Why TABOR matters:

Iowans for Tax Relief reached out for help in their efforts to protect taxpayers. The idea that citizens should have a say in how much tax they are mandated to pay – and how it’s used has wide appeal!

TABOR Committee members,

The TABOR Committee is one of two plaintiffs in a lawsuit regarding the City of Denver’s draconian campaign finance rules. We fear that simply taking a position on a lawsuit forces our Committee, which is organized as a non-profit corporation, to turn into an Issue Committee, with all the reporting requirements and deadlines. That would mean opening our records to inspection and violating the trust placed in us by donors who demand and expect their donations not to be disclosed to the general public. We are represented by the Goldwater Institute, which is concerned that the Left is pushing this idea across the nation, which will result in further restrictions on 1st Amendment speech.

Last week, we lost the trial on standing grounds. Although the judge found testimony from the TABOR Committee and CUT credible, he ultimately held that we had not shown that CUT and TABOR were likely to trigger the provisions of the Denver donor-disclosure ordinance in the near future.

Our attorneys believe this holding to be erroneous and contrary to established Colorado standing rules for free-speech cases. The City’s witness testified to how the ordinance operates and it was clear from that testimony, that the ordinance will apply to our organizations the moment we spend more than $500 to engage on a Denver ballot measure. Similarly, both entities testified that engaging on such ballot measures is squarely in the mission of our organizations, that we would like to do so in the near future, and that we could raise more than $500 to do so. Under free-speech standing analysis, that ought to have been enough. Continue reading

January 28, 2019 By Sherrie Peif

DENVER — Two Denver residents behind a proposed ballot initiative to repeal the Taxpayer’s Bill of Rights (TABOR) have filed for a rehearing after the Colorado Title Board initially rejected their proposal.

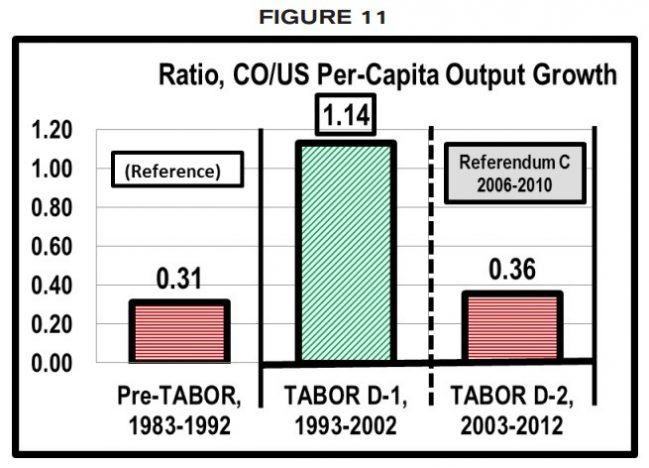

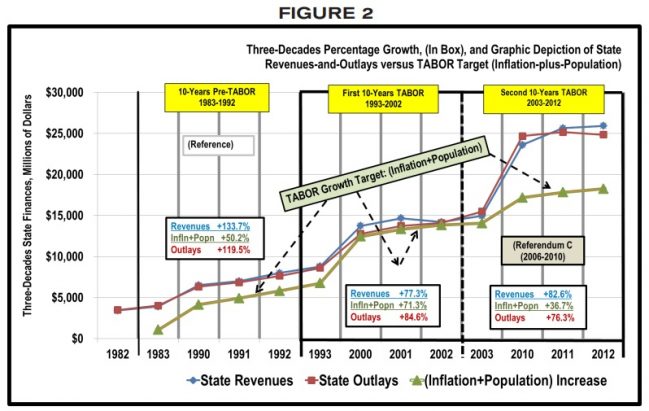

On Jan. 16, the Title Board denied setting a title on an initiative that would ask voters to repeal the 26-year-old constitutional amendment that requires voter approval to increase taxes or take on new debt. TABOR also limits the growth of a portion of the state budget to a formula of population growth plus inflation. The board said the initiative violated Colorado’s single subject rule.

