Democrats roll out tax and TABOR reform plan to remake state finances, calling for “a reckoning”

Colorado lawmakers float legal challenge that, if successful, could kill TABOR outright

A group of Colorado lawmakers has unveiled a plan to fundamentally change state tax policy and attempt to eliminate the Taxpayer’s Bill of Rights, or TABOR.

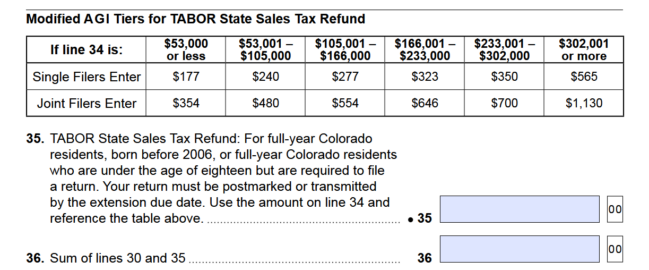

The plan, announced Monday afternoon by Democratic legislators, includes reclassifying chunks of Colorado highway funding so it doesn’t fall under the TABOR spending cap, which would free up money for other things. They also hope to end Colorado’s flat income tax and replace it with a system in which higher-income taxpayers pay higher rates than low-income filers.

Lawmakers also introduced a resolution Monday that seeks to launch a lawsuit challenging the legality of TABOR, which was passed by Colorado voters in 1992, under the U.S. Constitution.

“The state is coming to a reckoning on whether we can sustain ourselves,” said Sean Camacho, a Denver Democrat. “And all of these measures are critical to figuring that out.”

The lawsuit resolution has attracted a roster of co-sponsors, including some top legislative leaders. The proposals come as Colorado faces a budget hole of more than $1 billion because of the cap set by TABOR.

TABOR limits how much state spending can grow based on inflation and population growth. Certain sectors of government spending, chiefly mandatory Medicaid costs, have far outstripped the pace of consumer inflation, effectively eating into how much the state can spend on nonmandatory programs.

To read the rest of this article, click (HERE) to go to the Denver Post.