Residents are invited to learn more about the Mesa County Commission’s proposed ballot question to exempt state grants from the revenue and spending limitations of the Taxpayer’s Bill of Rights, or TABOR, at a town hall meeting on Tuesday, from 5:30 p.m. to 6:30 p.m. at the Old County Courthouse, 544 Rood Ave., in the public hearing room on the second floor.

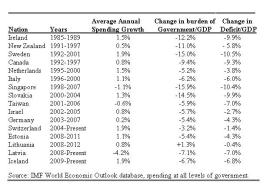

The commissioners are considering a ballot question to exempt state grants from the county’s TABOR cap, without increasing any taxes. Most of the state grants the county receives are for infrastructure projects, “so this actually grows the private sector, not county government, which should be limited,” Mesa County Commissioner Rose Pugliese said.

Pugliese also said, “This would include pass-through grants for our nonprofits like Mind Springs. If we continue to turn away grants, our taxpayer money will continue to go to the state and be used in other communities for their projects.”

The anti-TABOR, consent-hating, government-expanding, nannyist bureaucrat will interview and probably lecture our esteemed panelists of limited government, free market activists. What could go wrong?! It’s bound to be entertaining and educational!

The anti-TABOR, consent-hating, government-expanding, nannyist bureaucrat will interview and probably lecture our esteemed panelists of limited government, free market activists. What could go wrong?! It’s bound to be entertaining and educational!