Category Archives: Editorial

TABOR defense starts with you!

TABOR defense starts with you!

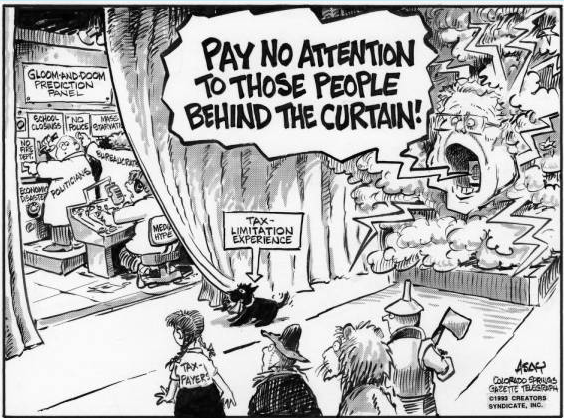

Power grabs in a republic rarely happen by brute force. They often happen quietly and steadily without fanfare or publicity. Marxist Antonio Gramsci called it “the long march through the institutions.” C.S. Lewis said “…the safest road to Hell is the gradual one–the gentle slope, soft underfoot, without sudden turnings, without milestones, without signposts.” TABOR opponents use this incremental strategy in an effort to undermine TABOR support and enforcement. How do they do this? Continue reading

Power grabs in a republic rarely happen by brute force. They often happen quietly and steadily without fanfare or publicity. Marxist Antonio Gramsci called it “the long march through the institutions.” C.S. Lewis said “…the safest road to Hell is the gradual one–the gentle slope, soft underfoot, without sudden turnings, without milestones, without signposts.” TABOR opponents use this incremental strategy in an effort to undermine TABOR support and enforcement. How do they do this? Continue reading

Fields: Taxpayer’s Bill of Rights deserves credit for Colorado’s economy, not John Hickenlooper

Under the scrutiny of the national media, John Hickenlooper’s official campaign for President has gotten off to a rocky start. Most of the national media coverage following his announcement has focused on his refusal to be labeled a capitalist during an interview on MSNBC. In a characteristic Colorado style, local TV anchor Kyle Clark tweeted, “’I may be a capitalist,’ @Hickenlooper writes. His 180 turned into a 360 now a 540. That’s @SeanWhite-level rotation.”

In his prepared launch video, and in media appearances since then, Colorado’s former governor has been regularly touting his role in Colorado’s booming economy. It’s true that Colorado has been ranked as the nation’s #1 economy. We’re consistently on lists of the best places to live and work in the U.S., and we attract hundreds of thousands of new residents every year.

Still, the fact is that our economy isn’t thriving because of John Hickenlooper. In actuality, a majority of the credit goes to the Taxpayer’s Bill of Rights (TABOR) – a unique law that allows Coloradans to vote on any and all tax increase.

It’s a simple concept – lawmakers have to make the case to voters in order to get more of their hard-earned money. TABOR also provides guardrails for the size of government. State spending still grows every year, but it’s limited to inflation plus population growth. The end result of TABOR is to keep the government truly serving the people. Continue reading

Amy Oliver Cooke: Colorado Democrats plan to trick voters into killing TABOR

Amy Oliver Cooke: Colorado Democrats plan to trick voters into killing TABOR

Colorado Democrats plan to trick voters into killing TABOR

As expected, Democratic lawmakers announced their intent to keep all taxpayer money and permanently set aside the spending cap that is key to the effectiveness of the Colorado’s Taxpayers Bill of Rights (TABOR), an amendment to the state constitution passed in 1992 that requires state and local government to seek voter approval before raising taxes. The measure also limits growth in state spending to population growth, plus inflation, and if the state takes in more than it is allowed to spend, the state must return the surplus to taxpayers.

TABOR is simple it’s about consent. Our government can raise taxes, but it has to ask first. Democrats in the State House and Senate don’t think they should have to ask first. In addition to seeking voter approval for additional taxes, TABOR fosters good, fair, and consensual government.

