From: Douglas Bruce <Taxcutter@msn.com>

To: “randy.baumgardner.senate@state.co.us”

<randy.baumgardner.senate@state.co.us>, “john.cooke.senate@state.co.us”

<john.cooke.senate@state.co.us>, “don.coram.senate@state.co.us”

<don.coram..senate@state.co.us>, “larry.crowder.senate@state.co.us”

<larry.crowder.senate@state.co.us>, “bob.gardner.senate@state.co.us”

<bob.gardner.senate@state.co.us>, “President Kevin J. Grantham”

<kevin.grantham.senate@state.co.us>, “owen.hill.senate@state.co.us”

<owen.hill.senate@state.co.us>, “chris.holbert.senate@state.co.us”

<chris.holbert.senate@state.co.us>, “kent.lambert.senate@state.co.us”

<kent.lambert.senate@state.co.us>, Senator Kent Lambert

<senatorlambert@comcast.net>, “kevin@kevinlundberg.com”

<kevin@kevinlundberg.com>, “kevin.lundberg.senate@state.co.us”

<kevin.lundberg.senate@state.co.us>, “vicki.marble.senate@state.co.us”

<vicki.marble.senate@state.co.us>, “beth.martinezhumenik.senate@state.co.us”

<beth.martinezhumenik.senate@state.co.us>, “tim..neville.senate@state.co.us”

<tim.neville.senate@state..co.us>, “kevin.priola.senate@state.co.us”

<kevin.priola.senate@state.co.us>, “ray.scott.senate@state.co.us”

<ray.scott.senate@state.co.us>, “jim.smallwood.senate@state.co.us”

<jim.smallwood.senate@state.co.us>, “senatorsmallwood@gmail.com”

<senatorsmallwood@gmail.com>, “senatorsonnenberg@gmail.com”

<senatorsonnenberg@gmail.com>, “jack.tate.senate@state.co.us”

<jack.tate.senate@state.co.us>

To all 18 Republican senators,

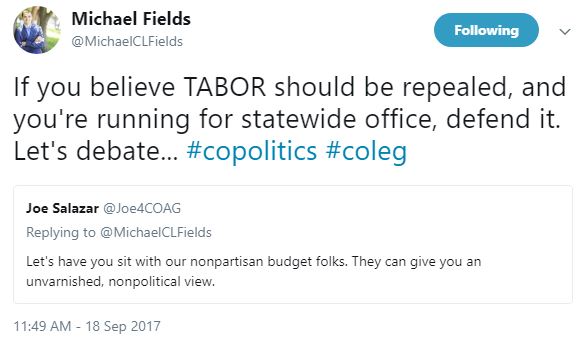

You are the only barrier to yet another TABOR violation. Just like the U. S. Senate on health insurance, we know 90% unanimity is not enough; you must be 100% united and show the public and your constituents it means something to be a Republican.

House Democrats and the governor are united in this latest effort to destroy TABOR. They will support any illegal action that puts government first and taxpayers last.

Even 17 GOP senators are not enough to prevent passing this “fix” that has already cast legislators into disrepute and ridicule. Continue reading