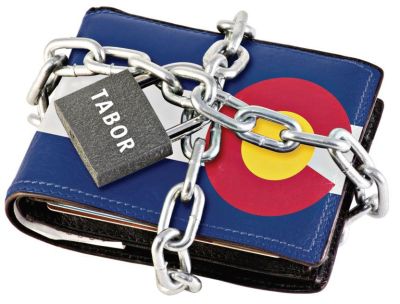

TABOR defense starts with you!

Power grabs in a republic rarely happen by brute force. They often happen quietly and steadily without fanfare or publicity. Marxist Antonio Gramsci called it “the long march through the institutions.” C.S. Lewis said “…the safest road to Hell is the gradual one–the gentle slope, soft underfoot, without sudden turnings, without milestones, without signposts.” TABOR opponents use this incremental strategy in an effort to undermine TABOR support and enforcement. How do they do this?

Power grabs in a republic rarely happen by brute force. They often happen quietly and steadily without fanfare or publicity. Marxist Antonio Gramsci called it “the long march through the institutions.” C.S. Lewis said “…the safest road to Hell is the gradual one–the gentle slope, soft underfoot, without sudden turnings, without milestones, without signposts.” TABOR opponents use this incremental strategy in an effort to undermine TABOR support and enforcement. How do they do this?

They use the legislature, the courts, politicians, union lobbyists, special interests, deceptions, propaganda, indoctrination, falsehoods, and even personal attacks to evade TABOR restrictions. The current executive, legislative, and judicial branches of Colorado government are united against TABOR. They call taxes “fees” and lament that they don’t have enough tax revenues to satisfy their financial desires. It has become a movement against the will of the Colorado voter. Former Gov. Roy Romer told Gov. Hickenlooper in 2015, “My advice is, Governor, lead a movement in this state to repeal the TABOR amendment.”

What does this mean to Colorado? It means the tax battle will become more intense. Colorado voters elected Democrats to all the statewide political leadership positions in November 2018 despite voting against statewide tax increases for transportation and education. Colorado voters have consistently voted against statewide tax increases since the passage of TABOR in 1992 (with the exceptions of taxing tobacco in 2004 and marijuana in 2013.) As a result of taxpayer opposition to statewide tax increases, Colorado legislators (particularly Democrats) have repeatedly sought ways to circumvent TABOR by calling taxes “fees” as in the Hospital Provider Fee (now an enterprise) or in the vehicle registration tax (called a “fee” under Governor Ritter’s administration in 2010.)

The TABOR Foundation has often been the last line of defense against the relentless onslaught of TABOR offenses by bringing legal action against such violations. However, legal fees are not cheap, the TABOR Foundation has limited resources to fight the vast and growing number of TABOR violations, and the courts have recently been favoring the taxing authority over the Colorado taxpayer. It is time for taxpayers to join the battle against calling taxes “fees”, creative tax maneuvers in building government broadband networks and other pet projects, escalating tax increases from hundreds of special districts in Colorado, excessive taxpayer support for inflated PERA retiree pensions, and so forth. There is even a Special District Association focused on protecting and expanding the power of special districts, a prime source of “invisible” property tax increases. There is no such formal group protecting TABOR besides the TABOR Foundation.

A recent taxpayer caller to the Colorado Department of Local Affairs concerning a TABOR violation was told, “We don’t do enforcement actions to assure compliance with TABOR. That is the taxpayer’s responsibility.” It is easy to see that special interests have much greater resources and are far more organized than are individual taxpayers. The Colorado taxpayer is only protected by Article 10 Section 20 of the Colorado constitution (which is the TABOR provision) and the willingness to undertake enforcement action on their own. Therefore, taxpayers need to be vigilant about their local, state, and special district governments and their increasing tax appetites.

The best way for taxpayers to protect themselves is to get involved. This means to be engaged with your local, county, and state government as well as your community. Public sector entities must comply with public disclosure requirements regarding tax increases. Often, there are no engaged taxpayers to oppose tax increases. Get on their mailing lists, public notice lists, town hall meetings, etc. Taxpayers should also engage with community social networks such as Nextdoor (nextdoor.com.) This a great place to inform and communicate what is going on in your respective community.

Another way for taxpayers to protect themselves is to get informed. This means reviewing your property tax statement and examining each special, fire, metro, school, library, county, drainage and water district for year over year tax increases. It also means knowing how property taxes are assessed. It also means keeping an eye on RTD tax increases, fee increases, etc. Finally, a review of the state budget is useful to understand how much taxpayer money is being spent and how it is being spent. About one in four Coloradans is on Medicaid and 600,000 of 5.7 million Coloradans are in the PERA (Public Employee Retirement Association) pension system (which has liabilities that exceed twice the entire state budget.)

There are about 120,000 PERA retirees who average 58 years old while receiving about $38,000 annually in retiree benefits for approximately 23 years of service. These PERA retiree benefits far exceed retiree benefits from either the private sector or from Social Security in terms of compensation amount, years of service required and minimum age requirements necessary for retirement. PERA also permits pension “spiking” which over weights the highest earning years to inflate the monthly benefit to retirees at the taxpayer expense. The taxpayer pours more money into the system than the employees contribute to their own retirement. Social Security and private pensions don’t do any of this. It is a public pension problem that costs the taxpayer enormously. The enormous liabilities from Medicaid expansion and PERA retiree benefits will motivate a crisis call for increased taxation on Colorado citizens. This condition will exacerbate when a recession eventuates. It is called the “public pension time bomb.” Only TABOR stands in the way from a taxpayer bailout of such government bloat and largess.

A 2019 polling study on TABOR was conducted by Baselice and Associates based upon 500 phone interviews with voters throughout Colorado. The interviews were sampled using 37% independents, 32% Democrats, and 31% Republicans. 88% of Colorado voters had heard of TABOR with 61% of voters somewhat or very familiar with TABOR. 47% of the voters favored TABOR while 26% were opposed to TABOR. When the voter became more informed about TABOR, the support for TABOR skyrocketed to 64% approval. It is easy to see why the opponents of TABOR don’t want voters to vote on tax increases nor become more informed about TABOR. The voters also said they favor requiring a super-majority vote of the legislature to raise a new fee by a 54% to 39% margin.

It is clear that Colorado voters want to be heard on excessive tax and spending increases. They don’t want tax and spending increases arbitrarily imposed by unaccountable government bureaucrats and legislators. If TABOR were repealed, legislators would impose excessive tax increases without voter approval. The Colorado flat tax on income of 4.63% would move in the direction of California’s top marginal income tax rate of 13.3%. Colorado is already surrendering sovereignty to California regarding emissions standards, the popular vote, etc. It will be catastrophic if Colorado surrenders its tax policy to emulate California as well. TABOR is the single best protection for Colorado voters to prevent Colorado from becoming another high tax state like California or New York. The more information that voters receive about TABOR, the more they support it, and the more likely TABOR will prevail over its opponents.

The mission of the TABOR Foundation is to educate the voters about the truth of TABOR and to protect the constitutional provisions of TABOR. Please visit thetaborfoundation.org to learn more about protecting TABOR today and how you can help secure the financial future of Colorado by protecting the taxpayer today. Voters need to reject the ongoing anti-TABOR propaganda and oppose the relentless assaults on TABOR and Colorado’s taxpayer rights.

Brad Hughes

Board Member

The TABOR Foundation

I have heard that there is a petition against the vehicle registration fees. where can i sign up?