Amid broader budget debate, a modest proposal for more Colorado school funding advances

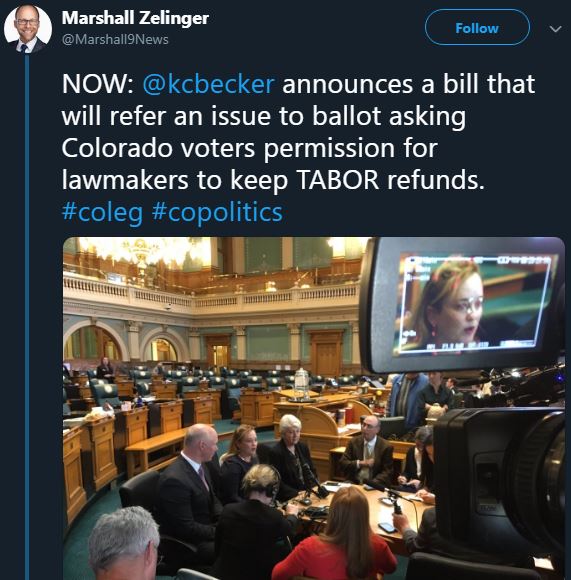

A bill that would ask voters to let Colorado keep more tax revenue — with a third of the money going toward schools — moved forward Monday, even as backers stressed that it is not a “cure-all” for the state’s broader fiscal challenges.

That uncertainty has education advocates watching nervously even though the proposed budget includes a major policy win: an $185 million set-aside to fully fund kindergarten starting this fall. If lawmakers and Gov. Jared Polis do put a lot more money into transportation, other K-12 programs could feel a pinch.

Power grabs in a republic rarely happen by brute force. They often happen quietly and steadily without fanfare or publicity. Marxist Antonio Gramsci called it “the long march through the institutions.” C.S. Lewis said “…the safest road to Hell is the gradual one–the gentle slope, soft underfoot, without sudden turnings, without milestones, without signposts.” TABOR opponents use this incremental strategy in an effort to undermine TABOR support and enforcement. How do they do this?

Power grabs in a republic rarely happen by brute force. They often happen quietly and steadily without fanfare or publicity. Marxist Antonio Gramsci called it “the long march through the institutions.” C.S. Lewis said “…the safest road to Hell is the gradual one–the gentle slope, soft underfoot, without sudden turnings, without milestones, without signposts.” TABOR opponents use this incremental strategy in an effort to undermine TABOR support and enforcement. How do they do this?

Michael Fields

Michael Fields