Category Archives: Editorial

After all, it’s my money, not the governments….

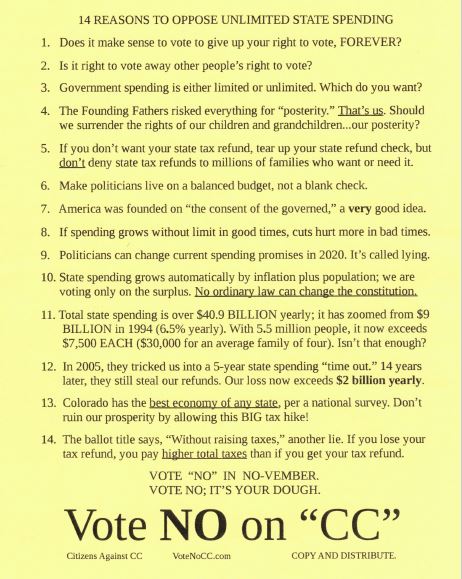

Vote No on Proposition CC on Your November 5 Ballot

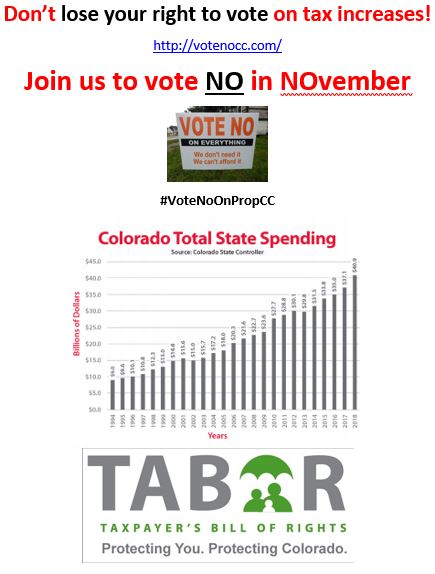

TABOR was passed by tax-paying voters in 1992 and became part of the Colorado Constitution. Its’ purpose is simple in that before lawmakers can raise your taxes, you get to vote yes or no, although spending increase by the inflation rate + population growth. Any extra revenue collected beyond that should be refunded to taxpayers.

If Proposition CC passes, you lose the right to vote on tax increases and lose any refunds due you. Not just for a year or two but permanently.

TABOR keeps government honest and forces it to prioritize the budget and spending.

Don’t lose your rights and refunds!

The TABOR Foundation & TABOR Committee urge you to Vote NO on Proposition CC

Vote No On CC Flyer

How Proposition CC Works

Referendum C hurt TABOR; Prop CC will do more harm

They lied to us in 2005, and they are doubling down on this lie in 2019. Colorado voters were sold a bill of goods with Referendum C in 2005, and it is of the utmost importance that we aren’t fooled again with Proposition CC in 2019.

Proponents of Referendum C originally claimed that their measure was “temporary.” The measure was supposed to offer a five-year reprieve from the constitutional limitations created by the Taxpayer’s Bill of Rights (TABOR), allowing some fiscal flexibility for Colorado lawmakers to invest heavily in education and transportation.

Or so they claimed.

SENGENBERGER | Safeguard TABOR — and stand up for Colorado taxpayers

The Taxpayer’s Bill of Rights is under attack. For at least a decade, Democrats in the Colorado legislature — backed by the Colorado Supreme Court in erroneous rulings and occasionally supported by faithless Republicans — have thwarted some of the protections afforded to Coloradans by the Taxpayer’s Bill of Rights.

Typically, these successful assaults against TABOR have come from taxes disguised as “fees.” In fact, this past legislative session Democrats even proposed financing a paid family leave program with a payroll tax (like the Social Security tax) that they would again have labeled a “fee.” (This legislation is likely to return next session.)

But this year’s attack — Proposition CC, put on the ballot by the Democrat-controlled General Assembly and backed by Gov. Jared Polis (D) — is particularly troublesome. Recall that the Taxpayer’s Bill of Rights was passed in 1992 and provides two essential protections for Coloradans. First, the amendment requires a vote of the people to raise taxes (unless legislators call it a “fee,” as discussed).

Why #TABOR Matters on August 10

Trump’s Greek-Style Budget Deal

In other words, we’re on the path to fiscal crisis. Is there a solution?

Yes, we could adopt constitutional restraints on the growth of government. I mentioned Colorado’s Taxpayer Bill of Rights in the interview, as well as the “debt brake” in Switzerland.

Why TABOR Matters on July 31st

Proposition CC, on the November 2019 ballot, gives government all extra tax monies collected above the TABOR limits – forever!

Vote No on Prop CC.