Unsustainable: Colorado budget structural deficit means widespread cuts

- Special to Colorado Politics/John Leyba

Colorado’s state budget is on an unsustainable path.

Unlike the federal government, the state is constitutionally mandated to produce a balanced spending plan each year.

That red flag warning from the chief economist of the Legislative Council and the director of the Joint Budget Committee staff in February signaled the problems ahead for the budget writers, as they tried to figure out not only how to cover a $1.2 billion general fund shortfall but also deal with a “structural deficit” that could affect future spending.

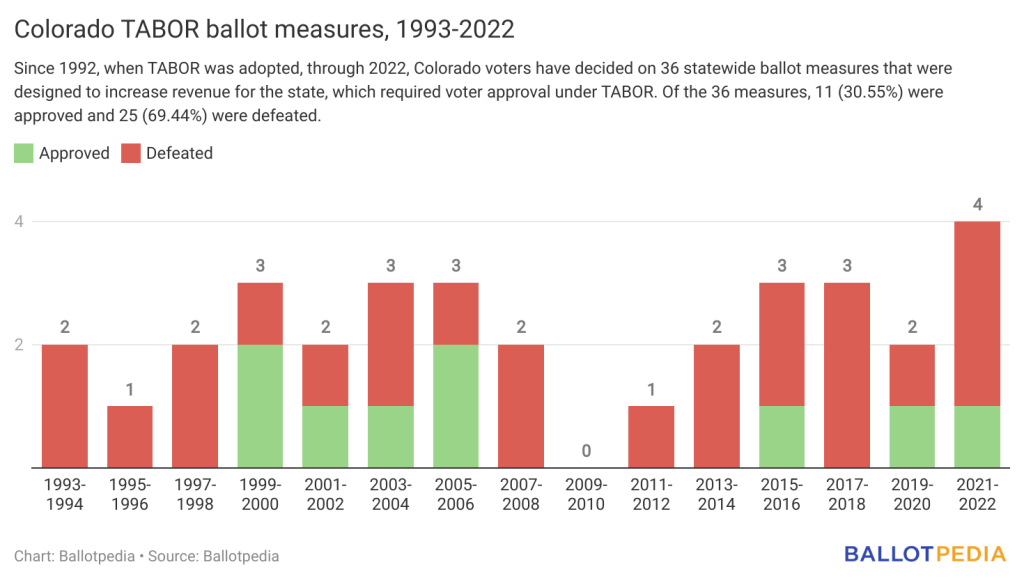

The structural deficit appears when state spending reaches the Taxpayer’s Bill of Rights cap. Despite a relatively healthy economy, according to recent forecasts, once the budget reaches the cap, without changes approved by voters, such as those made with Referendum C in 2005, lawmakers would be required to cut spending.

The panel had to come up with $1.2 billion in cuts from the general fund, which is the discretionary part of the state budget. The other two pots of money in the state budget are cash funds from fees and other sources, as well as federal dollars. The largest portion of federal funding, approximately $9 billion, is allocated to the Department of Health Care Policy and Financing, with the majority dedicated to Medicaid.

The budget panel “closed” the budget on Wednesday evening, March 26. It is now preparing to introduce what’s called the Long Appropriations Bill and possibly as many as 80 “orbital” bills that make the statutory changes needed to balance the budget. That’s a record, and by a long way; most years, the JBC offers no more than 30 orbitals.

“This is the most complicated budget that we have had,” said JBC Chair Sen. Jeff Bridges, D-Greenwood Village. “The complexity in this budget stems from our thoughtful, strategic, and bipartisan approach.”

Panel delays budget introduction as it scrambles to find solutions

On March 21, Bridges, recognizing that the budget would not be ready on time, sought and obtained permission from the Senate to delay it by a week, from March 24 to March 31. While it’s a week later than initially scheduled, it shouldn’t affect lawmakers’ ability to present the finished — and hopefully balanced — budget to the governor before late April.

The other decision the JBC made during the week of March 17 was to use the slightly more optimistic forecast presented on Monday by the Office of State Budgeting and Planning, which provided them with approximately $168 million more breathing room under the TABOR cap. That decision was adopted on a 4-2 vote, with the committee’s Republicans objecting. The latter preferred to use the more conservative numbers from the Legislative Council forecast.

