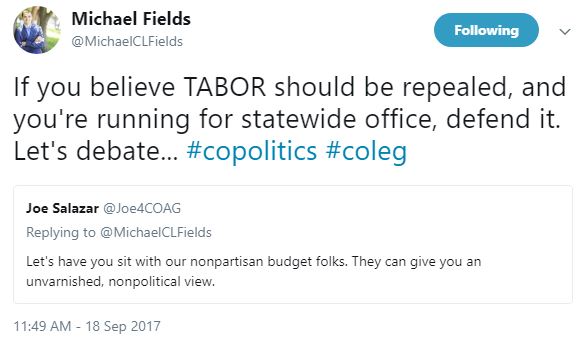

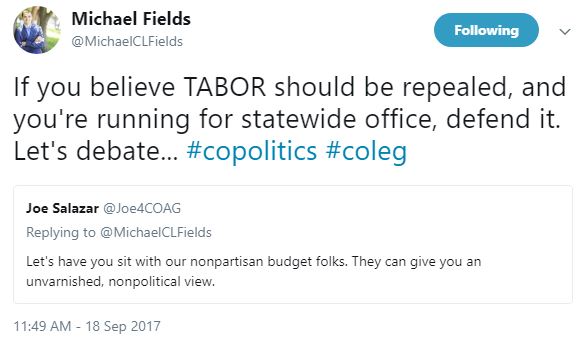

Michael Fields of Americans For Prosperity vs HD-31 Joe Salazar (running for Colorado Attorney General)

Michael Fields of Americans For Prosperity vs HD-31 Joe Salazar (running for Colorado Attorney General)

By Michael Carroll / September 11, 2017

Colorado state lawmakers increasingly engage in fiscal gymnastics to get around provisions of the state’s landmark Taxpayer Bill of Rights (TABOR), according to both supporters and critics of the state’s 25-year-old constitutional amendment.

Approved by voters in 1992, the TABOR amendment mandates that state and local governments get voter approval for specified tax increases, and it limits the rate of government spending growth based on population increases and inflation.

Though a subsequent voter-approved measure eased the spending cap, critics like Jon Caldara, president of the Denver-based Independence Institute, say the legislature has turned to “dark money,” such as newly designated “fees” that don’t require votes of the people, to avoid TABOR’s restrictions. Colorado courts have tended to uphold those TABOR workarounds.

In a blog post, Caldara pointed to efforts to create a hospital provider fee as one of the ways lawmakers evade the spirit of the amendment and avoid difficult budget decisions. The bill exempting the hospital fee from the TABOR spending cap was signed by Gov. John Hickenlooper in May.

Caldara credits TABOR with helping the state avoid economic pain. When the nation went into a recession in 2002, other states saw huge drops in revenues that caused massive budget shortfalls, but that didn’t happen in Colorado, he said.

Other observers, however, say TABOR has made Colorado nearly impossible to govern.

“From my perspective, it’s an unmitigated disaster,” Colorado State University political science professor John Straayer told Watchdog.org. “It’s stripped the legislature of its fiscal authority.” Continue reading

In an unusual ballot measure that walks uncharted constitutional ground, the Colorado Mountain College plans to ask voters in six counties for blanket approval to offset any future property tax cuts triggered by the Gallagher Amendment.

CMC’s board of trustees late last month approved the referred measure, which would give the board permission to raise property taxes any time the state constitution requires a cut to residential property assessments.

The measure won’t erase the cut that Gallagher has already caused: an anticipated $2.78 million this fiscal year for the Glenwood Springs-based institution.

The fate of a November ballot question that could lead to Fort Collins providing high-speed internet services is in the hands of Larimer County District Court judge.

Fort Collins resident Eric Sutherland and attorneys representing the city squared off in court Friday morning to argue about whether the content and form of the broadband ballot question meet legal requirements.

District Court Judge Thomas French has until Tuesday to decide whether to change the ballot language approved by City Council or let it stand.

The city’s deadline for certifying the ballot language to the Larimer County Clerk’s Office is Sept. 8. The county is coordinating the Nov. 7 election.

Sutherland raised five complaints about the ballot language, ranging from the lack of a comma, which he said made the question grammatically incorrect, to whether it complies with the Taxpayers’ Bill of Rights, or TABOR, amendment to the state constitution.