Opinion: TABOR has united Coloradans

Opinion: TABOR has united Coloradans

PUBLISHED ON MAR 10, 2019 5:00AM MDT

Michael Fields@MichaelCLFields

Special to The Colorado Sun

In a growing partisan culture, there’s still something Coloradans ranging the political spectrum can agree on: the Taxpayer’s Bill of Rights (TABOR).

In recent public polling, when given the simple, unbiased definition, 71 percent of registered voters in Colorado support TABOR, while only 28 percent oppose the law.

What’s the secret to this overwhelming popularity? First, Coloradans love being able to vote on tax increases. It’s simple: the government has to make the case to voters in order to get more of their hard-earned money.

Michael Fields

Michael Fields

Second, TABOR provides guardrails for the size of government. The state budget still grows every year, but the growth is limited. TABOR keeps the government truly serving the people.

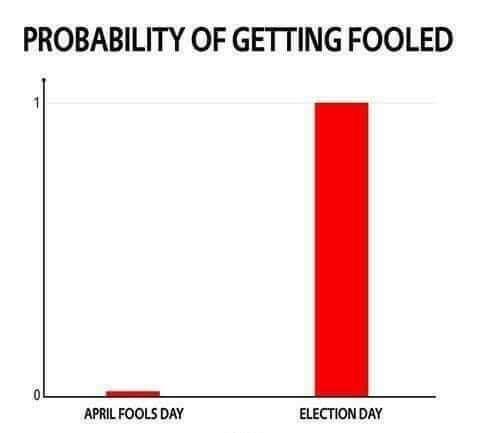

Over the past several years, voters have sent a message to state lawmakers by voting down the last six statewide tax increases on the ballot — most by huge margins.

But this hasn’t stopped lawmakers and progressive special interest groups from developing workarounds in the form of fees, enterprises, and lawsuits to allow the state to spend more taxpayer money. Continue reading

Democrats won’t leave TABOR alone

Democrats won’t leave TABOR alone

Well, you may have to do it again with Democrats wanting to take another swing at TABOR.

According to the Colorado Sun, Democrat lawmakers want voters to permanently set aside spending caps in the Taxpayer Bill of Rights.

House Speaker KC Becker, from Boulder, is drafting the measure. Becker at a town hall meeting pleaded, “I’m asking voters ‘Can you let the state keep the revenue we are already collecting?’”

Translation: We’re entitled to keep more of the money we are stealing from you.

The measure would allow the state to keep as much as $960 million in your tax dollars through June 2020.

What don’t these Democrats understand?

Will Democratic Primary Voters Tolerate a Liberal? A former Colorado governor will test whether the Sandernistas have taken over the party.

Will Democratic Primary Voters Tolerate a Liberal?

A former Colorado governor will test whether the Sandernistas have taken over the party.

By James Freeman

March 4, 2019 4:55 p.m. ET

Former Colorado Gov. John Hickenlooper at a campaign house party in Manchester, N.H. last month. PHOTO: ELISE AMENDOLA/ASSOCIATED PRESS

Sen. Bernie Sanders of Vermont is claiming a socialist victory in the battle of ideas. Meanwhile former Colorado Gov. John Hickenlooper is running for President and testing whether economic non-extremists can still win Democratic presidential primaries.

Sunday in Chicago, Mr. Sanders implied that people no longer view him as a Marxist kook. The Chicago Tribune reports on a Sanders speech at Navy Pier:

“Three years ago, they thought we were kind of crazy and extreme, not the case anymore,” he said. “We are not only going to defeat (President Donald) Trump, we are going to transform the United States of America.”

Mr. Sanders has certainly made extremism cool among Democratic presidential candidates. All of his fellow senators seeking the party’s nomination have joined him in co-sponsoring the Green New Deal and its promise of government health care and the end of traditional energy sources. They have also voted for an abortion policy so expansive that it allows adults to decide the fate of children even when they are no longer in the womb. Continue reading

State finances are enjoying flush times and some states are sending that bounty back to taxpayers.

Some States, Flush With Cash, Are Sending Money to Taxpayers

Ten years after the recession, many states have revenue surpluses and plan to boost spending or cut taxes

Support #TABOR

Follow The Money & You’ll Find Out Who Is Against #TABOR