The week’s delay bought the JBC time to tackle the most difficult decisions it faced in crafting the 2025-26 state budget — funding for higher education, Medicaid and specific programs within K-12 education, although the dollars for public schools will take place through the School Finance Act, a separate measure expected to be introduced shortly after the budget.

The most drastic cuts would be painful, budget drafters warned.

Click (HERE) to continue reading this story.

In 1992, Colorado voters passed the

In 1992, Colorado voters passed the

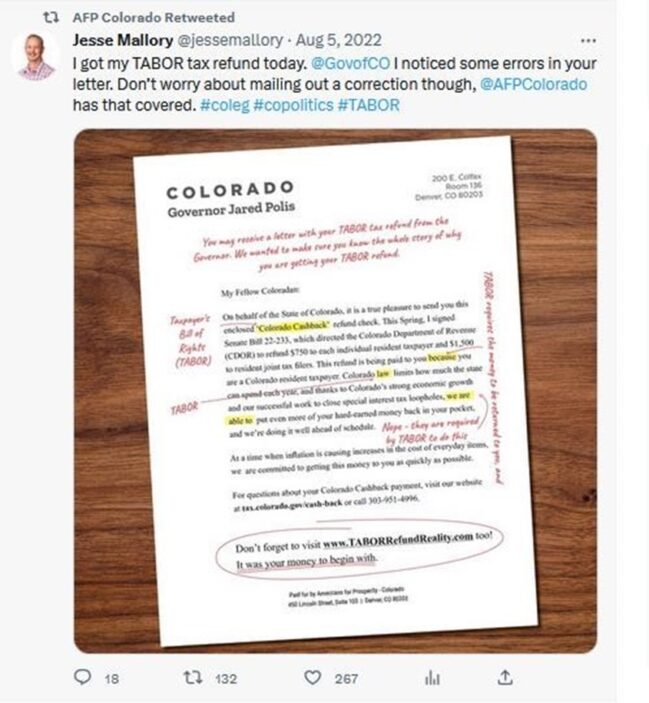

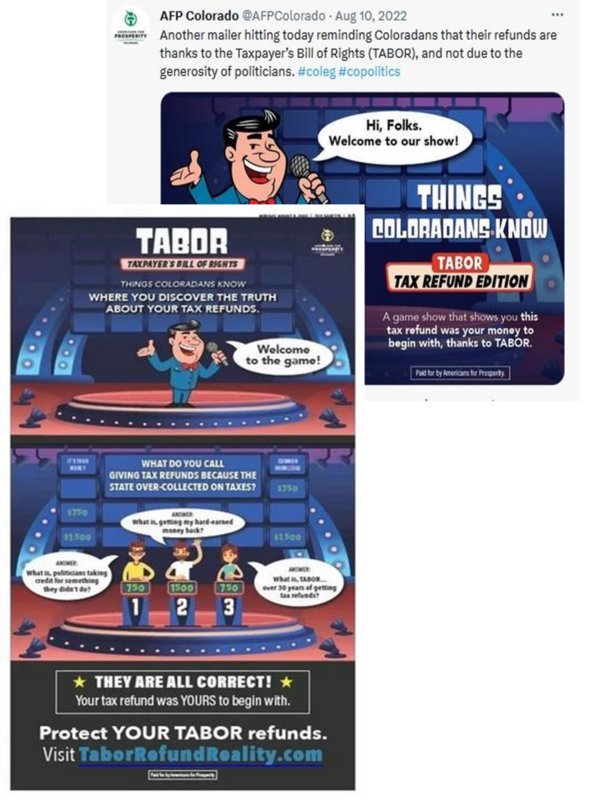

Last year, Colorado Democrats championed TABOR refunds as they campaigned for reelection. Yet not a week into the 2023 legislative session, they announced plans to try and halt those refunds indefinitely.

Last year, Colorado Democrats championed TABOR refunds as they campaigned for reelection. Yet not a week into the 2023 legislative session, they announced plans to try and halt those refunds indefinitely.