Ending tax refunds, sports betting on ballot as Propositions CC and DD

DENVER– According to the Secretary of State, two measures referred to voters in the 2019 Colorado legislative session–one aimed squarely at taxpayer refunds and another to implement sports betting– will appear on the November 5 state-wide ballot as Propositions CC and DD, respectively.

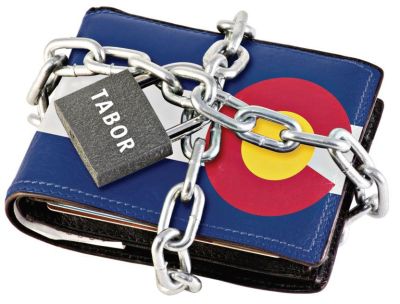

Proposition CC is the more contentious of the two, asking Coloradans to permanently give up any future tax refunds under the Taxpayer’s Bill of Rights, or TABOR.

TABOR is a constitutional amendment passed in 1992 that, among other things, limits the annual growth of a portion of the state budget to a formula of population growth plus inflation. The state is obligated to refund revenue in excess of that formula back to taxpayers, or get voter consent to keep and spend it temporarily.

So-called “enterprise” revenue is exempt from TABOR limits, and thus is already off limits for refunds. Enterprises are essentially government-owned entities that provide goods or services and are funded through fees, and which have grown dramatically in Colorado. According to the Legislative Council Staff, “Revenue to enterprises has grown significantly since the passage of TABOR, from $742 million in FY 1993-94, the first year TABOR was in effect, to $17.9billion in FY2017-18, the most recent year for which financial data are available.”

But if approved by voters, Prop CC would eliminate what’s left of the TABOR limit, allowing the state to keep and spend any and all excess revenues that would otherwise be refunded back to taxpayers in perpetuity.

The second measure, Proposition DD, would both authorize and tax sports betting in Colorado.

The U.S. Supreme Court in 2018 struck down a federal law restricting commercial sports betting in the states to only Nevada, thus opening the door for Prop DD. If passed, the measure would allow sports betting through licensed casinos in Colorado, as well as enact a 10 percent tax on the profits to “fund implementation of the state’s water plan and other public purposes.”

The propositions are statutory changes, meaning that they need 50 percent plus one of the vote to pass, and that lawmakers can later amend the measures if enacted, as with any other state law.

Ending tax refunds, sports betting on ballot as Propositions CC and DD