The Democrat plans to move aggressively to implement his priorities, starting with executive orders as early as this week.

The 43rd governor of Colorado didn’t have time to move into his new office before he took the oath Tuesday, and his desk sits mostly bare except for a ceramic plaque that says: “BE BOLD.”

The slogan is how Democrat Jared Polis won the seat and exactly how he says he will govern for the next four years.

In his first sit-down interview as governor, just hours after the inauguration, Polis told The Colorado Sun that “bold” describes how his administration will approach “anything and everything.”

“I will do things differently,” he said. “And we are focused on the big ideas — meaning things that will really move the dial and improve the quality of life for Coloradans.”

His administration is prepared to push aggressively on a number of issues — from education to health care to corporate tax breaks — from the start, leveraging the Democratic majority in the General Assembly to advance his agenda.

“If it was easy, it would have been done already,” he said. “I don’t think anything we are tackling is easy because it wouldn’t have been left to be done if it was.”

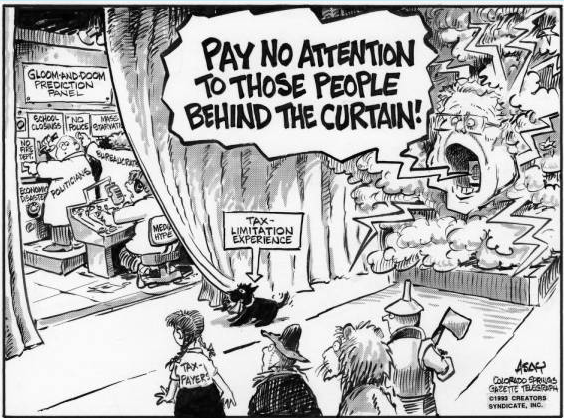

Before he even took office, he convened a meeting that included his predecessor, Gov. John Hickenlooper, and education and transportation advocates to look at ways to overhaul the Taxpayer’s Bill of Rights, a controversial topic.

And instead of waiting for legislative action, Polis plans to issue executive orders as early as this week to begin to implement his campaign pledges, including one to put the state on a path toward 100 percent renewable energy.