Board member LeeAnn Morrill, who represented the Attorney General’s office, cited a Supreme Court decision over a 2002 proposed initiative that included a provision preventing the complete repeal of TABOR. She pointed out that the court stated in its decision: Continue reading

Published: Jan. 24, 2019 • By Lisa Marshall

Is Colorado a blue state now?

Not necessarily, suggests a new CU Boulder survey that paints the state’s voters in more nuanced shades. The third annual Colorado Political Climate Survey released in full today, found that while Democratic candidates did sweep statewide races on election day, registered voters remain split on hot-button issues, such as fracking and whether businesses have the right to deny services based on religious beliefs.

“This was a midterm year, and therefore was expected to be a good year for Democrats nationally given the backlash toward the presidential administration. Perhaps no state had more of a blue wave than Colorado,” said Scott Adler, director of the American Politics Research Lab (APRL) and co-author of the study. “But based on our findings I would not call the state a permanent or fixed blue state. On many issues, it is still moderate.” Continue reading

On January 16, 2019 two representatives of the Japan Local Government Center met with TABOR Committee Chairman Penn Pfiffner to learn what proponents of the Taxpayer’s Bill of Rights know about the positive aspects of fiscal discipline.

The Center has seven offices around the globe that compare and contrast and learn from other countries’ practices. Working out of the New York City office is Ms. Kaori Kurauchi, an official with the Japanese Ministry of Internal Affairs. She was accompanied by Dr. Seth Benjamin, a Senior Researcher in the New York office. Ms. Kurauchi is on a two year assignment to research tax and expenditure limitations and other government fiscal limitations in America and Canada. Continue reading

DENVER — The Colorado Title Board rejected a proposal on Wednesday to put a full repeal of the Taxpayer’s Bill of Rights (TABOR) before voters in a future election.

The board voted 3-0 that the proposal violated the single subject rule and the board did not have jurisdiction to set a ballot title.

Proponents Carol Hedges and Steve Briggs had an initial hearing before the Title Board at 1 p.m. on Wednesday. Although voters several years ago passed new rules that make adding an amendment to Colorado’s constitution harder, it still only takes a simple majority to repeal an amendment.

Proponents Carol Hedges and Steve Briggs had an initial hearing before the Title Board at 1 p.m. on Wednesday. Although voters several years ago passed new rules that make adding an amendment to Colorado’s constitution harder, it still only takes a simple majority to repeal an amendment.

Denver-based attorney Edward Ramey, who represented the proponents, said the proposal was to do “one thing and one thing only.”

“That’s to repeal Article X, Section 20 of the Constitution,” Ramey told the board. “I emphasize that because we’re not adding anything to it. We’re not trying to tweak anything. We’re not repealing and ellipsis doing anything. This is just a straight repeal.”

Ramey said the single subject debate keeps coming up because the consensus is TABOR itself contains more than one subject, but he disagreed with those findings. He cited a couple of Colorado Supreme Court rulings that addressed the subject in a manner that he believed favored his clients in this case. Continue reading

DENVER — On the same day Democrats were sworn into all the top elected offices in Colorado, new Secretary of State Jena Griswold announced one of the first potential state-wide ballot initiatives to go before the Colorado Title Board will be a complete repeal of the Taxpayer’s Bill of Rights (TABOR).

The Title Board is the first step in putting a citizen-initiated question before voters.

TABOR is a constitutional amendment that was passed by voters in 1992 that requires voter approval to increase taxes or take on new debt. It also limits the growth of a portion of the state budget to a formula of population growth plus inflation. It has been a controversial topic since its inception, and it’s been debated in the courts numerous times.

Many Democrats say it is a threat to Colorado’s education, transportation and health care funding, while Republicans counter that it is what has allowed the Colorado economy to prosper, as well as allowing Colorado to more easily weather economic downturns than states that lack taxpayer protections such as TABOR.

Many attempts to repeal or tweak portions of the amendment have come before the Title Board. This is the first time, however, that anyone can recall where a full repeal of the amendment has been proposed.