Colorado House Joint Resolution HJR25-1023 seeks to challenge the constitutionality of TABOR (Taxpayer’s Bill of Rights) by authorizing a lawsuit to determine whether TABOR deprives Colorado of a republican form of government. The resolution argues that TABOR limits legislative authority over taxation and spending, shifting power to direct voter approval rather than elected representatives.

Colorado House Joint Resolution HJR25-1023 seeks to challenge the constitutionality of TABOR (Taxpayer’s Bill of Rights) by authorizing a lawsuit to determine whether TABOR deprives Colorado of a republican form of government. The resolution argues that TABOR limits legislative authority over taxation and spending, shifting power to direct voter approval rather than elected representatives.

Impact on TABOR

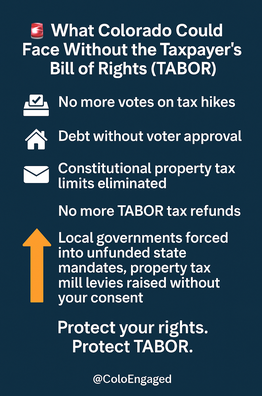

- Legal Challenge: If successful, the lawsuit could lead to TABOR being overturned, removing taxpayer refund protections and allowing the legislature to set taxes without voter approval.

- Reduced Refunds: TABOR has historically provided billions in taxpayer refunds; weakening or eliminating it could result in fewer or no refunds.

- Government Spending: Without TABOR’s restrictions, Colorado’s government could retain more revenue, potentially increasing funding for public programs but also raising concerns about unchecked spending.

This resolution is part of a broader legislative effort to redefine Colorado’s tax policies, sparking debate over whether TABOR is a safeguard for taxpayers or an obstacle to government flexibility.

#HandsOffTABOR

#DontBeFooled

#ItsYourMoneyNotTheirs

#TABOR

#FollowTheLaw

#FeesAreTaxes

#VoteOnFees

#ReplaceThemAllForNotFollowingVotersWishes

Leave a Reply