Court_wait Until After Ballot Initiative_12.13.19 by North Suburban Republican Forum on Scribd

Category Archives: Education

Court Order Vacates Appellate Panel Decision

Appeals Court Rules Standing OK

FILED

United States Court of Appeals

Tenth Circuit

PUBLISH

July 22, 2019

UNITED STATES COURT OF APPEALS

Elisabeth A. Shumaker

Clerk of Court

FOR THE TENTH CIRCUIT

_________________________________

ANDY KERR, Colorado State

Representative; NORMA V. ANDERSON;

JANE M. BARNES, member Jefferson

County Board of Education; ELAINE GANTZ BERMAN, member State Board of Education; ALEXANDER E. BRACKEN; WILLIAM K. BREGAR, member Pueblo District 70 Board of Education; BOB BRIGGS, Westminster No. 17-1192

City Councilman; BRUCE W.

BRODERINS, member Weld County

District 6 Board of Education; TRUDY B.

BROWN; JOHN C. BUECHNER, Ph.D.,

Lafayette City Councilman; STEPHEN A.

BURKHOLDER; RICHARD L. BYYNY,

M.D.; LOIS COURT, Colorado State

Representative; THERESA L. CRATER;

ROBIN CROSSAN, member Steamboat

Springs RE-2 Board of Education;

RICHARD E. FERDINANDSEN;

STEPHANIE GARCIA, member Pueblo

City Board of Education; KRISTI

HARGROVE; DICKEY LEE

HULLINGHORST, Colorado State

Representative; NANCY JACKSON,

Arapahoe County Commissioner; CLAIRE

LEVY, Colorado State Representative;

MARGARET MARKERT, Aurora City

Councilwoman, a/k/a Molly Markert; MEGAN J. MASTEN; MICHAEL MERRIFIELD; MARCELLA L.

MORRISON, a/k/a Marcy L. Morrison;

JOHN P. MORSE, Colorado State Senator;

PAT NOONAN; BEN PEARLMAN,

Boulder County Commissioner;

Continue reading

Court Wait Until After Ballot Initiative

Appellate Case: 17-1192 Document: 010110274622 Date Filed: 12/13/2019 Page: 1

FILED

United States Court of Appeals

UNITED STATES COURT OF APPEALS _________________________________ FOR THE TENTH CIRCUIT Elisabeth A. Shumaker December 13, 2019Tenth Circuit

ANDY KERR, Colorado State Clerk of Court

Representative, et al.,

Plaintiffs – Appellants,

v. No. 17-1192

(D.C. No. 1:11-CV-01350-RM-NYW)

JARED POLIS, Governor of Colorado in (D. Colo.) his official capacity,

Defendant – Appellee.

——————————

COLORADO ASSOCIATION OF

SCHOOL BOARDS AND COLORADO

ASSOCIATION OF SCHOOL

EXECUTIVES, et al.,

Amici Curiae.

_________________________________

ORDER

_________________________________

Before BRISCOE, SEYMOUR, and HOLMES, Circuit Judges.

_________________________________

This matter is before the Court on the appellee’s Petition for Rehearing En Banc of our decision in Kerr v. Polis, 930 F.3d 1190 (10th Cir. 2019). A response to the Petition is also on file.

Upon review of these pleadings we note that a ballot initiative has been filed with the Colorado Secretary of State that proposes a vote at the next general election to repeal

Appellate Case: 17-1192 Document: 010110274622 Date Filed: 12/13/2019 Page: 2

Section 20 of Article X of the Colorado Constitution, the Taxpayer’s Bill of Rights (TABOR). In June 2019, the Colorado Supreme Court held that the “initiative comprises a single subject within the meaning of the Colorado Constitution,” and returned the initiative to the Title Board to “set[] a title, ballot title, and submission clause.” In re Ballot Title #3, 2019 CO 57, ¶ 40. The initiative is currently pending review by the Colorado Supreme Court on a second appeal raising questions about the appropriate title for the initiative. Continue reading

Court Order Vacates Appellate Panel

FILED

United States Court of Appeals

PUBLISH Tenth Circuit

October 14, 2020

UNITED STATES COURT OF APPEALS

Christopher M. Wolpert

Clerk of Court

FOR THE TENTH CIRCUIT

_________________________________

ANDY KERR, Colorado State

Representative; NORMA V. ANDERSON;

JANE M. BARNES, member Jefferson

County Board of Education; ELAINE GANTZ BERMAN, member State Board of Education; ALEXANDER E. BRACKEN; WILLIAM K. BREGAR, member Pueblo District 70 Board of

Education; BOB BRIGGS, Westminster No. 17-1192

City Councilman; BRUCE W. (D.C. No. 1:11-CV-01350-RM-NYW)

BRODERIUS, member Weld County (D. Colo.)

