNo

#CoLeg

Let us decipher Matt Gray’s comments (…”we need new revenue to go along with it.”)

with our 6-word analysis:

“We’re going to raise your taxes”

#TABOR

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#FixTheDamnRoads

#CoLeg

Don’t believe us? Ask one.

Colorado voters love saying no to giving up more of their money to fix traffic and roads.

Don’t believe us? Look at the state’s history on ballot issues for roads.

Republican lawmakers want to continue using general fund money — the money that the state already collects and spends.

“This building keeps saying to the people of Colorado, ‘give us more money,’ and the people of Colorado are saying, ‘show me you’re going to spend the money we’re already given you on the things we care about, like roads and bridges,'” said Sen. Paul Lundeen, R-Monument.

Lundeen proposed a bill that would have brought back an old Colorado law that used existing money the state already collected.

For years — decades even — Coloradans have called upon the General Assembly to prioritize Colorado’s outdated transportation infrastructure. Our elected officials have for so long kicked this proverbial can down the (potholed) road that the Colorado Department of Transportation now has a backlog of anywhere from $7 billion to $9 billion in projects. To put that in perspective, that’s nearly a fourth of Colorado’s entire budget this year.

We hear it all the time — where are the taxes we already pay going?

The truth is that the legislature has been using your tax dollars as a piggy bank for pet projects instead of utilizing them to fill potholes and add new highway lanes. Pet projects such as Senate Bill 19-173, a $800,000 study on the feasibility of the state government getting involved in your retirement savings, the creation of an “Office of Just Transition” that has been covered extensively in the press, and $6 million for unnecessary census outreach that wasn’t required by the federal government. These have all been priorities of legislative Democrats — not transportation.