Category Archives: Editorial

Coloradans may face 4 spending questions this year. Will new nicotine tax measure overload the ballot?

Coloradans may face 4 spending questions this year. Will new nicotine tax measure overload the ballot?

The proposal, announced Wednesday by Gov. Jared Polis and Democratic state lawmakers, would set a uniform nicotine tax at 62 percent. That would lift the taxes on a package of cigarettes to $2.49 from 84 cents.

Why #TABOR Matters on April 25

#TheBottomLine

#TABOR

#ThankGodForTABOR

Ending Taxpayer’s Bill of Rights refunds a deservedly tough sell to voters

Sharf: Ending Taxpayer’s Bill of Rights refunds a deservedly tough sell to voters

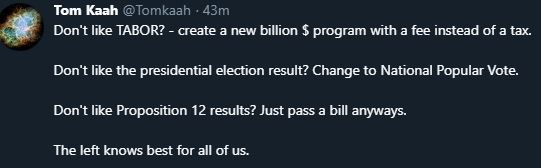

Another year, another legislative attempt to erode Colorado’s Taxpayer’s Bill of Rights (TABOR).

TABOR opponents, bored with chipping away at the law’s foundations, have broken out the chainsaws. On the one hand, legislative Democrats are ignoring the plain language of TABOR and unilaterally enacting a universal income tax increase without a statewide vote, by calling it a “fee.”

And on the other hand, they are proposing a ballot referendum to waive the law’s taxation restrictions. According to TABOR, any increase in general revenue above the previous year’s plus inflation and population increase must be refunded to the people. House Bill 19-1257 would remove that restriction, allowing the state to keep any and all tax revenue, forever.

In return, the money that was kept would go to transportation, transit, public education, and higher education. Theoretically, anyway. Such a deal might seem to have some superficial appeal to Colorado voters, but recent experience strongly suggests this may be a harder sell than proponents expect.

We don’t know where Referendum C dollars go

HB 1257 is Referendum C on steroids. In 2005, voters approved a temporary “time-out” from TABOR’s spending restrictions, allowing the baseline to grow at the inflation plus population formula regardless of what revenues actually did. Referendum C has allowed the state to keep about $17 billion, including over $1.2 billion in the last fiscal year alone.

Guest Opinion: Roads are the losers in 2019 Colorado Legislature

Guest Opinion: Roads are the losers in 2019 Colorado Legislature

Guest Opinion

Fixing the crumbling and crowded roads across our state has been a talking point for politicians in Colorado for years, as the project backlog has grown to more than $9 billion.

Democrats who control the purse in the legislature don’t seem to feel any urgency to fix the funding issues creating the backlog. In his first address to the General Assembly, Governor Polis spent mere seconds talking about the underfunded transportation infrastructure, offering no real solution.

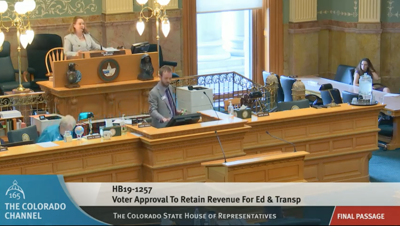

TABOR Repeal Bill Passes Colorado House of Representatives without Single Republican Vote

FOR IMMEDIATE RELEASE

202-380-7114 – MBLyng@NovitasCommunications.com

TABOR Repeal Bill Passes Colorado House of Representatives without Single Republican Vote

House Democrats’ attempt to permanently pocket taxpayer refunds advances on party-line vote

DENVER, April 17, 2019 – Yesterday, Democrats in the Colorado House of Representatives voted to pass House Bill 1257, a measure that would require state taxpayers to permanently forego tax refunds in any year in which they overpay the state.

“Colorado Democrats claim that their proposed theft of taxpayers would fund critical services like education and transportation, but Speaker K.C. Becker admitted in a committee hearing that they couldn’t provide any assurances as to how this supposed ‘excess’ revenue would be allocated in the future,” said Amy Oliver Cooke, Independence Institute Executive Vice President and TABORYes coalition member. “This isn’t even the government’s money in the first place. It’s money that hardworking Coloradans overpaid into the system, as codified by our Taxpayer’s Bill of Rights. Continue reading

Last-Ditch Effort To Jump-Start Colorado Sports Betting Afoot In Legislature

Last-Ditch Effort To Jump-Start Colorado Sports Betting Afoot In Legislature

It’s been nearly a year since Colorado lawmakers first discussed the possibility of legal sports betting in public, and the time for action has come.

This week, casino operators had the chance to offer feedback on preliminary language for a new CO sports betting bill. Reviewed by Legal Sports Report, the draft being circulated includes provisions for both physical sportsbooks and statewide mobile betting under a manageable tax structure.

Considering the bill has yet to be introduced, however, time is running a bit tight. The legislature adjourns for the year on May 3.

Colorado sports betting bill draft

Colorado House passes plan asking voters to give up their TABOR-driven taxpayer refunds

Editor’s note: Don’t just vote NO but vote HELL NO on this….

Colorado House passes plan asking voters to give up their TABOR-driven taxpayer refunds

House Bill 1257 is a referendum asking voters to allow the state to keep and spend excess revenues that would otherwise be refunded to taxpayers. If approved, the referendum would be on the November ballot.

When Liberals Don’t Like Something….

BRITAIN ISN’T THE ONLY PLACE WHERE ELITES TRY TO UNDO BALLOT MEASURES

NATELSON: BRITAIN ISN’T THE ONLY PLACE WHERE ELITES TRY TO UNDO BALLOT MEASURES

When British citizens voted to leave the European Union, I doubted the British political establishment would allow that decision to stand. Today that establishment is doing everything it can to undermine the Brexit referendum.

Such conduct is not limited to Britain. In the United States also, government officials have a long history of sabotaging ballot measures they don’t like.

Similarly, in 2015 SCOTUS reversed 30 statewide votes reaffirming — generally by landslide margins — the traditional definition of marriage.