District 6 Board of Education; TRUDY B.

BROWN; JOHN C. BUECHNER, Ph.D.,

Lafayette City Councilman; STEPHEN A.

BURKHOLDER; RICHARD L. BYYNY,

M.D.; LOIS COURT, Colorado State

Representative; THERESA L. CRATER;

ROBIN CROSSAN, member Steamboat

Springs RE-2 Board of Education;

RICHARD E. FERDINANDSEN;

STEPHANIE GARCIA, member Pueblo

City Board of Education; KRISTI

HARGROVE; DICKEY LEE

HULLINGHORST, Colorado State

Representative; NANCY JACKSON,

Arapahoe County Commissioner; CLAIRE

LEVY, Colorado State Representative;

MARGARET MARKERT, Aurora City

Councilwoman, AKA Molly Markert; MEGAN J. MASTEN; MICHAEL MERRIFIELD; MARCELLA L.

MORRISON, AKA Marcy L. Morrison;

JOHN P. MORSE, Colorado State Senator;

PAT NOONAN; BEN PEARLMAN,

Boulder County Commissioner;

Continue reading

Colorado taxpayers will be asked for more…

Colorado taxpayers will be asked for more…

As tax season is upon us, there are several considerations worth examining about how Colorado is doing. Colorado, like most states, faces fiscal challenges arising from COVID and the lockdowns. Colorado has one of the most expensive states for real estate and the recent Gallagher vote could result in higher residential property tax burdens for Coloradans in the years to come. The Colorado state pension system (PERA) has one of the worst funding ratios in the nation, suggesting PERA funding shortfalls will present problems for Colorado taxpayers and PERA beneficiaries in the years to come. Further, a low funding ratio could result in credit rating downgrades leading to higher borrowing costs for the state. Colorado has about 25% of the population on Medicaid. This could present significant challenges for the Colorado taxpayers in years to come. There will be calls for more taxes and fees to meet the desires of the Colorado legislature.

As tax season is upon us, there are several considerations worth examining about how Colorado is doing. Colorado, like most states, faces fiscal challenges arising from COVID and the lockdowns. Colorado has one of the most expensive states for real estate and the recent Gallagher vote could result in higher residential property tax burdens for Coloradans in the years to come. The Colorado state pension system (PERA) has one of the worst funding ratios in the nation, suggesting PERA funding shortfalls will present problems for Colorado taxpayers and PERA beneficiaries in the years to come. Further, a low funding ratio could result in credit rating downgrades leading to higher borrowing costs for the state. Colorado has about 25% of the population on Medicaid. This could present significant challenges for the Colorado taxpayers in years to come. There will be calls for more taxes and fees to meet the desires of the Colorado legislature.

Here are several sites for referencing how Colorado fiscally compares to the nation.

- Average house price by state: http://www.fool.com/the-ascent/research/average-house-price-state/

- Income tax rates by state: http://www.tax-rates.org/taxtables/income-tax-by-state

- State pension funding ratio by state: http://taxfoundation.org/state-pension-plan-funding-2019/

- Property tax rates by state: http://www.tax-rates.org/taxtables/property-tax-by-state

- Percentage of the population on Medicaid by state: http://www.medicaid.gov/state-overviews/scorecard/percentage-of-population-enrolled-medicaid-or-chip-state/index.html

- Car registration and fees by state: http://www.ncsl.org/research/transportation/registration-and-title-fees-by-state.aspx

- Excise taxes by state: http://www.tax-rates.org/taxtables/excise-tax-by-state

- Business taxes by state: http://www.tax-rates.org/taxtables/corporate-income-tax-by-state

Opinion: Politicians’ challenge to Colorado’s TABOR is without merit

For almost three decades, TABOR has been a godsend for Colorado taxpayers.

2:55 AM MST on Jan 24, 2021

Colorado’s Taxpayer’s Bill of Rights is under attack once again, this time by the very politicians whose actions TABOR is intended to check.

A lawsuit filed by state legislators and some local elected officials has been wending its way through the federal courts since 2011. They seek to overturn the voter-enacted TABOR amendment to the Colorado constitution, which requires voter approval before state and local legislative bodies can impose or raise taxes.

The lawmakers’ case rests on the dubious idea that by denying legislators a free hand on matters of taxing and spending, TABOR denies Coloradans a republican form of government, in violation of the U.S. Constitution.

It’s a specious, self-serving argument that ignores more than a century of case law and practical political experience with voter initiatives and referendums, in Colorado and elsewhere.