If approved, the measure would amend the City Charter to allow but not require the City Council to establish a telecommunications utility. The utility would be a standalone entity or part of the city’s Light and Power Utility.

It’s your money.

TABOR allows you a vote to let the government keep it or if you would rather have it in your pocket.

Posted: Aug 29, 2017 8:42 PM EDTUpdated: Aug 29, 2017 8:43 PM EDT

Colorado’s Taxpayer’s Bill of Rights (TABOR) was in demand at the 44th Annual American Legislative Exchange Council (ALEC) meeting held at the Hyatt Convention Center in Denver at the end of July. The TABOR Committee board of directors and friends presented the case (in a three hour workshop session) showing other states how to adopt measures similar to TABOR. TABOR Committee Chairman Penn Pfiffner also addressed approximately 60 legislators and staff at a special session on July 28th concerning the importance of TABOR-like efforts in their own states.

TABOR is a Colorado constitution protection (approved by the voters of Colorado in 1992) that restrains tax increases to not greater than the sum of population growth and the rate of inflation without a vote of the people. It is the gold standard for all 50 states regarding sound fiscal responsibility. It protects the citizen’s right to be heard on tax increases that otherwise would not be subject to voter approval. It was because of TABOR that Colorado voters had the opportunity to recently reject two very large tax increases in Colorado. Amendment 66, a $1 billion tax increase proposal in 2013, and Amendment 69, a $25 billion tax increase proposal in 2016, were both soundly defeated at the ballot box by more than 60% of Colorado voters. TABOR made those votes possible.

The American Legislative Exchange Council is a nonprofit organization of conservative state legislators and private sector representatives who draft and share model state-level legislation for distribution among state governments in the United States. ALEC provides a forum for state legislators and private sector members to collaborate on model bills—draft legislation that members may customize and introduce for debate in their own state legislatures. The ALEC annual meeting included keynote presentations by former US Speaker Newt Gingrich, Education Secretary Betsy DeVos, Colorado Congressman Ken Buck, Kentucky Governor Matthew Bevin, and other national leaders.

Please visit www.thetaborfoundation.org to learn more about TABOR and how you can help protect Colorado voter’s right to be heard.

DENVER – Transportation funding in Senate Bill 17-267, that was billed as the “Sustainability of Rural Colorado” Act, may in fact filter to more-populated areas if a newly-formed association made up of like-minded county commissioners has anything to say about it.

SB 267 was rushed through with more than 70 pages of strike below in the waning moments of the 2017 legislative session. It was billed as the “Grand Deal” by its supporters and the “Grand Betrayal” by its detractors.

There is no doubt it was controversial throughout the process because it involved reclassifying the Hospital Provider Fee from a Taxpayer’s Bill of Rights (TABOR) governed account to an enterprise, non-TABOR restricted account. It also put into use Certificates of Participation (COPs), which some believe are an end around TABOR. Some also believed it violated Colorado’s single-subject law for new legislation.

Since it was signed into law and took effect July 1, Complete Colorado broke the news that a drafting error would cost special taxing districts such as the Regional Transportation District (RTD) and the Scientific and Cultural Facilities District (SCFD), which funds the Denver Zoo and the Denver Museum of Nature and Science, millions in revenue.

Complete Colorado has also learned that an organized group of county commissioners called Counties and Communities Acting Together (CCAT) see the new law as a stepping stone to further weaken TABOR.

Is it a “tax” or “fee”?

You be the judge.

The Court held that the IRS could not charge “fees” for a thing with no value to the “tax”payer.

The judicial branch exists primarily to ensure that Constitutional principles are properly upheld by the courts. And yet, constitutional victories have been troublingly rare as of late. But even though limited government and a true separation of powers seems almost non-existent, the United States District Court for the District of Columbia just handed down a precedent-setting decision that is a win for anyone who supports constitutional limits to state power.

In the class action suit of Steele v. United States, the Court ruled that the IRS would be required to return an estimated $270 million in “user fees” charged to Americans in what a U.S. District Court determined was an unlawful expansion of the agency’s authority.

The Court ruled that occupational licensing was outside the IRS’ scope of authority.

In 2010, the Treasury Department and the IRS issued a tangle of new regulations, including a requirement that tax preparers register for a specific ID number (PTIN) to be entered on all returns. For anyone who had previously been preparing tax returns for others without a state-sanctioned “professional” preparer’s status, this new regulation required them to pass a competency exam before receiving the required PTIN.