The case will now be heard by the entire U.S. Court of Appeals for the 10th Circuit, although it seems likely that the U.S. Supreme Court will eventually get the final word.

It’s a complicated case involving questions of standing — who has the right to bring a case to court — and whether constitutional guarantees of a republican form of government include the actions of political subdivisions such as school boards.

To continue reading this story, please click (HERE):

Can voters ignore the state constitution when passing an initiative?

The Other Arizona Election Challenge

Can voters ignore the state constitution when passing an initiative?

By The Editorial Board

Dec. 6, 2020 5:43 pm ET

Voters wait in line at the Surprise Court House polling location in Surprise, Arizona, Nov. 3.

PHOTO: CHRISTIAN PETERSEN/GETTY IMAGES

The outcome of the presidential race isn’t the only election result being contested in Arizona, and the other has even greater consequences for the law. Last week two lawsuits were filed against Proposition 208, the ballot initiative that imposes a new 3.5% tax surcharge to raise an estimated $827 million for education. It passed with 51.7% of the vote.

The suits are challenging whether Prop 208, which passed as a statute, must conform to the state constitution. One suit was filed by businesswoman Ann Siner and retired judge John Buttrick, the other by the Goldwater Institute, the influential Arizona think tank.

The suits claim that Prop 208 contradicts a constitutional amendment that limits the amount of revenue provided to school districts each year. It also overrides another constitutional provision requiring a two-thirds majority of the Legislature to approve a tax increase.

The Legislative Council, a nonpartisan legislative office that reviews bills and ballot measures for form and constitutionality, held that Prop 208’s language exempting the money it raises from an existing cap on education spending “is likely invalid” because it violates express constitutional limits. Supporters went ahead anyway. The state Supreme Court declined to rule on claims that Prop 208 unconstitutionally curtails the Legislature’s authority but said it couldn’t consider the issue until it passed.

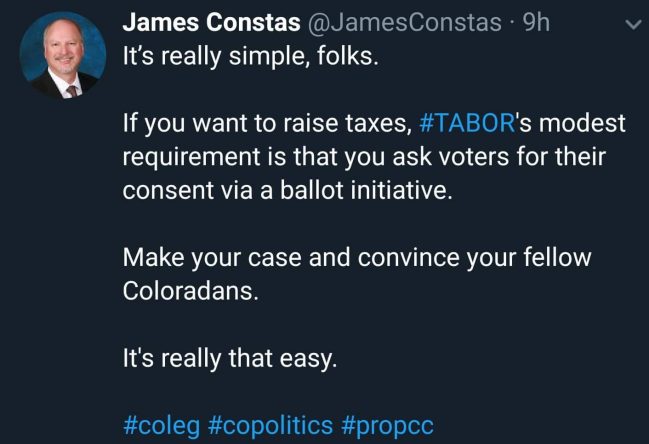

With TABOR, Make Your Case And Convince Your Fellow Coloradans

#TABOR

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteOnTaxesAndFees

#CoLeg

From An Editorial On May 5, 2019: State Could Go Off A Fiscal Cliff

State could go off a fiscal cliff

By: Barry W Poulson

By: Barry W Poulson

May 5, 2019

Colorado has created a fiscal cliff; the state is woefully unprepared for the revenue shortfall that will accompany the next recession. Citizens might be surprised to learn that the state has been pursuing imprudent policies that will result in a fiscal crisis when the next recession hits. It is important to understand how the fiscal cliff was created and what we can do about it.

Over the past two decades, Colorado has weakened the fiscal constraints imposed by the Colorado Taxpayer Bill of Rights. TABOR limits the rate of growth in state spending to the sum of inflation plus population growth, regardless of the amount of revenue the state takes in.

But most state revenue is exempt from the TABOR limit. The exempt funds include the revenue from enterprises and the fees collected by government agencies, which have grown rapidly over this period. As a result, over the past decade TABOR has not constrained the growth in spending, and this year the state will spend virtually every dollar of revenue it takes in.

The fiscal cliff is also linked to a rapid growth in debt and unfunded liabilities. While limits are imposed on general obligation debt, there are no limits on the issuance of revenue bonds. These are bonds with a dedicated stream of revenue used to pay off the bonds over time. As state enterprises have grown they have saddled the state with greater debt burdens.

Increasing debt is also incurred in the form of unfunded liabilities. Despite the recent reforms enacted in the Public Employees Retirement Association, unfunded liabilities continue to increase. The official estimate of these unfunded liabilities is $32 billion; but with realistic assumptions regarding rates returns on assets, the actual unfunded liabilities are estimated to be in excess of $100 billion. Continue reading